US Manufacturing Surveys Signal Stagflation: Prices Paid Up As Jobs Drop

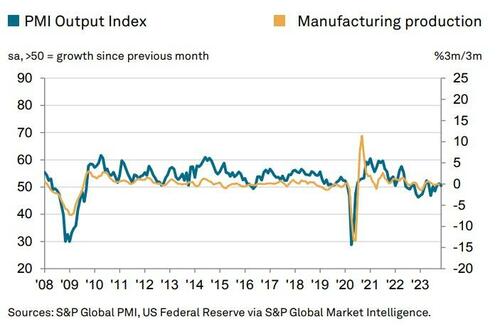

‘Soft’ survey data has been trending serially lower (aside from yesterday’s 13-sigma beat in Chicago PMI), catching down to ‘hard’ data’s decline and this morning saw the final print for S&P Global’s US Manufacturing PMI drop to 49.4 (from 50.0 in October and down modestly from the 49.5 flash print), driven by a decline in new orders and employment.

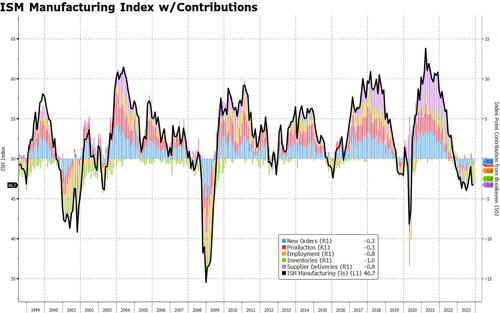

The ISM Manufacturing PMI was expected to improve (helped by gains in both new orders and employment), but it disappointed, printing 46.7 (the same as October’s final print), below the 47.8 expectations.

Source: Bloomberg

All subsectors of the ISM report contributed negatively:

Source: Bloomberg

While PMI price data slowed, ISM Prices Paid jumped higher (though still below 50) as Employment declined…

Source: Bloomberg

One respondent summed things up perfectly:

“A slow fourth quarter, and we’re clearly in a mild industry recession…” [Fabricated Metal Products]

“Economy absolutely slowing down. Less optimism regarding the first quarter of 2024.” [Chemical Products]

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“US manufacturers reported yet another tough month in November. Output barely rose as inflows of new work showed a renewed decline, hinting at little – if any – contribution to fourth quarter GDP from the goods-producing sector.

“Orders have in fact risen in only three of the past 18 months, reflecting a prolonged period of subdued post-pandemic demand, in turn linked to consumers switching their spending to services such as travel and recreation, and business customers reducing excess inventories which had been accumulated during the supply concerns of the pandemic.

“Encouragingly, there are some signs of the inventory cycle starting to turn, with producers of intermediate goods (inputs supplied to other firms) now reporting modest order book growth.

And it gets worse:

“US producers nevertheless continue to focus on cost cutting by trimming headcounts, and have now taken the knife to payroll numbers for two consecutive months.

Barring the early months of the pandemic, the survey has not seen such a back-to-back monthly fall in factory employment since 2009.

Which is a major problem for the service side of the economy, because:

“The decline in employment could feed through to weaker consumer spending, but will also reduce wage bargaining power.

But, the silver lining is – inflation is coming down…

“Lower wage pressures, combined with a marked cooling of raw material input cost inflation, have already fed through to a lowering of average factory selling price inflation for goods to a rate below the average seen in the decade prior to the pandemic, the rate of increase dipping again in November to help further lower consumer price inflation in the months ahead.”

It would appear that the Chicago PMI ‘adjustments’ did not filter al the way up to the national manufacturing surveys…

Source: Bloomberg

We await the ‘revisions’.

“The past relationship between the Manufacturing PMI® and the overall economy indicates that the October reading (46.7 percent) corresponds to a change of minus-0.7 percent in real gross domestic product (GDP) on an annualized basis,” says ISM’s Timothy Fiore.

Bidenomics is winning!

Tyler Durden

Fri, 12/01/2023 – 10:10

via ZeroHedge News https://ift.tt/cDsxnrj Tyler Durden