Blain: Gold, Always Believe In Gold!

Authored by Bill Blain via MorningPorridge.com,

‘In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.’

Gold has hit new record dollar levels – reflecting not just current uncertainty, but also the de-dollarisation narrative and it’s attractions as an inflation and market hedge, and long-term value. It’s worth keeping an eye on.

This morning there is so much to write about.

-

I could opine on the blind optimism of both bond and equity investors about the Fed et al swiftly easing rates (down 1.25 percentage points via 5 cuts next year in the US, apparently), to the naysayers in the Central Banks who say they remain on vigilant watch, ready to hike further at any sign of re-kindled inflation.

-

This week’s employment data will give important clues on the heat of the US economy. Many analysts reckon it will be strong!

-

There is a simply superb graphic by James Eagle “Megatechs go kaboom” I urge everyone to take a look at – the big 7 Megatechs: Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla are collectively up 83% this year. In contrast, the remaining “S&P 493” has posted a 4.1% gain. Worth thinking about….

-

What does the near-but-avoided-for-now collapse of Evergrande mean for China investments?

-

I could comment on the threats emerging from increased stalemate around the globe. Ukraine’s multiple travails: the stalled summer offensive, weapons and money from the west under threat, manpower shortages and growing internal dissent towards Zelensky spell trouble. Israel is trapping itself in a Gaza quagmire with the strategic direction of the war secondary to Netanyahu’s blundering political survival imperative. Could these conflicts further destabilise markets?

-

Or, maybe I should be looking at 2024 elections and the risks of political surprises roiling markets in the run up to UK and US elections?

Instead…. Let’s talk about Gold… This morning’s quote is classic Alan Greenspan, Fed Chair from 1987-2006.

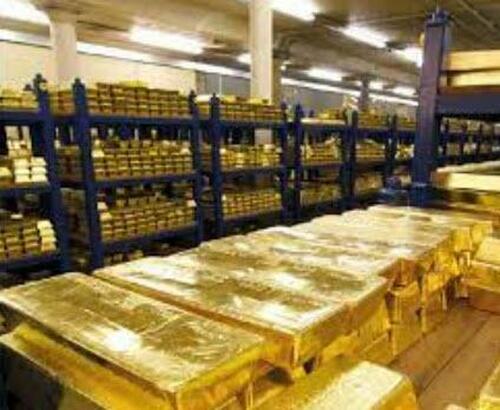

The yellow metal has hit a new record dollar high of $2111. Traditionally it’s the ultimate safe-haven investment, and thrives in time of uncertainty. However, it’s also on a tear because of expectations of US rate cuts, the weaker dollar making it cheaper for non-dollar buyers. The FT points out rising gold reserves at non-aligned and BRICS nations have been rising – as these nations have sold US treasuries, they’ve bought gold instead. (Much of what follows is based on an article I wrote for Property Chronicle earlier this year. Great magazine – try it out!)

Gold: Why Gold? Its intrinsically useless – but, oh, so beautiful. Everyone wants some – and not without reason. Whatever we think about history and value, or the returns on other “safe-haven” assets, there remain very good reasons to include Gold as part of a diversified asset portfolio.

Let’s get the “desirability” and emotional aspects out the way. I am told a significant influence on the price of gold is the weather – a good monsoon in India means farmers buy more bangles for their daughters weddings from the gold souks. It is beautiful. It is lustrous. It is unblemished. It is Gold. Always believe in… Gold! There will always be demand for gold for personal adornment – which is pretty much irrelevant when it comes to its proposition as an investment asset.

As an investment in its own right gold performs well; over the last 50 years Gold prices have risen over 3000%, compared to a 3500% gain in the S&P500. However, in periods of financial instability gold outperforms stocks – notably over the past 20-years even though the prices of financial assets were artificially juiced by the effects of zero interest rates! In terms of risk, companies come and go, but Gold is forever. If the world remains unstable – and no reason to think it won’t – then gold should be front and centre on your radar – no matter how archaic you consider it.

Goldbugs always start by telling you what a superb store of value the yellow metal is in times of financial uncertainty. Certainly, the world has seldom felt financially less certain than it does today;

-

Burgeoning national debt quantums have called into question the long-term sustainability of sovereign debt loads. If major nations really are going to default on their debt – then gold’s role as a safe-haven can only increase. (Personally, I think the risks of debt default are over-exaggerated, but there are good reasons to be concerned.)

-

Geopolitical crises have destabilised supply chains, and threaten further recessionary shocks and energy inflation spikes. Such threats feel to be multiplying. Gold prices hedge against inflation while cash is just cash and offers zero upside.

-

Electorates across the democratic West appear to have lost trust in politics in the face of populism and rising authoritarianism. Rising political risks to bond markets, currencies, commodities and growth, raise the need for decorrelated safe-haven investments. Gold as an asset looks less correlated than any alternatives.

-

Markets are struggling to maintain still sky-high valuations established during the zero-interest QE interregnum in today “normalised” interest rate environment. In a falling market, gold may struggle, but it won’t default, be invaded or be wiped away be a natural disaster. It will remain … gold. Indestructible!

Goldphobes claim gold is no longer what gold once was. 80 years ago, Allied Airmen around the globe had Gold Sovereigns stitched into the linings of their flight suits to facilitate escape if shot-down – everyone, everywhere, knew hard gold was the ultimate store of wealth and value and exchangeable everywhere and anywhere. In the Middle ages Viking wealth was defined by the gold armbands warriors wore – they would hew off lumps to pay for goods, again secure in the knowledge of its value. Gold worked because it was easily accepted as a medium of exchange.

That is no longer true.

Escaping airmen in dodgy countries will be asked by dodgy smugglers to pay in equally dodgy crypto. In a world where retail outlets will only accept electronic cash via card or mobile device, you are unlikely to find a grog shop willing to carefully weigh your shavings of gold to calculate the weight of gold equivalent to a pint based on the current price. (To be fair, there are even fewer pubs willing to accept a bearer Treasury bond.) In terms of a medium of exchange, gold has become somewhat hypothetical – which has been happening for decades since nations came off the Gold Standard.

As a result, gold in the form of easily traded gold linked investments and Exchange Traded Funds (EFTs) linked to the Gold price is now the simplest way to hold gold exposure. That is not risk free. You will have counterparty risk. Gold purists (ahem) say this is dangerous – having direct physical control of specie is the only truly safe way to own gold. I take the pragmatic view that if my Blackrock Gold ETF defaults, events will mean that redeeming my gold vouchers will be among the last of my immediate worries.

(And if I held physical gold – would it have been destroyed by the atomic fire, or would it have slowed me down escaping from the rampaging victims of a zombie plague? (These are just two of the low probability real gold scenarios I’ve stress tested. Honest…))

As for sovereign bonds such as US Treasuries or UK Gilts, I have a very simple approach to their value as safe haven assets. What is the likelihood is they will repay in full? High. And what is the risk of inflation? High. Gold is a good inflation hedge, but the downside of any Sovereign Financial Nation is that they own the keys to the money printing presses. That means all a government has to do to repay debt is press print to repay outstanding debt. That leaves the nation exposed to consequences including rising inflation by increasing the money supply, and a collapse in its currency (from money printing and inflation), and a negative shift in its terms of trade, further destabilising the economy.

Bonds are never completely free of risk. There is a simple way to consider such risks – the Virtuous Sovereign Trinity: that a nation with a stable currency, a sustainable bond market, and political competency will tend to do well and be able to keep the trinity in balance. If one part fails – as we saw dramatically demonstrated during the brief but too long Liz Truss premiership when her brash political naivety spiked the Gilts market – then the result is chaos.

IF there is one particular risk to Sovereign Bond markets to be aware of, it’s the US 2024 Elections. This morning Donald Trump is leading the polls in five of the key swing states. If he wins the consensus is for a serious re-appraisal of the US Treasury market and the US dollar by global investors. Although there is no other as liquid safe-haven asset and global trade is de facto dollarised – the risks of the US Virtuous Sovereign Trinity being upended by vengeful Trump should not be underestimated. It’s would undoubtably boost the price of gold if US treasury investors decide gold looks a better option!

Finally, let’s consider the pretender to the safe-haven market; Cryptocurrencies, and Bitcoin in particular, claim to be digital gold. Bollchocks. They are not. They are constructs of pointlessness. They claim to be a store of value – they are not, witness the enormous volatility in prices. They claim to be freely exchangeable – they are not, they are subject to ongoing concerns on legality, traceability and the safety of trade execution. They claim to a means of exchange – or as a very funny TV ad put it’s as a chap tries to buy some apples from a scruffy roadside stall: “which cryptocurrency would you like settle this transaction in?”

Many years ago I offered £100 to any reader of my daily Morning Porridge market commentary who could explain to me one thing cryptocurrency can do (legally) better that isn’t already done? I am still waiting…

Tyler Durden

Mon, 12/04/2023 – 08:35

via ZeroHedge News https://ift.tt/wiUmbAp Tyler Durden