“Inflation Is Your Fault” And Other Self-Loathing Liberal Lies

Submitted by QTR’s Fringe Finance

Hell hath no fury like a New York City limousine liberal full of self-guilt, ready to submit to their overlords in the government and media, even if it means blaming themselves (and everybody else) for problems that have absolutely nothing to do with them.

But, rather than try to deal with the mindset of those malleable enough to walk around accepting blame for problems others have created, I wanted to write this article to go right to the source. This weekend, that source was The Atlantic. Yes, the same publication that got down on its hands and knees and begged us for Covid amnesty after being part and parcel with an authoritarian group of psychopaths, who were happy to abscond with the civil rights of everybody around them, unilaterally now wants to blame us – everyday Americans – for inflation.

How do I know this? They wrote a f***ing article called “Inflation is Your Fault” and titled it in all capital letters, in the douchiest Serif font they could find:

The article’s subtitle, written in the same pretentious style that suggests it’s some type of peer reviewed scientific revelation, is: “If people are so mad about high prices, why do they keep buying so many expensive things?”

The irony here is widespread. First off, f***ing everything is expensive. So the answer to the question of “If people are so mad about high prices, why do they keep buying so many expensive things?” could be anything. It could be because people need to wipe their ass with something. It could be because people need bread to eat. It could be because they need to put gas in their car. It could be because they need laundry detergent, or a winter jacket. All of these are “expensive things” nowadays.

Second off, I don’t know anybody that takes their social cues from what people write in The Atlantic. A fancy typeface can only cover up so much inane, lobotomized bullshit, and the print over at The Atlantic has done about as much heavy lifting as it possibly can.

Third off, I can’t think of anybody less qualified to offer commentary on the state of the financial world than people on the left side of the aisle. Sure, Republicans contributed to our current inflationary crisis by helping unleash trillions of dollars in new money during Covid, but the Biden administration has also, over the course of the last four years, run the US national debt up to $34 trillion and shown zero semblance of fiscal discipline, spending restraint, or comprehension of the sovereign debt crisis that the country is heading toward.

And now, this same lot is not only going to explain to us why inflation is persisting, but also start casting blame on the American middle and lower class for it? The same middle and lower class who were disproportionately shit on by the same money printing that both caused inflation and widened the wealth inequality gap over the course of Covid?

I don’t think so.

As you would expect, the thesis of the entire Atlantic article is that because Americans are spending too much on items that are high-priced, inflation is persisting.

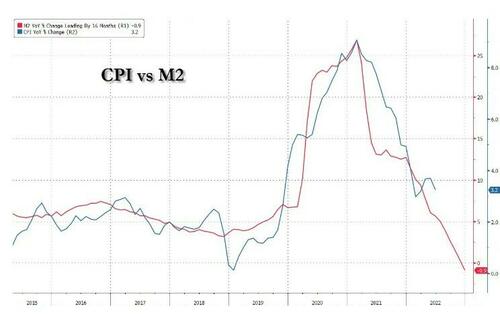

First, this is obviously a giant misunderstanding of where inflation comes from to begin with. Inflation is a monetary phenomenon that comes from the expansion of the money supply. We expanded the money supply by double digits over the years during Covid; hence, we find ourselves on the brink of a newfound inflation problem. See if you can spot where the M2 money supply took off:

💥 50% OFF FOR LIFE: For those that aren’t paid subscribers yet, you can take 50% off an annual plan: Get 50% off forever

Second, most Americans aren’t chasing the price of discretionary items higher anymore. As credit card debt skyrockets and personal savings hit a trough, average Americans have been primarily focused on household goods and everyday items. To the extent that Americans are spending more on these items, it’s only out of necessity.

But this is hardly a ‘chicken and the egg’ conundrum. Prices started to skyrocket because the Federal Reserve unleashed trillions of dollars in new cash, disguised as loans and stimulus, during Covid. As usual, corporations reaped the biggest rewards, with billion-dollar companies like Target allowed to stay open while small businesses were forced to close. Remember when hedge funds were cashing in PPP loans while the everyday American just tried to keep food on the table and keep their job? I wonder if The Atlantic would tell us that government mandated shutdowns during Covid were our fault, too.

Remember, as Americans were spending like crazy prior to the Covid crisis, the main problem was that we didn’t have enough inflation. Central Bankers were telling us we couldn’t figure out how to generate inflation and we were scared that inflation would never happen again.

In other words, this ‘missing inflation’ gave monetary policy ‘experts’ carte blanche to pull whatever strings they thought they had access to during Covid, and now we’re reaping the results of what we have sown. And by ‘we’ have sown, I don’t mean the everyday American — I mean the hundreds of PhD economists at the Fed that collectively still can’t figure out when a recession is coming, why market cycles take place, why they’re necessary and generally what the fuck is going on at any given point in time

But trillions in money printing didn’t stop some faux-intellectual, professor-like liberal from donning their spectacles and putting pen to paper on an article that makes the blame for the government’s inflation problem communal.

Get this: the same group that flips out when privatizing profits and socializing losses happen on Wall St. is now running the same exact scam for the government. They claim victory when the government does something good, but it’s everybody else’s fault when the government does something wrong. Just more cruel irony.

And of course, the mother of all irony is still to come. You see, this idiocy from The Atlantic this weekend is coming at potentially the worst possible time. If you have been paying attention to the money supply versus CPI, you might be of the mindset that inflation is actually about to peter out. Here’s a chart from Zero Hedge that I put in one of my recent articles:

If the rubes over at The Atlantic can’t look at this and figure out that inflation is tied directly to the money supply, I don’t know what is going to do it for them.

But regardless, when you combine the contraction of the money supply with what I believe is going to be the economy grinding to a halt, and a massive rush to deleverage, there is a very real case for us being on the precipice of a deflationary depression. This all hinges on whether or not the Federal Reserve chooses to respond by printing more money. If they do, we will avoid a deflationary depression at the cost of inflation that starts skyrocketing once again. There is really no easy way out of this Catch-22, and all I can say is I look forward to watching it unfold, no matter how it is going to take place.

If the former situation (deflation) takes place, it’ll be easy to further ridicule this weekend’s article. If the latter (inflation, printing) takes place, you’re just going to have to remind The Atlantic one more time that we are part of a broken, fucked-up system involuntarily – we aren’t the one pulling the strings at the Federal Reserve or the Treasury. We’re just along for the read.

Hilariously, I’m more than certain that the author of this Atlantic article probably rubs elbows with people at dinner parties that her criticism would be far more appropriately directed at. The ones that do pull the strings. But we couldn’t write an article blaming them — that would fuck up this weekend’s dinner plans at Martha’s Vineyard.

So, who are you going to trust? Me, a tattooed, single, 40-year-old man living in a studio apartment driving a car badly in near of a side view mirror — or the geniuses that brought you the ‘groundbreaking’ ideas that the deficit is really a myth and we can print a trillion dollar coin to solve all of our problems?

—

Thank you for reading QTR’s Fringe Finance. This post is public so feel free to share it: Share

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Tyler Durden

Mon, 12/04/2023 – 06:30

via ZeroHedge News https://ift.tt/EV8QU2p Tyler Durden