Markets Are Overstretched But No One Wants To Sell

By Michael Msika, Bloomberg Markets Live reporter and strategist

Warnings are piling up that the market is overheating, but “don’t fight the tape” seems to be the motto now in this last stretch of the year.

The market continues its grind higher after a stellar performance in November for bonds and stocks. With December typically a good month for stocks, it seems no one wants to be short or bet that things will get shaky. If anything, there’s just a bit of hedging or rotation going on.

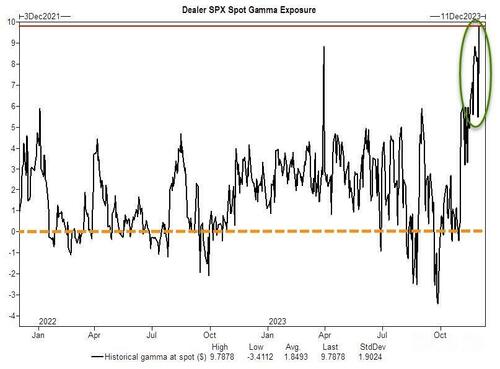

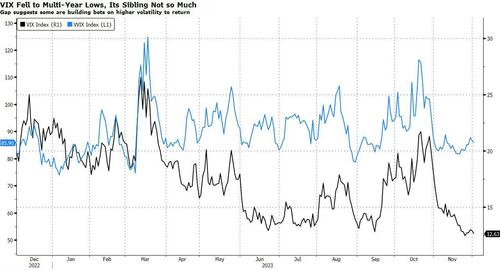

“Given that dealers are still positioned in positive gamma, there appears to be no immediate catalyst to disrupt the ongoing low-volatility environment,” say Tier1Alpha strategists.

“If the S&P 500 begins to trend lower, market makers will have to mechanically buy the dip. Conversely, if the market trends higher, dealers will have to sell futures in order to maintain a delta-neutral position.”

The rally has broadened, taking the Stoxx 600 technical breadth to levels that typically warrant a pause, if not a retracement. Not only is the benchmark is now overbought based on the relative strength index (RSI), but the proportion of overbought members is the highest since February, exceeding 20%.

“The bounce is a squeeze,” say UBS strategists led by Gerry Fowler, who see the November surge as being driven by technical factors. “CTAs were short but have now closed 80% of their position. Investors had become short a range of unloved stocks and were squeezed out of positions.”

The strategists still expect that the highly anticipated slowdown and equity weakness are coming but it could be like an “escalator down” – slow.

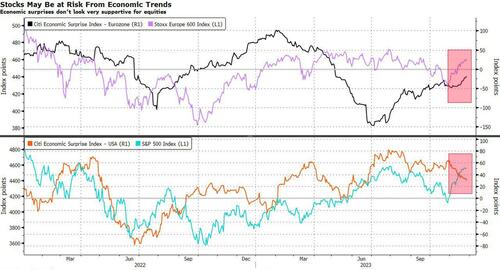

Last week, surprisingly strong US GDP data as well as stabilizing flash PMIs in Europe were additional reasons to embrace the soft-landing narrative. Nevertheless, while economic surprises are showing improvement in Europe, they’re still negative, while the US equivalent is on a downward slope, possibly a bad medium-term omen for stocks.

Yet, that may not be enough to stop the market’s ascent, especially as central banks are turning increasingly dovish. Citigroup strategists led by Beata Manthey, who see around 10% upside for European stocks next year, expect an “improving balance of risks.”

“Rates/inflation are falling, geopolitical risks have abated, and European PMIs have likely bottomed,” they say. “This points to rising chances of economic ‘soft landing’ scenarios and potentially expedited policy easing.”

“We stay bullish into year end, appreciating the fact the set up — positioning, technicals, sentiment, year-to-date performance — is very different compared to where it was this time last month,” says Carl Dooley, head of EMEA trading at TD Cowen.

Tyler Durden

Tue, 12/05/2023 – 08:50

via ZeroHedge News https://ift.tt/jETnpLW Tyler Durden