Sliding Corn Prices Sends Grain Index To Decade-Low

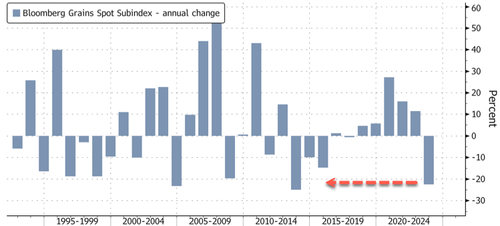

Corn prices tumbled to a three-year low as mounting supplies from the US and Brazil collided with sliding demand. This downturn helped push down the Bloomberg Grain Spot Subindex, which tracks near-term futures contracts for soybeans, corn, and wheat, leading to its largest annual decline in a decade.

Bloomberg Grain Spot Subindex records the worst yearly slump since 2013.

Ag traders are waiting for a US Department of Agriculture’s monthly WASDE report on Friday to gauge the status of foreign and domestic harvests.

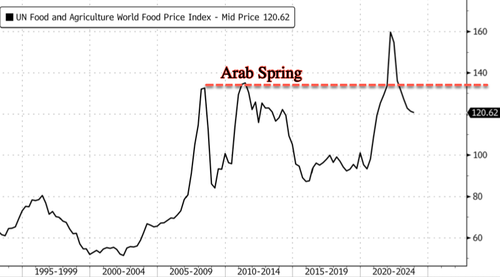

Despite the large decline in grain prices, the Food and Agriculture Organization’s global food price index, which tracks the most globally traded food commodities, is still at highs responsible for the Arab Spring food riots across the Middle East in 2010-11.

Last month, Sara Menker, founder and CEO of Gro Intelligence, warned the current global food crisis has surpassed that of the Arab Spring because crop prices remain high while local currencies around the world have plunged against the dollar.

Tyler Durden

Tue, 12/05/2023 – 04:15

via ZeroHedge News https://ift.tt/AfYJWna Tyler Durden