AMD Unveils New AI Chip To Challenge Nvidia’s Market Dominance

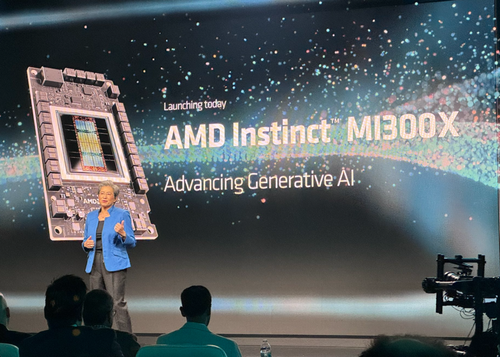

Shares of Advanced Micro Devices rose in premarket trading on Thursday after chief executive Lisa Su unveiled AMD’s newest artificial intelligence chip, the Instinct MI300X, at an event in San Jose, California, on Wednesday. Su highlighted that this new chip surpasses the performance of Nvidia’s current AI chips.

The launch of MI300X is one of AMD’s most important in years as it prepares to take on the AI chip market dominated by Nvidia. These graphics processors are being used to power AI models by OpenAI’s ChatGPT and Elon Musk’s xAI Grok.

AMD’s new chip has more than 150 billion transistors and 2.4 times the memory compared with Nvidia’s H100, the current leading AI chip. It also has 1.6 times more memory bandwidth, further increasing performance. Su noted the new chip is equivalent to H100 in its ability to train AI software.

She provided a stunning projection for the AI chip market’s size, estimating it could surpass $400 billion in the next four years. This figure is double the forecast AMD provided in August.

“I think it’s clear to say that Nvidia has to be the vast majority of that right now,” Su said, referring to the AI chip market, adding, “We believe it could be $400 billion-plus in 2027. And we could get a nice piece of that. “

Soaring demand for Nvidia AI chips this year from data centers fueled a massive rally in the company’s shares, sending its market value over the trillion-dollar market. One major question is how long will Nvidia retain AI chip dominance.

Nvidia shares closed down 2% on Wednesday, a sign investors see MI300X as a new threat to the company’s market dominance. As of premarket trading on Thursday, Nvidia was flat, while AMD was higher by 2%.

Meanwhile, the PHLX Semiconductor Sector has put in 2 lower highs.

Analysts said that they believe AMD’s chips will gain traction because of affordability:

BMO Capital Markets analyst Ambrish Srivastava (outperform)

- AMD did a considerably better job in its second AI event this year

- The company “provided a fairly comprehensive look at its AI portfolio, its approach to addressing the market, and more importantly filling in a few blanks such as performance metrics, and customer/segment traction/ announcements”

Stifel analyst Ruben Roy (buy)

- AMD’s prospects look positive as AI total addressable market (TAM) continues to increase

- The company displayed “growing ecosystem momentum and increased focus on collaboration”

Wells Fargo analyst Aaron Rakers (overweight)

- AMD flagged the breadth of cloud customer adoption on the MI300X beyond just Microsoft Azure

- Highlighting other customers like Oracle and Meta and flagged a “huge increase” in AI accelerator TAM

TD Cowen analyst Matthew Ramsay (outperform)

- The event reinforced belief that “AMD is well positioned to meaningfully participate in a large AI accelerator growth TAM”

- It was a “key milestone in the company’s AI journey, cementing its role as the leading genAI alternative”

And let the competition begin.

Tyler Durden

Thu, 12/07/2023 – 10:05

via ZeroHedge News https://ift.tt/pf4sT1O Tyler Durden