‘Japanic Attack’: Dollar Dumps On Yen Strength, Big-Techs Rip Ahead Of Buyback Blackout

For a change, the big moves were in FX-land today… and oh my, the irony that Japan would spark the market chaos on this ‘infamous day’.

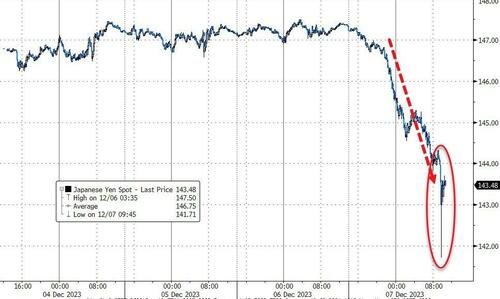

USDJPY dumped overnight after shockingly hawkish comments from BoJ officials hinting at the end of NIRP. That tumble then morphed into a flash crash as it broke 144 (instantly slammed to a 141 handle)…

Source: Bloomberg

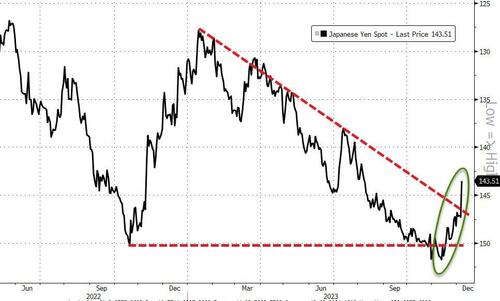

…but despite the bounce back, it was still an ugly day and USDJPY broke its 2023 trendline (inverted to show JPY strength upwards in chart)…

Source: Bloomberg

At the same time, Swissy stormed to new highs (before the Japanic hit the dollar). But overall, the franc has been a one-way train against its European peers for decades…

Source: Bloomberg

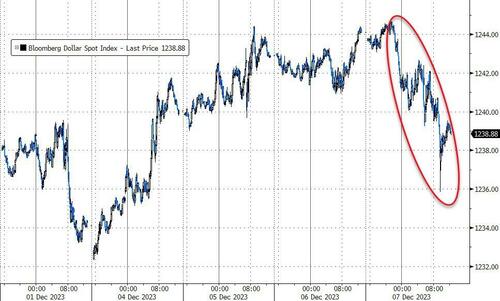

All of which meant the dollar was clubbed (lower) like a baby seal (biggest intraday drop in three weeks)…

Source: Bloomberg

Magnificent 7 stocks soared higher today (after 5 down-days in the last 6), thanks in large part to GOOGL’s biggest daily gain since July (on another AI chatbot). This surge also comes ahead of tomorrow’s start of the buyback blackout window…

Source: Bloomberg

That surge smashed Nasdaq and S&P higher (but all the majors ended green). The S&P and Dow snapped a three-day losing streak…

Interestingly, this is the first day in December that “AI-favored” names have outperformed “AI-at-risk” names…

Source: Bloomberg

But, Anti-Obesity drug names have been December’s losers as ‘Pro-Obesity’ stocks (not sure if that’s the best way to describe them) have rallied…

Source: Bloomberg

VIX was marginally higher ahead of tomorrow’s payrolls data (despite stocks being up) but it was 0-DTE Vol that did the usual spike above ‘VIX’ ahead of an event…

Source: Bloomberg

Treasuries were mixed today with the short-end outperforming (2Y -1bp, 30Y +4bps). 2Y yields remain the only part of the curve higher on the week with 30Y yields down around 15bps…

Source: Bloomberg

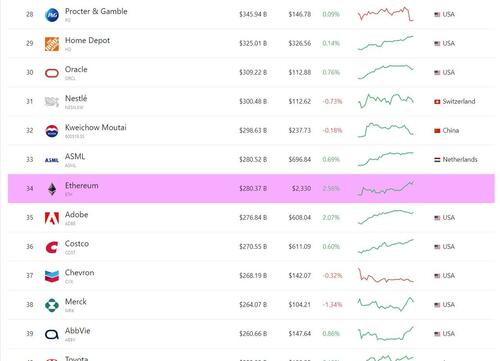

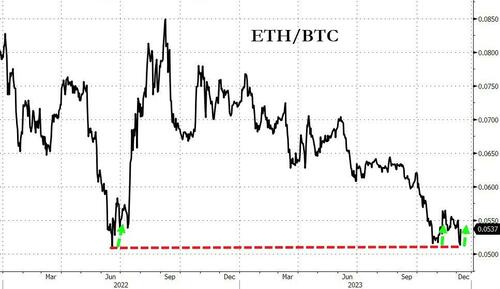

Ethereum outperformed Bitcoin (for a change) today (hitting $2350 – highest since May 2022)…

Source: Bloomberg

This pushed ETH total market cap above that of Adobe and Chevron…

…with the ETH/BTC cross bouncing off serious support…

Source: Bloomberg

Gold continued to tread water in a tight range (despite the dollar dump), with spot prices still holding above $2020…

Source: Bloomberg

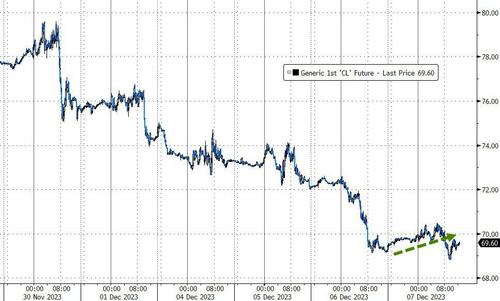

After 5 straight days lower, oil prices managed a gain today (albeit very marginal) as WTI desperately trying to hold on to $70 handle…

Source: Bloomberg

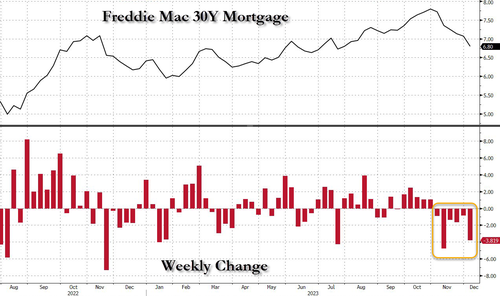

Finally, some good news… maybe? Mortgage rates have plunged for a sixth straight week, now at their lowest level since August…

Source: Bloomberg

Time for another home-buying-panic?

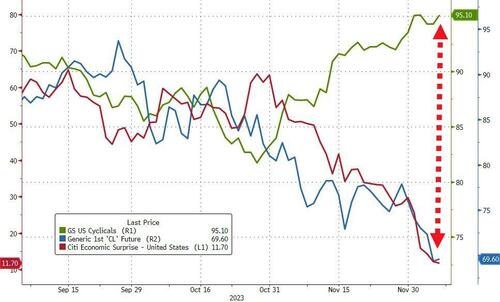

But the divergence between stocks, commodities, and macro continues to widen…

Source: Bloomberg

Who will be right on ‘growth’?

Tyler Durden

Thu, 12/07/2023 – 16:00

via ZeroHedge News https://ift.tt/j0JvPrg Tyler Durden