Bond Rally Hinges On Jobless Rate, Not NFP Number

Authored by Ven Ram, Bloomberg cross-asset strategist,

If economists’ forecasts are right, the most-dissected headline number from today’s set of non-farm payrolls data is also perhaps the least important number for both Treasury traders and the Fed’s dot plot that we will get next week.

Rather, it is the jobless rate and the hourly earnings growth that will determine whether or not the rally of the past month in Treasuries comes to a stop.

Employers are estimated to have added 183k jobs in November. As long as the actual number is within, say, 145k to 156k – the first standard deviation of the predictions – it won’t matter much to the markets or policymakers.

Everyone and their pet poodle already knows the labor market is resilient, and another that shows more of the same isn’t going to move the needle much.

The market will care a lot more about the unemployment rate.

That’s especially against a backdrop where the average over the past three months is running at around 3.8%, considerably lower than the 4.1% rate that the Federal Reserve reckons is needed to bring the labor market back into balance.

-

A rate higher than the 3.9% that the markets have penciled in will give policymakers a greater degree of confidence that their cumulative policy tightening is funneling its way through the economy.

-

A number lower than forecast turns the clock back as it were, and would put a full-stop to this ongoing rally in Treasuries.

Average hourly earnings growth is estimated to slow to 4% from 4.1% in October.

Even so, a number along those lines would still keep inflationary pressures intact given that it would be well over the long-term average of 3%.

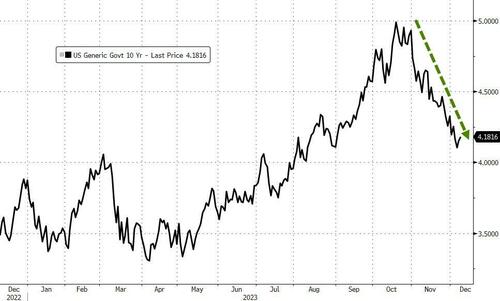

At around 4.60% on the two-year note and some 4.15% on the 10-year maturity, the markets have priced in all the news that is favorable for bonds – leaving little room for error.

Given the sheer velocity of the rally we have seen in the past month, traders may be looking for an excuse to take some money off the table.

Tyler Durden

Fri, 12/08/2023 – 08:08

via ZeroHedge News https://ift.tt/alBCQD4 Tyler Durden