Ugly, Tailing 3Y Auction Sees Lowest Foreign Demand Since June 2022

The week’s accelerated auction schedule kicked off at 11:30am this morning with a 3Y auction (the 10Y benchmark auction will follow at 1pm and the 30Y is on deck tomorrow) which was below mediocre at best.

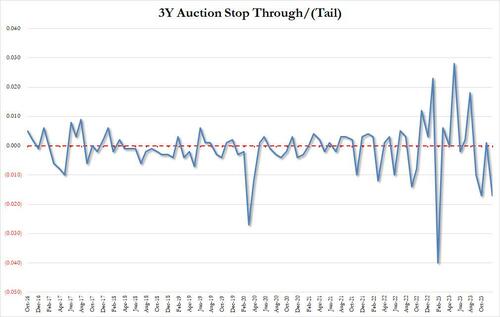

Pricing at a high yield of 4.49%, the auction saw a big drop from last month’s 4.701% – and was the lowest since August – if not as low as the market had expected, with the When Issued trading 4.473% pre-sale, resulting in a 1.7bps tail, tied for the biggest tail since the record 4bps tail in February.

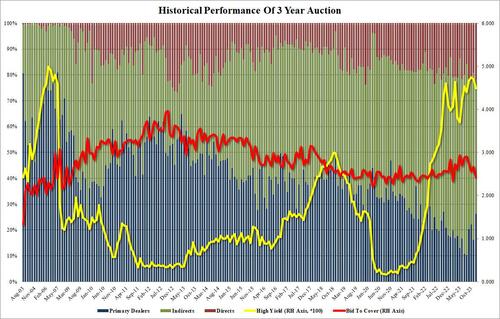

It was all downhill from there, with the bid to cover tumbling to 2.416 from 2.668, far below the 2.743 recent average and the lowest, again, since that infamously ugly Feb 2023 auction.

Then, moving to the internals, we go from bad to worse as buyside demand also collapsed and Indirects (i.e. foreign accounts) took down just 52.1%, a sharp drop from 64.6% last month (and the 63.9% six-auction average), and the lowest since June 2022; and with Directs awarded 21.7%, Dealers were left with a whopping 26.2%, a huge jump from last month’s 16.3% and the six-auction average of 16.1%.

Overall, this was a very ugly auction and one which has pushed 10Y yields to session highs of 4.28%, up almost 20bps from the Thursday low of 4.10%, indicating that the market finally realized that it had eased financial conditions far too much ahead of the Wednesday Fed meeting.

Tyler Durden

Mon, 12/11/2023 – 12:04

via ZeroHedge News https://ift.tt/hc23KEl Tyler Durden