Powell “Pivots”, Sends Dow To Record High With Election-Year Rate-Cut Projection

Did Powell get a ‘Biden-esque’ tap on the shoulder?

The Powell pivot begins.

Dec 1: “It would be premature to … speculate on when policy might ease.”

Dec 13: Rate cuts are something that “begins to come into view” and “clearly is a topic of discussion.”

What a difference two weeks can make. https://t.co/Vox8LKSgf0

— Nick Timiraos (@NickTimiraos) December 13, 2023

The Dow hit a new record high after The Fed signaled – via its ‘dot plot’ – that it has pivoted from a pause, dovishly delivering what the market was pricing in (and Powell didn’t even get close to trying to walk back the exuberance)…

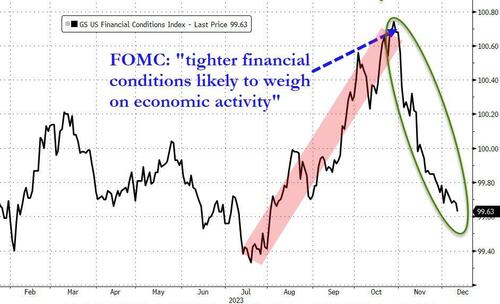

Fed Chair Powell said absolutely nothing about the massive easing of financial conditions (the tightening of which was the reason for them to pause at the September meeting).

Source: Bloomberg

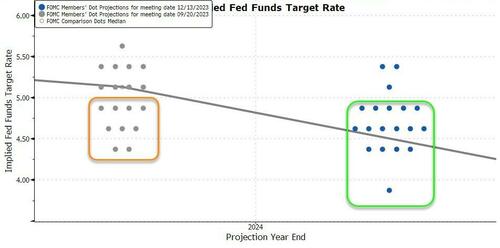

And then pivoted to a major rate-cut trajectory for 2024 (election year).

-

In Sept, 5 Fed members expected three cuts or more

-

In Dec, 11 Fed members expect three cuts or more.

Source: Bloomberg

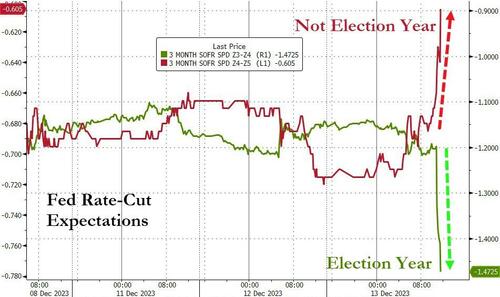

Of course, Powell explained, when asked about the election year:

“We don’t think about political events, we just can’t do that” as he frontloads rate-cuts (from 2025) ahead of 2024 presidential elections.

As The Fed shifted dovishly towards the market, the market shifted even more dovishly – now pricing in 150bps of rate-cuts in 2024 (an election year) – bringing forward the cuts from 2025 (a non-election year)…

Source: Bloomberg

However, amid all the excitement, on a real rate basis, The Fed’s policy restriciveness will be basically unchanged by the end of next year IF their inflation and rate forecasts are met

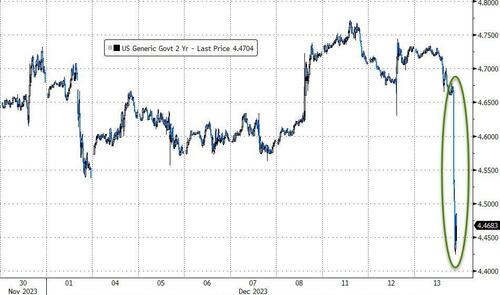

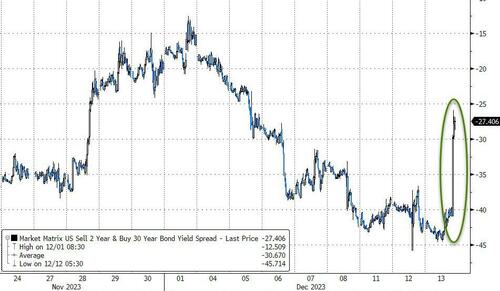

Bonds ripped higher (in price) with the short-end outperforming (2Y -27bps, 30Y -12bps)

Source: Bloomberg

The 2Y Yield plunged over 30bps from the intraday highs – the largest daily drop since the SVB crisis in March. Other than that, you have to go back to the GFC (2008) to see moves like this…

Source: Bloomberg

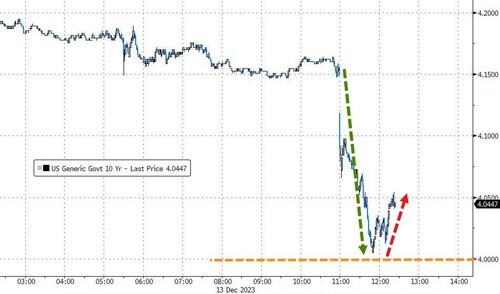

Interestingly, 10Y Yields tumbled to 4.00% and found support there (which stalled stocks)…

Source: Bloomberg

The yield curve (2s30s) massively bull-steepened…

Source: Bloomberg

Is 4.00% 10Y the ‘fear’ level that prompts equity bulls to lose faith in the soft-landing/goldilocks narrative? Stocks were on a roll though and closed near their highs with Small Caps up 3.5% and the rest of the majors up around 1%

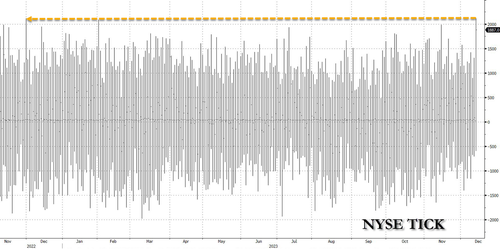

The Fed triggered the biggest stock-buying program since Nov 2022…

Source: Bloomberg

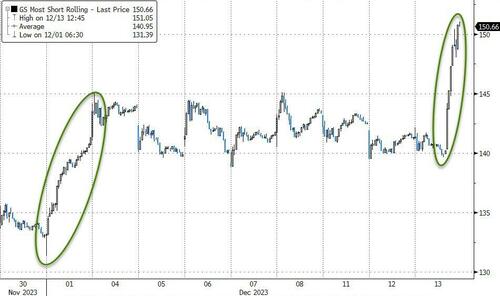

This was the second biggest short-squeeze in stocks since Nov 2022…

Source: Bloomberg

The Magnificent 7 stocks did not exuberantly participate in the yield-collapse the way you think they should have…

Source: Bloomberg

But retail faves are #winning…

Source: Bloomberg

Meanwhile, over in Homebuilder fantasy-land – new highs as the housing market collapses ‘because, hey, The Fed will slash rates next year, right’… except the only thing that will drive that kind of a massive sudden rate cut is a massive sudden recession… which is not good for homebuilders…

Source: Bloomberg

The dollar puked to late November lows…

Source: Bloomberg

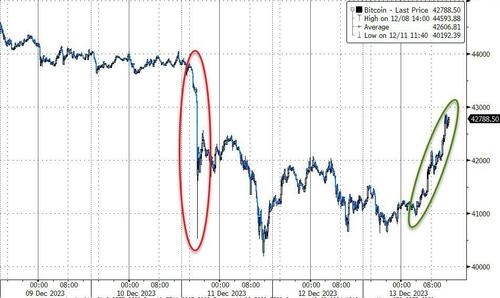

Bitcoin ripped up towards $43,000…

Source: Bloomberg

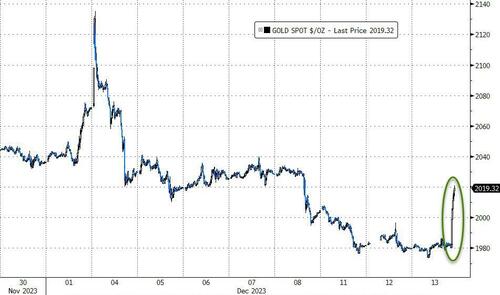

Gold soared over $40, back above $2,000…

Source: Bloomberg

Oil prices rallied (WTI back above $69) but were relatively subdued compared to the rest of markets…

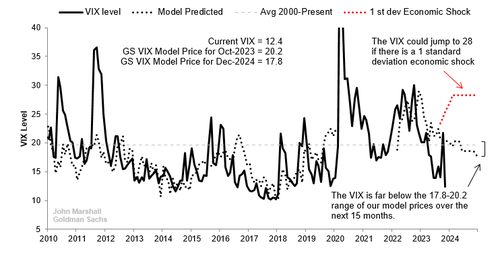

Finally, VIX remains extremely low, but, as Goldman highlighted today, it should be 5-8 points higher based on recent economic data…

As they said: We believe that index options prices are much lower than they should be; however, volatility tends to decline at this time of the year, making it difficult to recommend buying VIX.

Tyler Durden

Wed, 12/13/2023 – 16:00

via ZeroHedge News https://ift.tt/VdmS04p Tyler Durden