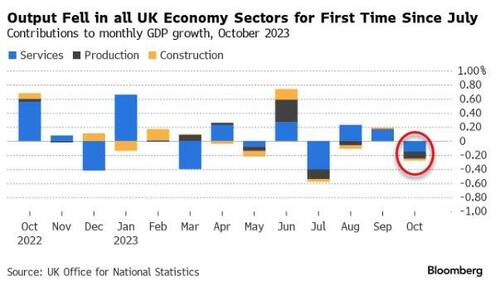

Traders Fully Price-In 100bps Of BoE Rate-Cuts After UK GDP Plunges In October

The UK economy shrank significantly more than expected (-0.3% MoM – below the worst economist’s expectations) in October with activity declining in all major sectors…

Source: Bloomberg

Activity decreased by 0.2% MoM in services, 0.8% MoM in production, and 0.5% MoM in construction.

Declines in services output were led by a contraction in the information and communication industry, while consumer facing services saw a smaller contraction (-0.1%mom).

Weakness in production activity was driven principally by broad-based declines in manufacturing output.

Wet weather was reported to have weighed on output in construction, retail, and recreation.

As a result of today’s print, Goldman revised down their Q4 tracking estimate to +0.1%qoq (not annualised) from +0.2% previously, and lowered their annual growth forecast for 2023 to +0.5% (from +0.6% previously) and for 2024 to +0.6% (from +0.7% previously).

It marks a sharp reversal from slightly better than expected figures for much of this year and adds to the impression that Britain is stuck in a long-running stagnation.

“2023 UK GDP figures paint a picture of sluggishness, bleakness, and lackluster economic performance,” said Douglas Grant, CEO of Manx Financial Group.

It also suggests Prime Minister Rishi Sunak’s beleaguered Conservative government is facing a bleak economic backdrop for a general election expected to be held next year.

“These grim figures show the UK is dangerously close to recession,” said Paul Nowak, general secretary of the Trades Union Congress.

“The red warning lights should be flashing. The UK is stuck in a rut and the Tories have no plan for getting us out of it.”

Chancellor of the Exchequer Jeremy Hunt suggested a sputtering economy is necessary to rein in inflation, also a key goal of the government.

“It is inevitable GDP will be subdued whilst interest rates are doing their job to bring down inflation,” Hunt said in a statement.

“But the big reductions in business taxation announced in the Autumn Statement mean the economy is now well placed to start growing again.”

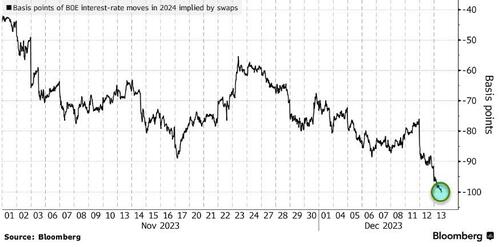

The result of this major disappointment is that traders have now fully priced in 100bps of rate-cuts in 2024 by the BoE…

Source: Bloomberg

However, as we noted earlier, BOE Governor Andrew Bailey faces a serious predicament.

Headline inflation is still around 5%, core inflation within reach of 6% and services inflation not too far from 7%.

While data this week showed weekly earnings growth slowed, the reality is that it is still above 7%.

Those aren’t numbers screaming “2% inflation is here,” so the right question for the markets to ask isn’t really how many times the BOE will be able to cut rates in 2024, but whether it can avoid tightening more.

While headline inflation came in at 4.6% for October, each of the three prints before that was 6.7% or higher.

Those are not numbers that suggest the disinflationary process in the UK is clear and well embedded – unlike the case in the US and the euro zone.

“While some market participants may be tempted to front load rate cuts in 2024, we think that the BOE would await more evidence that UK inflation in particular has continued to fall before discussing any easing measures,” said Valentin Marinov, head of G10 FX strategy at Credit Agricole CIB.

Finally, we can’t help but find the irony in blaming wet weather in England for a weak economy.

Tyler Durden

Wed, 12/13/2023 – 08:05

via ZeroHedge News https://ift.tt/c3B6Odl Tyler Durden