WTI Holds Gains After Big Crude Draw; Biden Admin Unexpectedly Drains SPR

Oil prices are rebounding modestly today after yesterday’s puke (though WTI is still on pace for its longest weekly losing streak since 2018), as OPEC forecast a significant shortfall in global oil supplies next quarter.

It even raised forecasts for the crude needed from OPEC this quarter by 190,000 barrels a day, amid a weaker outlook for production from its rivals.

“Speculators played a major role in this trend, cutting their bullish positions sharply while increasing short positions. The market dynamic was fueled by exaggerated concerns about oil demand growth, which negatively impacted market sentiment,” the report stated.

In theory, that puts world markets on track for a record shortfall of about 3.3 million barrels a day in the last three months of 2023.

Such estimates are increasingly hard to reconcile with real-world data.

“The oil market will likely struggle until the numbers confirm that OPEC+ have reduced production in the first quarter next year,” said Arne Lohmann Rasmussen, head of research at A/S Global Risk Management.

That doubt may explain why key market gauges over the past few weeks have signaled supply continues to outpace global demand.

Nearby contracts are trading below those with a later date – a bearish structure known as contango – and some spreads are at the weakest since late 2020.

The bearish view could be upset if API’s crude draw is confirmed by the official DOE data.

API

-

Crude -2.35mm (-1.2mm exp)

-

Cushing +1.4mm

-

Gasoline +5.8mm (+1.9mm exp)

-

Distillates +300k (+400k exp)

DOE

-

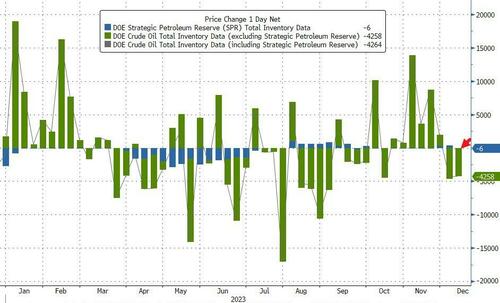

Crude -4.26mm (-1.2mm exp)

-

Cushing +1.23mm

-

Gasoline +409k (+1.9mm exp)

-

Distillates +1.49mm (+400k exp)

Crude stocks fell for the second week in a row with a notably bigger-than-expected draw of 4.26mm barrels. Cushing stocks rose for the 8th straight week and products saw modest builds…

Source: Bloomberg

The negative adjustment factor remains significant in this report at about -1 million barrels a day, though it recovered marginally from last week’s record low.

All of which points to the significant amount of noise that remains in providing a nationwide balance every week.

Bloomberg Intelligence Senior Oil & Gas Analyst Fernando Valle notes that gasoline and diesel demand are both 7% lower than seasonal 2015-19 averages.

The Biden administration drained 6k barrels from the SPR (despite oil prices being near multi-year lows)…

Source: Bloomberg

Stocks at Cushing rose to their highest since August…

Source: Bloomberg

US Crude production was flat on the week, just off record highs…

Source: Bloomberg

WTI was hovering around $69 ahead of the official data and pushed modestly higher after…

Oil prices are falling as record production in the U.S., Canada and Brazil collide with a weakening economy in China, raising concerns among traders that the market is oversupplied.

Finally, we note that thinning liquidity ahead of the holiday period has exacerbated price movements, with US trading volumes below the 30-day average in three of the last four sessions.

Tyler Durden

Wed, 12/13/2023 – 10:38

via ZeroHedge News https://ift.tt/GHQ7wgU Tyler Durden