FedSpeak Pushes Back On Powell ‘Pivot’ Panic-Bid In Bonds & Stocks

Powell “pivoted” and everything exploded (bonds, stocks, rate-cut expectations, gold, oil, and crypto) as the dollar dumped.

The result was a $2 trillion rise in the value of US aggregate bonds and stocks in the last three days and over $7 trillion since the start of November (the prior FOMC)

Source: Bloomberg

And world equity and bond markets added $4 trillion this week alone, and are up over $15 trillion since the November FOMC…

Source: Bloomberg

It appears the exuberance was a little too much and three separate Fed heads were unleashed to tamp down the ‘animal spirits’… and fight the Fed’s dots.

Just how excited?

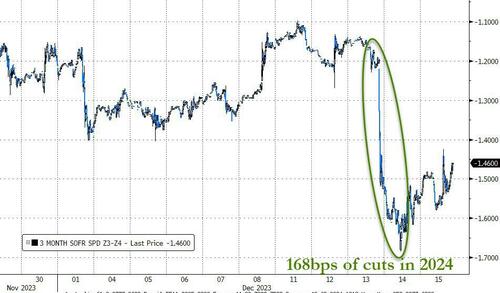

The market immediately priced-in almost 7 rate-cuts for 2024…

Source: Bloomberg

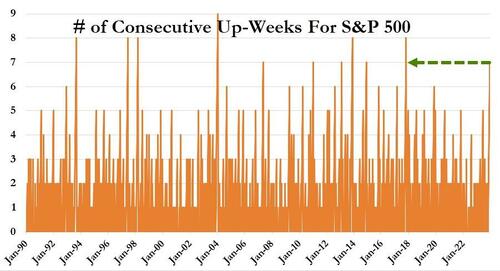

The S&P 500 is up 7 weeks in a row – its longest winning streak in six years (Nov 2017)

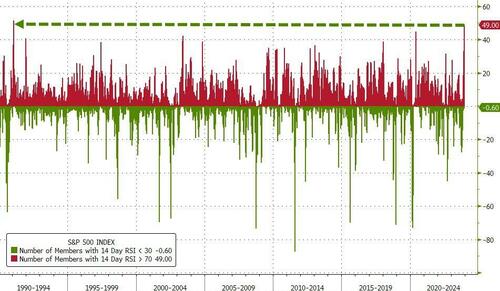

49% of the S&P 500 members are ‘overbought’ after Powell and his pals “rang the bell” this week on rates. That is the most ‘overbought’ breadth since Feb 1991…

Source: Bloomberg

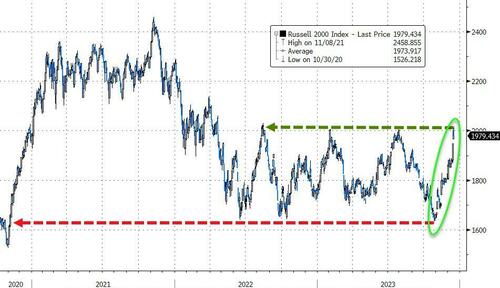

And it only took 48 days for the small-cap Russell 2,000 to go from 52-week low to 52-week high; the shortest turnaround in the index’s 45+ year history…

Source: Bloomberg

So Williams, Bostic, and Goolsbee were unleashed.

Fed’s Williams sparked chaos early on by directly contradicting Chair Powell’s uber-dovishness by saying that “we aren’t really talking about rate cuts right now.”

“I just think it’s just premature to be even thinking about (rate cuts),” he added when asked about cuts in March, warning that inflation is not dead…

“One thing we’ve learned even over the past year is that the data can move and in surprising ways, we need to be ready to move to tighten the policy further, if the progress of inflation were to stall or reverse.”

Later in the day, Fed’s Bostic also came out considerably less dovish, suggesting just two rate-cuts in 2024, and likely after Q3.

“I’m not really feeling that this is an imminent thing,” Bostic was quoted by Reuters as saying.

Policymakers still need “several months” to see enough data and gain confidence that inflation will continue to fall, Bostic said, according to Reuters.

Fed’s Goolsbee was dovish, but also less so than the market and the dots, saying that he expects rates to be lower next year than they are right now, but not significantly, warning that “as inflation comes down, we’ve got to think about how restrictive do we want to be and are there dangers on the employment side of the mandate.”

“We should be prepared to raise rates if we stop getting good news and it looks like we’re not on path to get down to” the Fed’s target, Goolsbee said.

“But also if we see inflation going down more than we expected, we should be prepared to recognize whether that level of restrictiveness that we’re at now, which is clearly restrictive, whether that’s appropriate and whether we should loosen” policy.

The result of all that – March rate-cut expectations tumbled from 100% to around 66%…

Source: Bloomberg

Gold gave back some of its dovish gains…

Source: Bloomberg

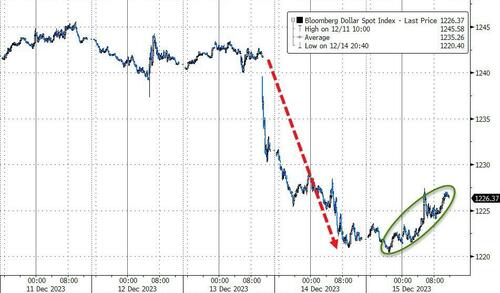

The dollar stopped its freefall…

Source: Bloomberg

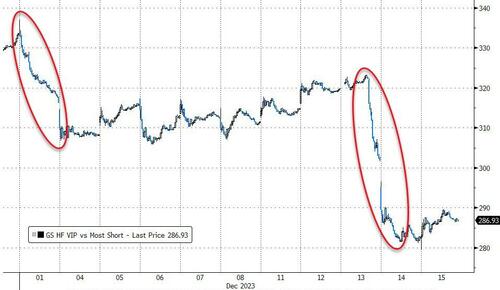

And the massive ‘short squeeze’ stalled…

Source: Bloomberg

Which helped wipe some of the lipstick off Small Caps (which were up almost 8% at one point). The rest of the majors were up 2-3% on the week. Nasdaq closed at a record high for the first time since Nov 2021.

The S&P and Dow were dragged green on the day in the last few minutes and then in the last few seconds, AAPL got his from headline about China’s iPhone ban being more widespread…

AAPL is down 1% after hours…

The dash-for-trash accelerated this week with MAG7 stocks used as a ‘source of funds’ to buy profitless tech…

Source: Bloomberg

Despite the gains, L/S hedge funds were clubbed like baby seals this week as their favorite shorts were face-ripped higher and favorites longs lagged as the dash-for-trash accelerated…

Source: Bloomberg

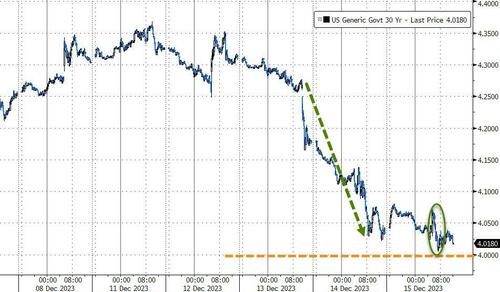

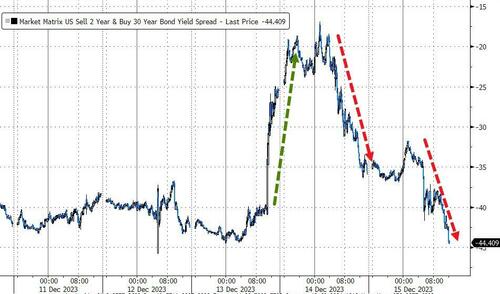

Treasury yields collapsed on the week with FedSpeak prompting a little chop today but clustering the curve down around 26-32bps on the week (belly outperformed)…

Source: Bloomberg

The 10Y Yield fell below (and held below) 4.00% and 30Y tumbled down to within a tick of the same level today – the lowest level since 7/31…

Source: Bloomberg

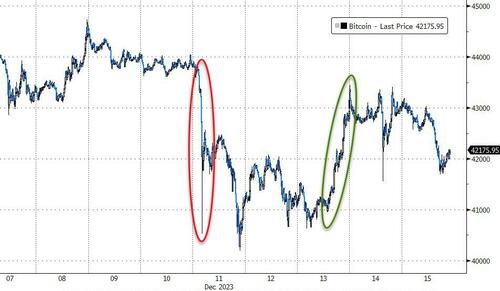

Bitcoin and Ethereum were both down around 4.5% on the week as The Fed prompted a recovery from the Monday “Liz Warren” plunge…

Source: Bloomberg

That reversed all the curve steepening from midweek…

Source: Bloomberg

NatGas rallied on the week and oil (Brent) managed to just close green on the week, the first positive week since October…

While bitcoin was down a little this week, the trend is your friend in crypto and gold as real-yields re-compress…

Source: Bloomberg

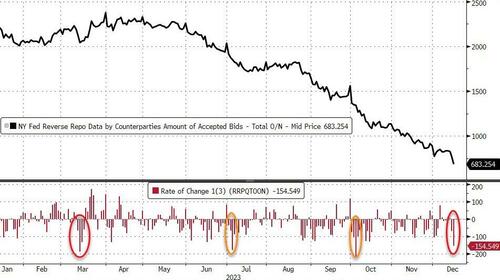

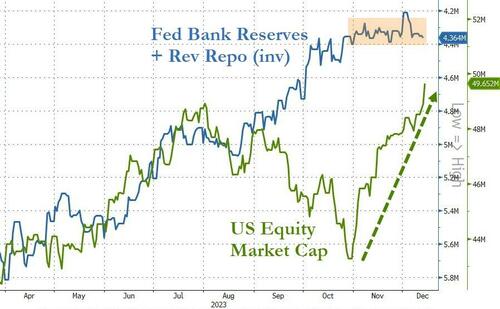

Finally, we note that The Fed’s reverse repo facility has seen over $150BN drained from it in the last 3 days which, outside of quarter-end liquidity needs – is the largest drawdown since the SVB crisis in March…

Source: Bloomberg

Why does this matter? Because…

What a “complete coincidence” https://t.co/GWAJGgnir8 pic.twitter.com/2GHQVWzMmf

— zerohedge (@zerohedge) December 15, 2023

More of the same from the last fifteen years – liquidity is all that matters!

But is the resurgence in stocks almost done?

Or will Powell surprise even more with and end to QT or restart of QE? Would that really be as big a jump as “no rates cuts even considered” on Dec 1st to “6 rate-cuts possible” on Dec 13th?

Tyler Durden

Fri, 12/15/2023 – 16:00

via ZeroHedge News https://ift.tt/6dvm9Bz Tyler Durden