Number Of Americans In Upside-Down Auto Loans Continues To Worsen

Consumers face increasing financial difficulties due to elevated inflation, a generational high in interest rates, maxed-out credit cards, lack of personal savings, and two years of negative real wage growth amid the mounting failures of ‘Bidenomics.’ The latest distress is that the number of Americans in upside-down auto loans has reached the highest level since 2020.

According to automotive research firm Edmunds.com, the number of Americans with auto loans “underwater” or “negative equity” in November reached an average of $6,054, the highest level since April 2020.

“It’s a precarious spot for many Americans, coming after a twin surge in car buying and interest rates has strained finances and fueled an uptick in automobile repossessions,” Bloomberg explained, adding the average rate for a new car loan is 7.4% and 11.6% for a used car.

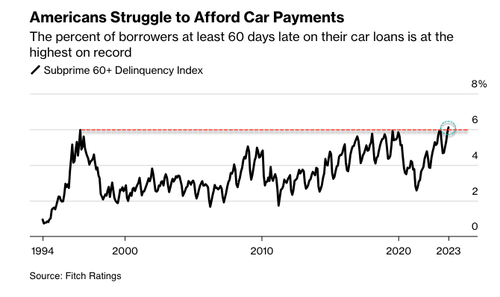

Earlier this year, when discussing the “perfect storm” hitting the US auto market, we showed that according to Fitch, “More Americans Can’t Afford Their Car Payments Than During The Peak Of Financial Crisis“… The average new car loan has reached a record high of $40,000.

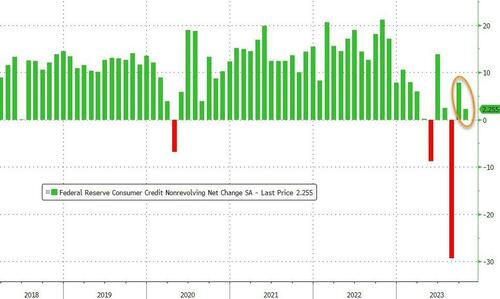

… which was to be expected: after all, the latest consumer credit report from the Fed revolving credit shows high-interest rates have bogged down student and auto loans; in other words, consumer is stretched.

“We’re in this situation where combined with the cost of the vehicles being so high and the interest rates being so historically high, you have a lot of people who are in bad car loans,” Joseph Yoon, consumer insights analyst for Edmunds, told Bloomberg.

To Yoon’s point, the percentage of subprime auto borrowers at least 60 days past due in September topped 6.11%, the highest ever.

The bear market in used car prices will only accelerate the number of auto loans underwater into 2024.

Tyler Durden

Sat, 12/16/2023 – 17:55

via ZeroHedge News https://ift.tt/ZCJUixo Tyler Durden