Bitcoin Flash-Crashes On 15th Anniversary Of ‘Genesis Block’

While many celebrate Oct. 31, 2008 – the release of the Bitcoin whitepaper – as Bitcoin’s original birthday, others take a more technical approach to determining the true age of Bitcoin.

For the latter, Jan. 3 is the actual date Bitcoin materialized as a store of value and transferable currency.

As CoinTelegraph reports, the genesis block, a.k.a. the first Bitcoin block, was mined on Jan. 3, 2009, by its mysterious creator Satoshi Nakamoto.

What followed was years of triumph versus naysayers that included critics, mainstream media, politicians and governments worldwide.

From an inspired spark in the digital depths to a global system of empowerment. Happy Birthday #bitcoin. Cheers to 15 years of pioneering the financial revolution! pic.twitter.com/m0nJg2zmyU

— Mike Novogratz (@novogratz) January 3, 2024

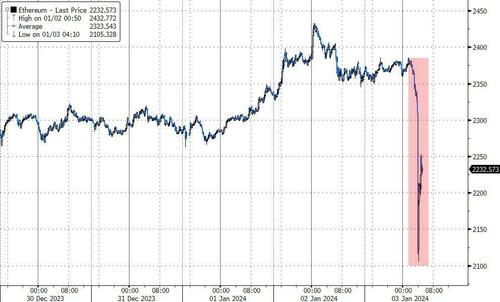

And to celebrate that milestone, crypto market flash-crashed this morning with Bitcoin instantaneously puking from $45,500 to $41,000…

And Ethereum followed suite…

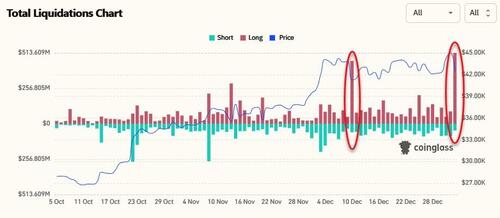

Over $550 million in crypto long positions were liquidated in the past 24 hours, per data from CoinGlass, including $104 million in Bitcoin longs in the past hour alone.

Cryptos are recovering from the initial puke and while the catalyst is unclear, some market participants are pointing to this FUD post on X by MatrixPort analyst Markus Thielen that suggested significant downside and expectations of an SEC rejection of a spot BTC ETF. This is in contrast to the optimistic stance expressed by Bloomberg Intelligence and JP Morgan analysts.

Matrix on Target projects a January rejection for Bitcoin Spot ETFs by the SEC, cautioning traders to hedge long exposure. With #SEC Chair Gensler’s skepticism towards #crypto, a potential -20% #Bitcoin price drop is anticipated upon #ETF denial, though a positive end-of-2024… pic.twitter.com/IgaMhBJtiP

— Matrixport (@realMatrixport) January 3, 2024

There’s just one thing, 24 hours earlier, the same X user posted projections of BTC hitting $50k…

Anticipate a substantial #Bitcoin surge to $50,000 in January, driven by an imminent #BitcoinSpot #ETF approval, institutional buying, and factors such as supply shortage and historical trends, with potential for #altcoin season and a funding rate reaching +66%.

Read the full… pic.twitter.com/sueG5LqENp

— Matrixport (@realMatrixport) January 2, 2024

Take your choice.

And so with all that reactionary FUD, CoinTelegraph takes a bird’s eye view of the Bitcoin ecosystem 15 years on.

Bitcoin ATM Network

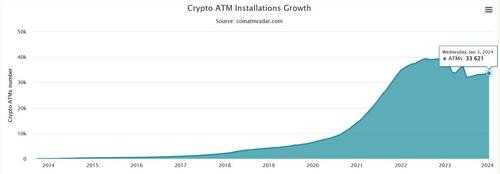

Bitcoin ATMs were first conceived nearly five years after the first block was mined, with historical data confirming that the first ATM went live in October 2013. The motive was to provide another avenue for people to exchange their local fiat currencies for Bitcoin.

While the Bitcoin ATM network saw staggered growth initially, thousands of Bitcoin and crypto ATMs were added yearly across the globe as mass Bitcoin adoption brewed. At its peak, nearly 40,000 Bitcoin ATMs were active on the network in 2021.

Crypto ATM installations growth to date. Source: CoinATMRadar

Post 2021, geopolitical tensions and negative investor sentiment amid a bear market saw an immediate but short-lived reduction in Bitcoin ATMs. However, as of Jan. 3, 2024, nearly 34,000 Bitcoin ATMs remain operational worldwide.

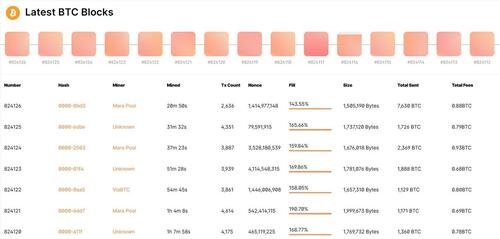

Close to 1M Bitcoin blocks mined

15 years after the creation of the first block, Bitcoin miners continue to mine blocks in return for rewards. The growing interest from individuals and corporations in mining Bitcoin confirms the process as a viable business model that also helps secure the Bitcoin network from external attacks.

Latest BTC blocks. Source: Blockchain.com

Millions of Bitcoin transactions that have been processed over 15 years have been permanently recorded in 825,000 blocks, and neither the miners nor the investors intend to stop.

Mainstream adoption of Bitcoin

Despite the strong resistance to mainstream adoption, those from hyperinflated economies first understood the importance of Bitcoin as the future of money.

El Salvador took charge of establishing Bitcoin as a legal tender and, in two years, showed the resilience of Bitcoin amid global economic turmoil.

El Salvador’s #Bitcoin investments are in the black!

After literally thousands of articles and hit pieces that ridiculed our supposed losses, all of which were calculated based on #Bitcoin’s market price at the time…

With the current #Bitcoin market price, if we were to sell… pic.twitter.com/gvl2GfQMfb

— Nayib Bukele (@nayibbukele) December 4, 2023

El Salvador President Nayib Bukele indirectly gave confidence to the leaders of other countries to reconsider Bitcoin’s proposition. On the other hand, several countries like China and Saudi Arabia continue to restrict the use of Bitcoin — given its ability to provide unsolicited freedom from centralization.

Bitcoin’s journey from worthless to priceless

Beating all odds, Bitcoin now boasts a nearly $900 billion market capitalization, a valuation accumulated in just 15 years. In 2010, an early Bitcoiner convinced a pizza joint to sell him two pizzas for 10,000 BTC. Today, he could start his own pizzeria business for not much more than just one Bitcoin.

Establishments across nearly all business verticals have started to accept Bitcoin in exchange for their services. From real estate and concert tickets to vacations and education, Bitcoin can be used to make almost any purchase without involving banks or other centralized entities. Read this article to learn more about how actually to spend Bitcoin.

Let us not forget that #Bitcoin is the 9th most valuable asset in the world. In less than 15 years, it surpassed 7,963 other assets to accomplish this. By the end of 2025, I suspect it to be in the top three. We shall see. #stackharder pic.twitter.com/kOYK5mqY49

— Oliver L. Velez ⚡️ 13%’er Bitcoiner (@olvelez007) January 2, 2024

As of January 2024, Bitcoin is the 9th most valuable asset in the world based on market cap alone. Professional trader and financial author Oliver Velez noted that Bitcoin surpassed 7,963 assets in 15 years to rank 9th and anticipated the asset to rank in top three by 2025.

Tyler Durden

Wed, 01/03/2024 – 08:24

via ZeroHedge News https://ift.tt/wodVG6S Tyler Durden