This Week’s Data Will Give Early Read On 2024 Recession

Authored by Simon White, Bloomberg macro strategist,

This week sees an important piece of soft data – the manufacturing ISM, released today – and hard data, the jobs numbers out on Friday.

The evolution of soft and hard data in 2024 will give an indication of if and when the US economy is likely to slip into a recession – something stocks near all-time highs do not yet have on their radar.

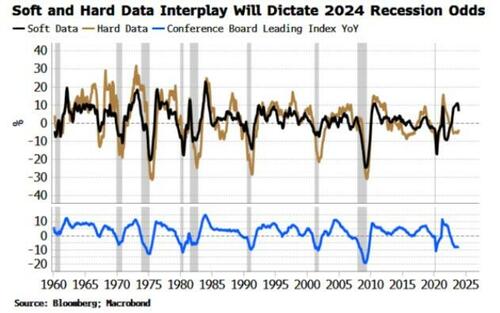

You may have missed it, but the Conference Board’s Leading Index for November was released just before Christmas. It has been declining for 20 months, and consistent with a recession.

Yet an NBER-defined downturn has been avoided thus far and is not on the cards in the near future.

What’s going on?

A look under the hood of the CB’s Leading Index – which has 10 inputs – shows that it is the hard data dragging the index down; the soft data remains elevated.

Almost all previous NBER recessions (vertical gray bars in chart below) had both the soft and hard data inputs for the Leading Index contracting at the same time.

Recessions typically occur when both hard and soft data begin to reinforce one another in a negative feedback loop. As the chart above shows, hard data is contracting, but appears to be stabilizing, while soft data has started to turn down, but remains elevated.

Key then this year will be to watch for a deterioration in soft data, i.e. stock prices, credit and survey data, or for hard data – employment, building permits, capital goods orders, etc – to begin weakening at an accelerating rate. Either would indicate an increased probability of a recession-inducing negative feedback loop developing.

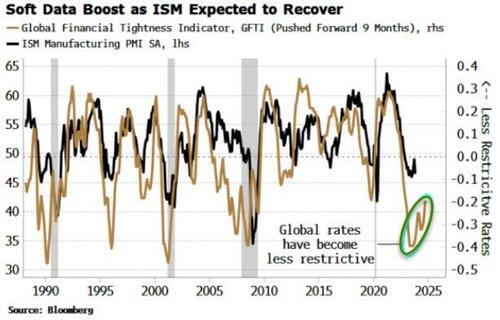

A key soft data point, the manufacturing ISM, is released later today. It has been in the sub-50 zone since November 2022, and lurched lower towards the end of last year after showing some improvement. Leading indicators are optimistic that it resumes its recovery.

The chart below shows the Global Financial Tightness Indicator, essentially a diffusion of central-bank rate hikes and which leads the headline ISM by about nine months.

As most central banks pull back from raising interest rates and begin cutting, conditions are easing, which points to a higher ISM.

On the hard-data front, we’ll get the latest jobs numbers on Friday (plus some less reliable data beforehand such as the JOLTS and ADP).

The labor market is slowing, it just depends whether it begins to slow at an increasing rate.

Last month’s improvement in the unemployment rate, and the recent inflection lower in unemployment claims – which (inversely) lead payrolls – suggest that any worsening in jobs-market momentum is not imminent.

With no expected sudden ratcheting up of recession risk in the near term, that’s one risk buoyant stocks will not yet have to contend with.

Tyler Durden

Wed, 01/03/2024 – 13:05

via ZeroHedge News https://ift.tt/YzU2Bfe Tyler Durden