Magnificent Seven’s January Start Gives Clues To Market’s Year

Authored by Simon White, Bloomberg macro strategist,

The first week of the year’s performance in the seven largest S&P 500 stocks has some utility for gauging full-year results in the broad index.

Cameron Crise on Wednesday looked at how year-to-date returns in the S&P relate to full-year returns.

Following on from this, I thought I would look at how the first week of the year’s returns in the top seven stocks correlate with their full-year returns, and similarly for the remaining stocks in the index.

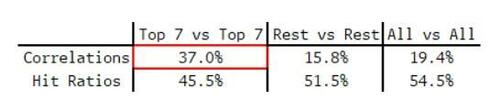

The results are shown in the table below.

As can be seen, there is a relatively high correlation between top seven’s first-week and full-year performance (data back to 1990).

This is a higher correlation than the index ex-top seven stocks (the rest), or the whole index.

However, the hit ratio (the percentage of times where the first-week and full-year performances have the same sign) is under 50% for the top seven, while it is more than half for the rest, and the whole index.

Does the top seven’s early performance have any utility for the outlook for the index over the course of the year?

It turns out it has some.

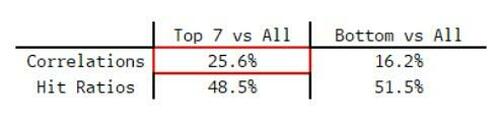

There is a ~26% correlation between the top seven’s first-week returns and the full index’s whole-year returns, albeit with a hit rate of just under 50%. That correlation is higher than that between first-week and whole-year returns for the full index of ~19%.

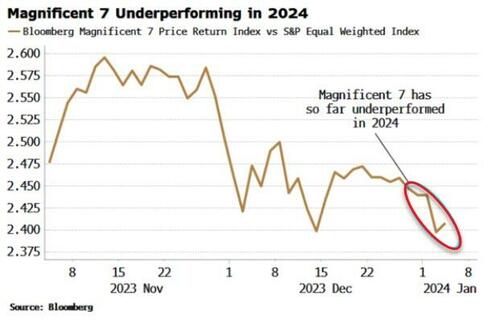

Based on this analysis, the prognosis for the S&P’s 2024 returns has a negative skew, given the Magnificent Seven is so far down on the year and is underperforming.

Nonetheless, in agreement with Cameron, there is no “a-ha” conclusion where year-to-date returns – either for the full index or subgroups of it – tell us something overly compelling about whole-year performance.

Tyler Durden

Thu, 01/04/2024 – 15:25

via ZeroHedge News https://ift.tt/vtZN5xr Tyler Durden