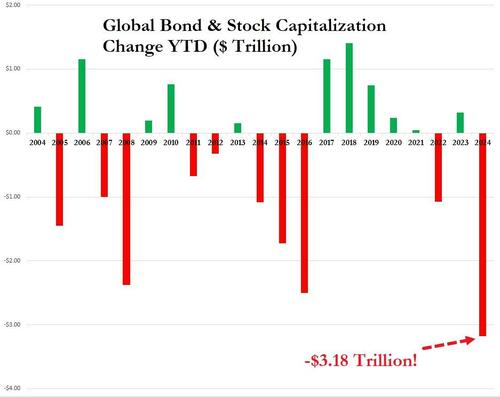

Global Markets Suffer Worst Start In Over 20 Years As ‘Soft’ Data Stalls, Financial Conditions Tighten

In terms of total wealth destroyed, 2024 has started with the worst record ever as global bond and stock markets saw over $3 trillion wiped away…

The losses are dominated by global stocks (down around $2 trillion), while bonds are down around $1 trillion (but still up massively from the major inflection point at the start of November)…

Source: Bloomberg

This shift has dramatically changed the trend for financial conditions (which have tightened by the most over the past week since October)…

Source: Bloomberg

And hope is rung out of the economy as ‘soft’ data starts to catch down to ‘hard’ data’s somber reality…

Source: Bloomberg

Despite initial appearances (payrolls rose more than expected), the jobs reports was a shitshow and markets began to realize it after a while with rate-cut hopes, bond yields, gold and stock prices all reversing the initial kneejerk move.

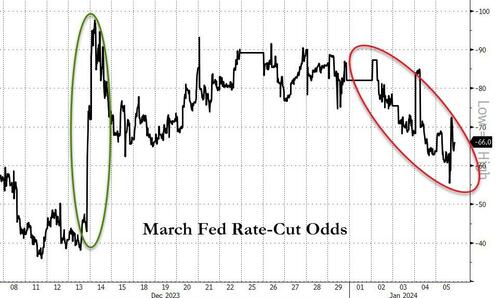

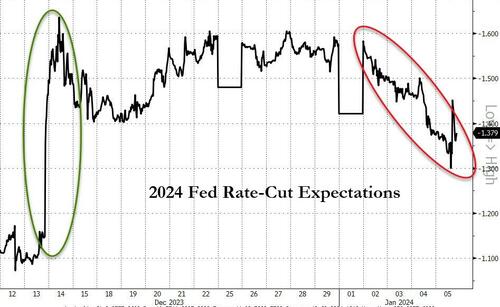

Rate-cut expectations initial tumbled on the ‘good’ jobs data then whipped higher on the ‘bad’ ISM before settling back around unch on the day (though March odds and 2024 total cuts both hawkishly dropped this week)…

Source: Bloomberg

All the US Majors were down to start the year with Small Caps and Nasdaq the biggest losers (down around 3.5-4%). The Dow was the least harmed but still down 1% on the week

This was Nasdaq’s worst week since last March.

Today saw stocks swing wildly around the macro data but a late day charge lifted most majors barely green…

Magnificent 7 stocks saw over $400 Billion of market cap wiped away this week, erasing all of December’s gains…

Source: Bloomberg

As financial conditions have tightened so the laggards that became major leaders in the last two months of 2023 have once again become laggards…

Source: Bloomberg

Anti-Obesity drug-stocks managed gains on the week…

Source: Bloomberg

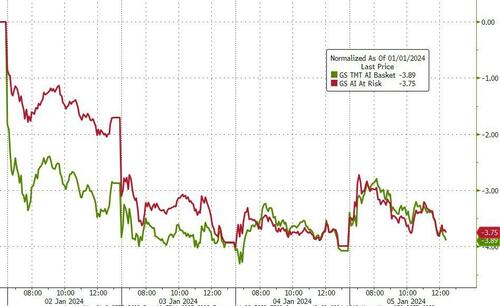

Notably, this was not a “AI-bubble-burst” moment – as AI-beneficiaries and those ‘at risk’ from AI were both hit just as hard this week as rates rose…

Source: Bloomberg

While the entire curve was higher in yield on the week, 30Y yields rose the most (up 16bps – the second biggest yield jump to start a year since 2011)

Source: Bloomberg

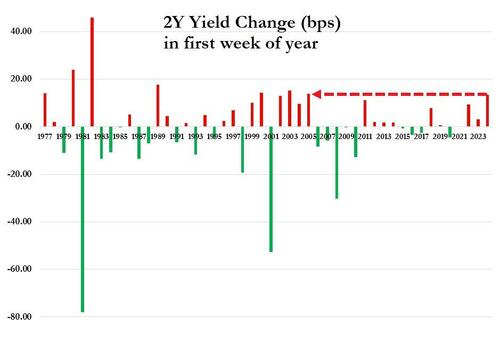

…but 2Y yields were up 13.5bps – the biggest yield increase to start a year since 2005…

Source: Bloomberg

Today was a little more crazy that most with yields spiking on payrolls beat, then tumbling on ISM Services miss, then rising back as the ugly reality of the jobs data hit home.

Source: Bloomberg

That was a 17bps hi-lo range for 2Y yields…

Source: Bloomberg

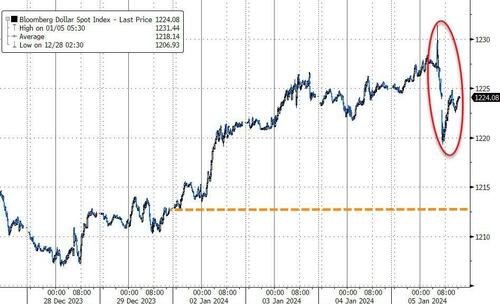

The dollar rallied to start the year and had a wild day today (like bonds)…

Source: Bloomberg

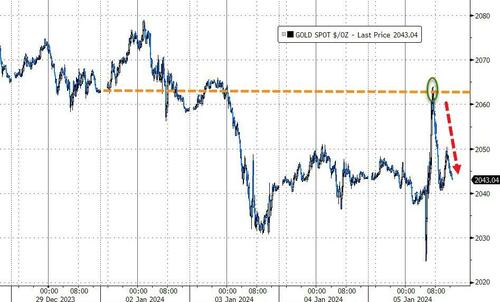

Gold fell to start the year but not after ramping up to green for a few brief minutes after this morning’s weak ISM…

Source: Bloomberg

Oil prices chopped around wildly this week but ended higher – in fact WTI had its best week since October trading up to $74…

Source: Bloomberg

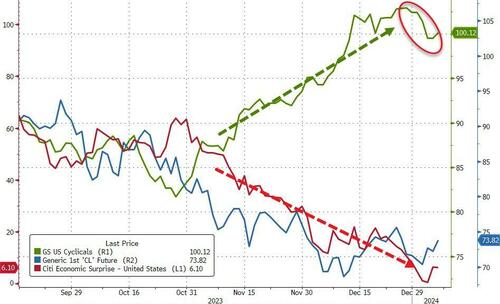

Finally, are cyclical stocks about to start rolling over and catching down to the de-growth reality of US macro and oil prices?

Source: Bloomberg

That’s quite a gap! Can stocks remain buoyant as reserves bleed?

Source: Bloomberg

Meanwhile, the AAPL has fallen far from the tree (down almost 10% from its record highs…

Source: Bloomberg

…far enough to now be ‘oversold’.

Tyler Durden

Fri, 01/05/2024 – 16:00

via ZeroHedge News https://ift.tt/3ILK87O Tyler Durden