The Houthi Butterfly Flaps Its Wings

Earlier, we reported that on Wednesday, the White House warned that this ongoing Red Sea turmoil could hit the US economy in a briefing:

The White House has warned that the potential for higher shipping costs to affect the U.S. economy amid diversion of ships from the Red Sea will depend on how long Houthi rebels sustain their attacks on commercial vessels.

“If we weren’t concerned, we wouldn’t have stood up an operation in the Red Sea, now consisting of more than 20 nations, to try to protect that commerce,” White House spokesman John Kirby said at a White House press conference on Wednesday, referring to the U.S.-led military force Operation Prosperity Guardian.

“The Red Sea is a vital waterway, and a significant amount of global trade flows through it. By forcing nations to go around the Cape of Good Hope, you’re adding weeks and weeks onto voyages, and untold resources and expenses have to be applied in order to do that. So obviously there’s a concern about the impact on global trade.”

Interestingly, Kirby was then asked by a reporter whether the spiraling situation would become “pocketbook” issue for Americans.

Kirby responded by saying “It would depend on how long this threat goes and on how much more energetic the Houthis think they might become.” He added: “Right now we haven’t seen an uptick or a specific effect on the U.S. economy. But make no mistake. This is a key international waterway. Countries more and more are becoming aware of this increasing threat to the free flow of commerce.”

Thus he fully acknowledged this is a distinct possibility that’s fast approaching.

Indeed as Paris Johnson details below via DailyReckoning.com, the impact of a small group of rebels may just cause a financial hurricane in the US.

The Butterfly Effect

Houthi rebels are the new Somali pirates.

Imagine a bunch of goatherders, who are pissed off at Israel over the Gaza bombing, stopping world trade.

It’s improbable. Unlikely. Fatuous, even.

And yet, here we are, talking about everything Joke Biden needs to bury if he (or his body double) wants to win in November.

The Butterfly Effect is when a very small change in initial conditions that creates a significantly different outcome.

In 1950, Alan Turing noted: “The displacement of a single electron by a billionth of a centimeter at one moment might make the difference between a man being killed by an avalanche a year later or escaping.”

There is no need to wonder what Turing would be thinking if a bunch of Houthis were sitting on the cliffs lining the Bab Al-Mandeb Strait, lighting off cheap drones and rockets at any Israeli or Israel-aligned ship.

If you’re Russian or Chinese or anyone aligned with the Global South, pass “Go” and collect $200.

From the December 22nd edition of the Rude Awakening:

On our editorial call on Wednesday, ex-naval aviator and Paradigm’s venerable historian Byron King mentioned something I hadn’t considered.

Byron said – and I’ll paraphrase – that the Houthis were using $100,000 drones to attack commercial shipping in the Red Sea, while the US Navy was using $1 – 4 million rockets to shoot those drones down.

You don’t need a mathematics degree to see why experts think this unbalanced exchange of munitions will eventually pressure the Pentagon.

Well, thanks to these Houthis, we’re heading back to the water routes of the 1860s!

Why Americans Need to Care About This… And Think Carefully.

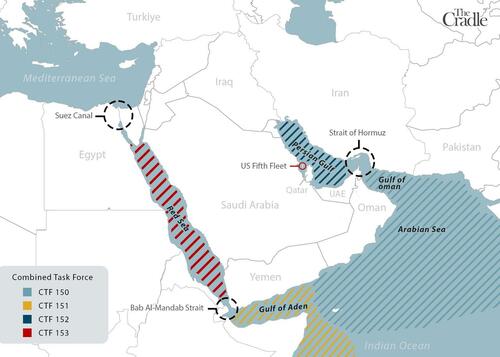

You may not yet recognize the Bab Al-Mandeb Strait I mentioned earlier. That’s the waterway a ship needs to travel through to get to the Suez Canal.

If the Strait is blocked due to rocket fire and the subsequent suspending of maritime insurance, then the Canal is inaccessible. And that means you’ve got to sail around Africa for goods to reach Europe and the West.

Credit: The Cradle

The military angle is easy enough.

From The Cradle:

While the US military is successful at producing expensive, technologically complex weapons systems that provide excellent profits for the arms industry, such as the F-15 warplanes, it is not capable of producing enough of the weapons needed to actually fight and win real wars on the other side of the world, where supply chains become even more critical.

But the economic warfare is even more dreadful.

Impact on Shipping Costs

Shortest Route

The Suez Canal offers the most direct sea route between Asia and Europe, significantly reducing travel time and distance compared to the alternative Cape of Good Hope route (around the bottom of Africa). When the canal is inaccessible, ships are forced to take this longer route, increasing travel times by weeks and fuel costs exponentially.

Fuel Costs

Longer journeys translate directly into higher fuel consumption. This additional cost is invariably passed onto consumers, raising the prices of goods transported via these routes.

Charter Rates

The canal closure often leads to a shortage of available shipping capacity. Ships tied up in extended voyages reduce the supply of vessels available for other routes, driving up charter rates. This, in turn, inflates shipping costs, a burden that the consumer again bears.

Congestion and Delays

The aftermath of a canal closure typically involves significant congestion and logistical backlogs. This can lead to substantial delays, further disrupting shipping schedules and increasing operational costs.

Breaking the Supply Chain

Just-in-Time Inventory

Modern business models, such as just-in-time inventory systems, rely heavily on timely and predictable delivery of goods. The closure of the Suez Canal disrupts these delicate systems, leading to widespread shortages and inefficiencies.

Perishable Goods

The delay in shipping routes particularly impacts the delivery of perishable goods. This leads to wastage and disrupts food supply chains, affecting markets and consumers globally.

Manufacturing Delays

Industries dependent on specific components, such as automotive and electronics, are significantly impacted by delays in the delivery of these parts. This halts production lines, leading to broader economic repercussions.

Global Interconnectivity

The closure of the canal highlights the deeply interconnected nature of global trade. A disruption in a single yet crucial location can have far-reaching effects, impacting various sectors and economies worldwide.

Inflationary Pressures

Increased Transportation Costs

The surge in transportation costs due to longer shipping routes and heightened fuel consumption contributes to overall inflation, as these costs are typically transferred to the consumer.

Supply Shortages

Disruptions in supply chains can create shortages of various goods. According to the principles of supply and demand, reduced supply often leads to increased prices, contributing to inflation.

Speculative Increases

Anticipation and speculation about delays and shortages can trigger preemptive price increases. These speculative actions can exacerbate inflationary pressures even before actual shortages occur.

Economic Recovery Post-Pandemic

In a post-pandemic world, where economies are in various stages of recovery, the closure of a critical trade route like the Suez Canal compounds existing challenges, such as labor shortages and heightened consumer demand, further fueling inflation.

Broader Economic Implications

Global Trade Dynamics

The Suez Canal’s role in global trade dynamics is multifaceted. It’s a conduit for goods and a barometer for global economic health. Its closure signals deeper issues in international trade relations and economic stability.

Energy Markets

The canal is also vital for the transport of oil and natural gas. Its closure can disrupt energy markets, leading to fluctuations in energy prices globally. This domino effect affects industries and consumers alike, as energy costs are a fundamental component of almost every economic activity.

Long-Term Strategic Changes

Repeated disruptions may prompt companies to reassess their supply chain strategies. This might include diversifying shipping routes, increasing inventory levels, or even reshoring some manufacturing operations. While these strategies can mitigate risks, they also come with increased costs and complexities.

Environmental Impact

Longer shipping routes increase costs and have a significant environmental impact.

Wrap Up

Whether you own a business or are just looking after your investments, it’s paramount that you keep abreast of this situation.

Yes, a bunch of goatherders has just thrown a monkey wrench into the world’s economic works.

But this also represents an enormous opportunity to profit if you keep your head about you.

Look at the energy and transportation sectors. Look at precious metals. Look at other tangible assets and commodities, like copper.

While the Houthis are wreaking havoc on the West, you can protect your investments and profits before most people even know what’s happening.

Good hunting!

Tyler Durden

Thu, 01/04/2024 – 20:00

via ZeroHedge News https://ift.tt/btAshy5 Tyler Durden