Boeing & Spirit AeroSystems Shares Plunge After Max 737-9 Max Door Blowout Incident

Boeing shares tumbled in premarket trading in New York after an emergency door separated from an Alaska Airlines 737-9 Max jet over Portland on Friday evening, forcing the Federal Aviation Administration and European Union Aviation Safety Agency to ground the jets for inspections.

Bloomberg Intelligence’s George Ferguson and Melissa Balzano believe the mid-cabin exit door that ripped off the Max jet on Friday “probably stems from a manufacturing oversight, a sign of deficiency at Spirit AeroSystems, Boeing’s key supplier.”

“Manufacturing training and oversight appear to be lacking, as Spirit’s component flaws have become an unsettling pattern,” the analysts continued.

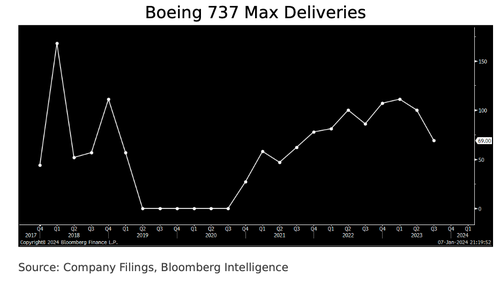

Persisting quality control issues pose a significant threat to Boeing’s turnaround efforts. The increased production rates of the 737, for which Spirit is the top fuselage supplier, are crucial for boosting profits and cash flow for both companies.

A faltering turnaround plan is why Boeing shares plunged 9%, and shares of Spirit AeroSystems crashed 20%. Meanwhile, competitor Airbus shares rose 1.5% in European trading.

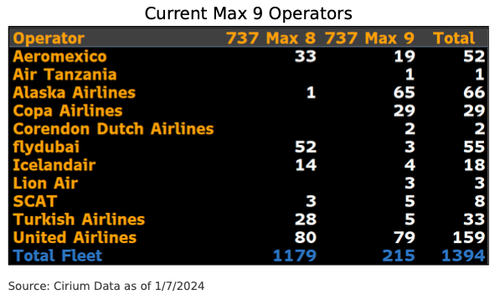

Here are the current operators of the 737-9 Max jets:

Wall Street analysts said continued quality control issues at Boeing and Spirit AeroSystems could derail the 737 Max production ramp (list courtesy of Bloomberg):

Morgan Stanley (equal-weight, PT $255)

- Analyst Kristine Liwag expects the market to receive the Alaska Air incident negatively for both Boeing and its fuselage supplier, Spirit AeroSystems

- Without significant improvement in quality control, a steep ramp-up in aircraft production for Boeing would be unlikely and “imprudent;” sees increase in regulatory scrutiny on Boeing, potentially causing certification delays to the 737 Max 7 and Max 10

JPMorgan (overweight, PT $270)

- The incident is not helpful in regards to Boeing’s key task of ramping production over the next two years, analyst Seth Seifman writes, though the extent of the setback is not yet clear – notes focus also on supplier Spirit Aero

- While FAA’s initial requirement for a four to eight hour inspection did not seem like a major impediment to a return to service, path back has become less clear since then; it is imperative for both Spirit Aero and Boeing to shore up quality of production

Citi (buy, PT $315)

- The 737 issue is likely a manufacturing issue with this particular aircraft given the newness of the aircraft and fact the Max has been in service since 2015 without a similar event, analyst Jason Gursky says

- This likely limits Boeing’s financial exposure to an immaterial amount in context of longer-term targets; analyst does not expect issue to impact other variants of the 737 given the 9 is only one allowing for a plugged door

Truist Securities

- Expects bulk of the attention to focus on Spirit AeroSystems (hold), which has been “plagued” with quality escape issues over the past 12 months, analyst Michael Ciarmoli says, and is the largest Max supplier to Boeing

- Does not believe the issue with derail Max production, but the investigation is still in early stages

Remember this.

As a reminder, the 737 Max was “designed by clowns who in turn are supervised by monkeys”.https://t.co/Z5rt2LoI3e

— zerohedge (@zerohedge) January 6, 2024

Boeing is starting the new year on the wrong foot.

Tyler Durden

Mon, 01/08/2024 – 07:15

via ZeroHedge News https://ift.tt/ilfFDk1 Tyler Durden