The Goldilocks Narrative Reigns For Now

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

Market narratives have been around for ages. However, the internet and, more recently, social media allow narratives to spread much quicker. Accordingly, they have become more frequent and potent market forces. Following economic data, corporate earnings, politics, global affairs, and many other factors are still crucial for investors. But equally important, especially over short periods, is identifying which narrative(s) most heavily impact markets. Today’s popular narrative is a growing consensus for the Fed to engineer a soft landing and a Goldilocks economy. It’s worth appreciating the Fed and Jerome Powell, purposely or not, started the narrative.

As the fiscal stimulus that drove above-average economic growth in the post-pandemic era exits the system and monetary policy remains very tight, economists and investors wonder what comes next. The scenario rapidly gaining in popularity is the Goldilocks narrative.

In case you forgot, Goldilocks and The Three Bears starts with Papa, Mama, and Baby Bear leaving their house for a walk while their porridge cools. Goldilocks enters their home and tastes the three bowls of porridge. Papa’s is too hot, and Mama’s is too cold. Baby Bear’s is just right. She also finds Baby’s chair and bed are just right, not too hard or soft. Goldilocks prefers things “just right.”

Like the tale, a Goldilocks economic scenario is a slowdown to more sustainable growth rates. Such does not involve a recession or high inflation. For most asset markets, it’s a dream scenario.

Regardless of what you or I think, markets are currently taking their cue from Goldilocks, at least until the next narrative takes charge.

The Fed Brought Goldilocks To Life

On November 1, 2023, the Fed hinted that the Goldilocks era is in view. Per our Commentary following the meeting:

Of importance, Chairman Powell stated: “Financial conditions have tightened significantly in recent months due to longer-term rates.” Further, he says the stronger dollar and weaker equity prices will weigh on economic growth. As long as those conditions remain persistent, the Fed is unlikely to hike rates. Based on trading yesterday afternoon, the stock and bond markets seem to agree the Fed is likely done raising rates. Assuming economic activity does slow, the market will start anticipating rate cuts.

Starting in November, the “pause” was on. As we predicted, the market turned its attention to when the Fed might cut rates. At the following meeting on December 13, the Goldilocks narrative came to be. From our Commentary that next morning:

This meeting included the Fed’s quarterly economic and rate projections and comparisons to September. As we show, the Fed’s median estimate is for three 25bps rate cuts next year. One participant sees rates falling 1.25% by the end of next year. The minutes and projections are more dovish than the market expected.

The stock and bond markets rocketed as rate cuts and no recession, i.e., Goldilocks, translated into buy, buy, and buy more.

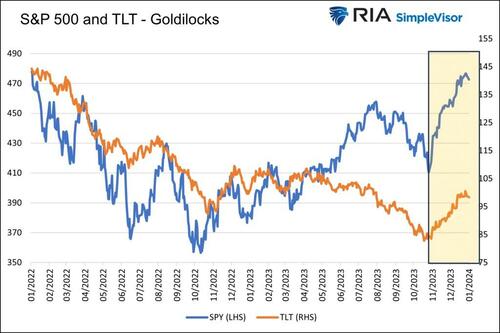

Since November 1, 2024, highlighted below, the S&P 500 (SPY) has been up 12%, and 20-year UST (TLT) has risen over 15%.

We do not know how long the Goldilocks narrative will drive stocks higher and bond yields lower, but we know that investor flows in both markets favor this bullish scenario.

Investing For More Goldilocks

Based on the narrative du jour, it’s worth assessing stock sectors and factor performance since November 1. This will help us assess which stocks might benefit most if the Goldilocks narrative continues to lead the stock market higher.

Before we share sector and factor performance data, it’s worth disclaiming that year-end-related trading had a powerful effect this year. Given the significant performance discrepancies, portfolio rebalancing, tax gain/loss trading, and window dressing considerably and disproportionately impacted many stocks and sectors over the last few weeks of December. Therefore, we mustn’t attribute the performance data below solely to Goldilocks.

Sectors

The first graph below shows how each S&P 500 sector has performed since November 1.

Interestingly, the 2023 market leaders, technology, communications, and consumer discretionary, did well during the period but did not lead the pack. Transportation and real estate stocks were the best performers. Energy stocks were the only sector that didn’t benefit from Goldilocks.

Real estate did very well for a couple of reasons. First, it had been down 12% year to date before November. A strong economy and lower interest rates would limit real estate property losses. Further, lower interest rates make their relatively high dividend yields more competitive.

The transportation sector is among the most correlated with economic activity. Therefore, the thought of no recession bodes well for many of the stocks in the sector.

Despite declining yields, higher dividend stocks like utilities and staples lagged many other sectors. This is likely a function that they tend to have lower betas. Ergo, in a risk-on environment, you want more exposure to the market, not less.

Factors

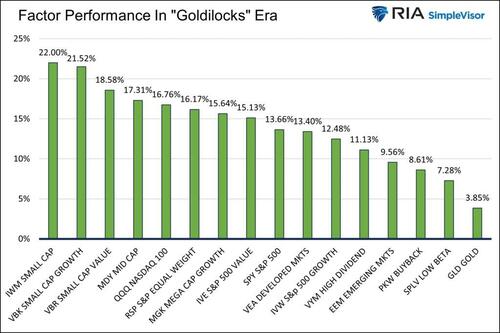

The following graph shows how many S&P 500 factors performed since November 1.

As for the first ten months of the year, the market cap factor remained the prominent stock factor. However, since November 1, small and mid-cap stocks led the way, not the large-cap leaders of the first ten months.

Also, bucking the trends of January through October, the equal-weighted S&P 500 (RSP) beat the S&P 500. Before November, RSP was down 3.75%, while the S&P 500 was up 10%. RSP finished the year up 12% as Goldilocks fever saved RSP investors 2023 returns.

Despite apparent dovishness by the Fed, gold lagged every stock factor. However, gold rose about 10% in October. Might gold investors have been expecting an easier Fed but not assumed continued economic expansion that would preclude the Fed from lowering rates too much?

Summary

History is littered with booms and busts. Behind each of those dramatic events was a strong narrative.

Many less dramatic market moves were also fed by narratives. Considering the current narrative and its staying power, we must appreciate it.

“What we’re seeing now can be described as a soft landing.” -Janet Yellen (1/5/24)

Is a Goldilocks soft landing possible, as Janet Yellen claims?

Yes.

Is it probable?

Based on history, no.

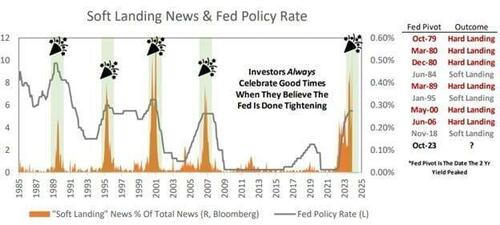

Unfortunately, soft landings are a rare species. In the graph below, Michael Kantrowitz quantifies that soft landing tales are often wrong.

1995 was the rare soft landing. The Fed raised rates without a recession following.

Government spending is robust. Couple that with hopes for lower interest rates, and the Goldilocks narrative is possible to stick around. Given that we are in an election year, such spending is more probable. However, government spending alone can’t stop a recession. As such, we are watching employment data closely. We suspect that if the unemployment rate rises steadily, a recession will shortly follow.

We should be aware of the pitfalls of the narrative, but until it changes, the narrative will dictate market performance. To reiterate:

Regardless of what you or I think, markets are taking their cue from Goldilocks, at least until the next narrative takes charge.

Tyler Durden

Wed, 01/10/2024 – 08:40

via ZeroHedge News https://ift.tt/BXnelCi Tyler Durden