Airlines Hit Turbulence After Delta Trims 2024 Earnings Forecast

Airline stocks hit turbulence Friday after Delta Air Lines trimmed its full-year adjusted EPS forecast for 2024, which was below the “more than $7” per share target discussed previously by the company. The airline also reported a decline in total revenue per available seat mile.

Delta told investors it was now forecasting between $6 and $7 after once forecasting “more than $7” for its full-year adjusted EPS forecast this year. Delta posted 2023 adjusted earnings of $6.25 per share.

Bloomberg pointed out, “The outlook shows Delta’s not immune to the elevated costs and other challenges plaguing the industry, as supply chain shortages have increased engine repair times and slowed the delivery of some new aircraft. New pilot contracts at three of the four largest US carriers have pushed up spending for wages and other compensation.”

“With all the uncertainty in the environment, we thought it was prudent” to adjust the forecast, Chief Executive Officer Ed Bastian said in an interview. He said most of the challenges are due to inflation and labor costs, adding, “I’m not giving up on the $7.”

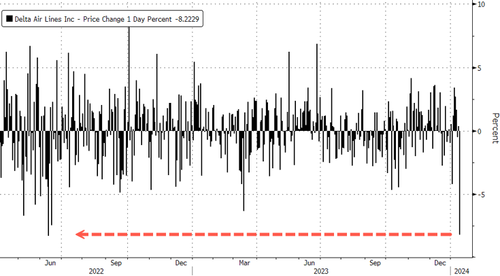

As a result, Delta shares plunged 8.5%, the most significant intraday plunge since July 2022.

Here’s what Wall Street analysts are saying about Delta (list courtesy of Bloomberg):

Bloomberg Intelligence

- “Delta’s 4Q results indicate fares are weakening and may no longer compensate for higher costs, as the 15% increase in traffic led to 12% more revenue and a 190 bps decline in operating margins,” writes analyst George Ferguson

Citi (buy, PT $56)

- Analyst Stephen Trent says that while EPS and free cash flow for the year are guided lower than previous expectations, he views any stock price dips as enhanced buying opportunities

- “Continued expected multi-billion-dollar FCF generation, earnings growth, and a dividend payout, screen as factors that underpin Delta Air Lines’ quality, in our view.”

Evercore ISI (outperform, PT $60)

- Delta’s expected adj. total revenue increase of 3-6% year- over-year “feels conservative,” according to analyst Duane Pfennigwerth

- “Our initial take is this has room to firm over the balance of the quarter, likely somewhat dependent on the trajectory of fuel prices.”

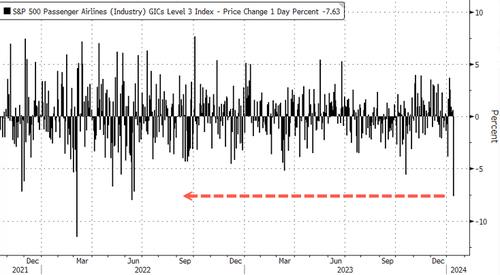

Delta’s forecast downgrade led to selling across the industry.

Despite mounting costs, Delta’s CEO believes “2024 demand for air travel remains strong, and our customer base is in a healthy financial position with travel a top priority.”

Tyler Durden

Fri, 01/12/2024 – 14:40

via ZeroHedge News https://ift.tt/FjKcvYd Tyler Durden