Bitcoin Bloodbaths, Ethereum Outperforms As BlackRock’s Fink Backs Ether ETF

‘Sell the news’ hit bitcoin after all following the much-anticipated launch of a spot ETF yesterday after the SEC’s begrudging approval on Wednesday.

‘Day One’ was incredibly impressive as the freshly minted ETFs managed to clear $4.5BN worth of volume.

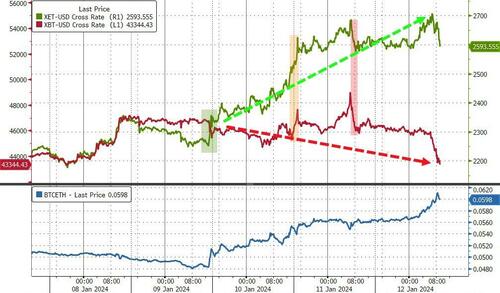

But, this morning’s renewed selling pressure has Bitcoin down almost $6,000 from its post-ETF approval highs (hit right before the cash ETF trading started yesterday)…

Source: Bloomberg

Some have argued this is South Korean traders – who have been among the most aggressive buyers over the past two months – taking some profits.

As Bloomberg noted in December, the won was exchanged for Bitcoin in 42.8% of fiat trading activity in the largest cryptocurrency in November, CCData says.

From September to the present, the won’s market share increased by about 17% to around 41%, while the dollar’s share decreased 11% to around 40% of activity.

Others have suggested large transfers from Grayscale to CoinBase might be responsible for the weakness.

The selling wave appears to concentrated from the US equity market open to the EU equity market close for now…

Whatever it is, while BTC has been dumped, it appears we were right on what would happen next…

And now, frontrunning the ETH ETF

— zerohedge (@zerohedge) January 9, 2024

As Ethereum is dramatically outperforming…

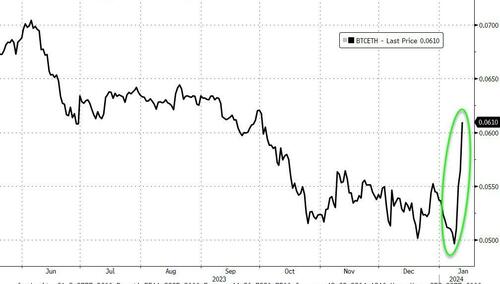

With the ETH/BTC pair roaring higher…

…off previous medium-term support…

Sure enough, as Decrypt reports, experts now believe the SEC’s acquiescence could have opened the door to the approval of other crypto-backed spot ETFs, namely a spot Ethereum ETF.

And thanks to the precedent set by a Bitcoin ETF, that financial product could enter the market in a matter of months, not years.

Eric Balchunas, a senior ETF analyst at Bloomberg, says he is 70% confident that a spot ETH ETF will be approved by May.

Larry Fink, the CEO of BlackRock (BLK), backed the notion of an ether (ETH) exchange-traded fund (ETF) a day after the much-anticipated bitcoin (BTC) ETF went live.

“I see value in having an Ethereum ETF,” Fink said in an interview with CNBC on Friday.

“These are just stepping stones towards tokenization and I really do believe this is where we’re going to be going.”

Scott Melker, known as “The Wolf Of All Streets,” responded on X (formerly Twitter).

“The rotation is real.”

Fink also said he did not see cryptocurrency as a currency but as an asset class, referring specifically to bitcoin as “an asset class that protects you” against fears of geopolitical risk.

“It’s no different than what gold represented over thousands of years,” he said.

“Unlike gold, we’re almost at the ceiling of the amount of bitcoin that can be created.”

ARK Invest founder and CEO Cathie Wood previously predicted that the approval of a spot Bitcoin ETF in the U.S. could potentially trigger short-term selling. The executive is still bullish on BTC price in the longer term.

Tyler Durden

Fri, 01/12/2024 – 12:20

via ZeroHedge News https://ift.tt/HVEWCMS Tyler Durden