Yield-Curve Dis-Inverts After ‘Cool’ PPI, Bullion & Bond Prices Bounce

‘Cooler-than-expected’ PPI apparently trumps ‘hotter-than-expected’ CPI and the markets are reacting ‘dovishly’ with rate-cut expectations soaring.

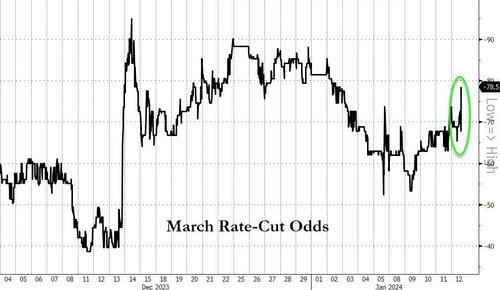

The odds of a March rate-cut have jumped back up to over 75%…

And the market now expects 160bps of cuts in 2024…

2Y yields tumbled to 8-month lows…

Which has forced a dis-inversion of the (2s30s) yield curve..

For the first time since October…

And gold is bouncing too…

Ugly-ish bank earnings data makes the case even stronger for The Fed to start cutting in March – as we detailed here and here – and PPI is just the icing on the cake.

Tyler Durden

Fri, 01/12/2024 – 09:08

via ZeroHedge News https://ift.tt/cXjLeFb Tyler Durden