ECB Pricing Gets A Dose Of Reality Check All The Way From Davos

By Ven Ram, Bloomberg Markets Live reporter and strategist

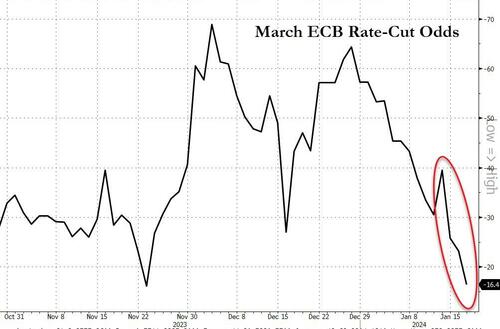

Market pricing of a rate cut from the European Central Bank as early as March has withered since the start of the new year. Now, officials seem to be questioning even the notion of a reduction in April — highlighting another pocket of possible mispricing. Also at peril may be traders’ estimate of how low the ECB’s benchmark rate could really go this year.

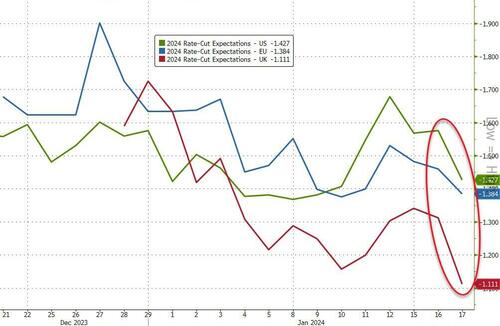

[ZH: We also note that this is not just an ECB thing… US, UK, and EU rate-cut expectations are tumbling…]

The annual World Economic Forum in Davos doesn’t usually stir the markets, but this time around ECB speakers have been pretty vocal in conveying a central message: that when wage inflation in the euro zone is running at 5%+, investors shouldn’t go overboard in pricing aggressive rate cuts.

Governing Council member Mario Centeno has said that the ECB should avoid inflation declining below 2%, reiterating his stance for lower rates sooner. Centeno, not the most hawkish of ECB officials, has so far been outnumbered by his colleagues.

Bundesbank President Joachim Nagel told Bloomberg Television that any reduction can wait for the summer break, while Austrian central bank Governor Robert Holzmann went further by questioning the very notion of rate cuts this year. You could dismiss both those comments made by arch hawks, but even the more dovish-leaning officials have jawboned the markets regarding the aggressive pricing that sees as many as six cuts this year.

ECB Chief Economist Philip Lane warned that reductions that are too quick tend to stoke a new wave of inflation, putting policymakers in “a far worse scenario”. Lane also made a number of pertinent observations, including that wages have been growing well above the long-run equilibrium rate and that key Eurostat national accounts data would be available in time for the central bank’s rate meeting in June. If a dovish member of the ECB is himself alluding to June, it may be worth pondering whether an April cut — which even now is fully priced — should be a central scenario.

His colleague Madis Muller went as far as to question the markets’ pricing 150 basis points of reduction this year, citing stubborn wage inflation. While euro-zone interest-rate traders have already calibrated their bets for rate cuts this year, it clearly looks like there is more to come.

As I write this, ECB President Christine Lagarde is telling Francine Lacqua much the same thing and is concerned about the second-round effects of wage inflation. Lagarde sent traders scrambling to adjust rate-cut bets, saying aggressive pricing on ECB easing wasn’t helping in the battle against inflation. She did say it’s “likely” the ECB will lower rates by or in the summer.

“It is not helping our fight against inflation, if the anticipation is such that they are way too high compared with what’s likely to happen,” Lagarde said.

All this is clearly not the news that the markets were positioned for at the start of the year.

Tyler Durden

Wed, 01/17/2024 – 09:40

via ZeroHedge News https://ift.tt/XI4kwy2 Tyler Durden