UMich Inflation Expectation Plunges To Lowest Since 2020, Sentiment Soars

After soaring in October and November, and crashing back to earth in December, consensus estimates for UMich inflation expectations in preliminary January data were basically unchanged – but instead they declined further to 2.9% (1Y) and 2.8% (5-10Y)…

Source: Bloomberg

This lack of fear of inflation sent the sentiment indicators soaring 9.1pts to 78.8, the biggest monthly advance since 2005.

The current conditions gauge rose 10 points to 83.3, and a measure of expectations climbed to 75.9. Both were the highest since 2021.

“Sentiment has now risen nearly 60% above the all-time low measured in June of 2022 and is likely to provide some positive momentum for the economy,” Joanne Hsu, director of the survey, said in a statement.

Source: Bloomberg

“Consumers exhibited stronger views on multiple facets of the economy, suggesting greater confidence of a soft landing,” Hsu said.

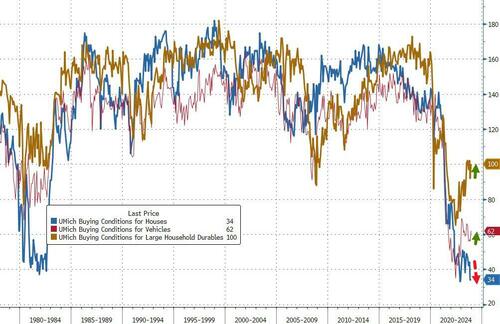

“Improvements in inflation expectations have been supported by perceptions of easing price pressures in buying conditions for both durable goods and vehicles,” she said, adding that consumers increasingly expect the Federal Reserve to lower rates this year, but not housing…

That’s “consistent with the belief that inflation will not accelerate in the near future,” Hsu said.

The survey showed the pickup in optimism was broad, with improvements across age, income and political affiliation. More than half of households expect their incomes to grow at least as fast as inflation, the highest share since mid-2021.

Meanwhile, stock market expectations were the strongest in more than two years, the report showed.

Consumers’ perception of their current financial situation rose to a two-year high, while expectations for future finances climbed to the highest since 2021.

Democrats are loving it…

Are ‘animal spirits’ coming back? The Fed should be careful what it hopes for.

Tyler Durden

Fri, 01/19/2024 – 10:10

via ZeroHedge News https://ift.tt/alTMOsf Tyler Durden