Deflation is Making China’s Growth Look Much Better Than It Really Is

By John Liu and Zheng Wu, Bloomberg markets live reporters and strategists

Three things we learned last week:

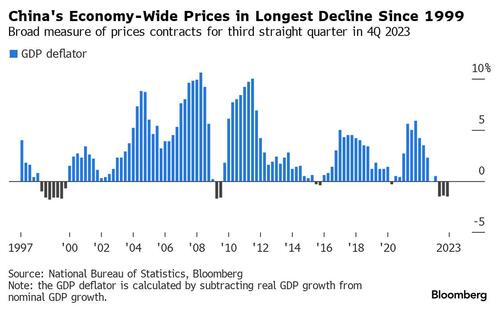

1. China met its 2023 growth target but the data understated challenges. Data released Wednesday showed the world’s second-largest economy grew 5.2% last year, above Beijing’s official target of around 5%. Besides a low base in 2022, when stringent Covid curbs severely disrupted economic activities, the nation’s longest deflation streak since 1999 also boosted the headline growth number.

China’s gross domestic product was reported in real terms, after discounting the price factor in nominal growth. As consumer and factory-gate prices fell last year, the price adjustment effectively inflated the growth rate.

The difference, known as the GDP deflator, is now the biggest “inflator” in GDP calculation in 14 years. Some private-sector economists say last year’s actual growth was much lower.

2. Investor anxiety is growing over Beijing’s plan to fix the economy this year. News that China is considering 1 trillion yuan ($139 billion) of new special sovereign debt, only the fourth such sale in the past 26 years, did little to help market sentiment. The MSCI China index has dropped nearly 10% so far this year, down 60% from its peak in 2021. Disappointed local investors paid a premium of more than 10% for exchange-traded funds to chase Japanese stocks instead.

Investors had hoped for stronger public spending to offset weak consumption but were disappointed after Premier Li Qiang downplayed the idea of big stimulus again at the World Economic Forum in Davos. The People’s Bank of China’s surprise move to hold its key policy rate unchanged Monday also curbed their enthusiasm. Officials even avoided acknowledging that the economy is in deflation.

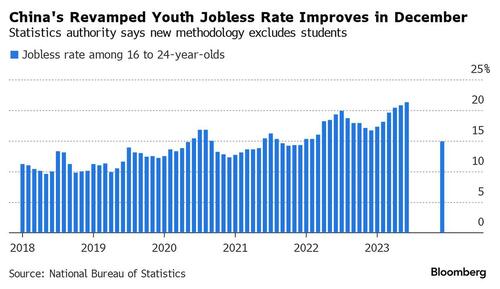

3. Youth unemployment data returned after a six-month halt. The 14.9% jobless rate for December still looks concerning, although it was down from a record 21.3% in June, after which authorities suspended releasing such data.

While the government said its new methodology, which excludes students, reflected a more accurate picture of unemployment, some economists cautioned the fresh criteria made it hard to assess the December number. Still, more transparency is better.

Tyler Durden

Sun, 01/21/2024 – 23:20

via ZeroHedge News https://ift.tt/obBv8xX Tyler Durden