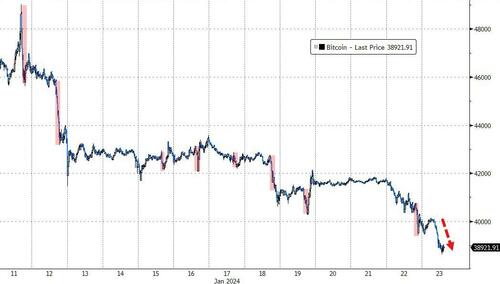

Bitcoin Breaks Below $39k Amid FTX, MtGox Liquidation Chatter

It’s been an ugly ‘sell the news’ period since spot bitcoin ETFs were unleashed by a desperately begrudging SEC.

Having peaked above $49,000 on the day the new ETFs opened, bitcoin has broken back below $39,000 overnight…

Source: Bloomberg

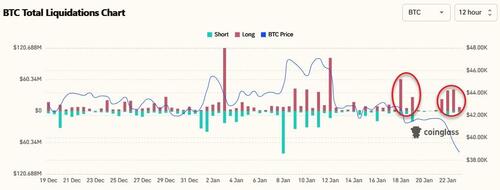

Data from Coinglass shows long-position liquidations for Bitcoin have been considerable in the days since the new ETFs were launched, but today’s data is significantly lower, suggesting the initial purge may be slowing…

This is (purely coincidentally) ‘great news’ for Liz Warren and Gary Gensler who can gloat at their warnings of the dangers to investors of placing their hard-earned wages (after taxes) into these volatile, terrorist-funding assets.

But, maybe there’s more to it – maybe this is not just ‘sell the news’-driven profit-taking (or GBTC-discount-arb-driven recycling).

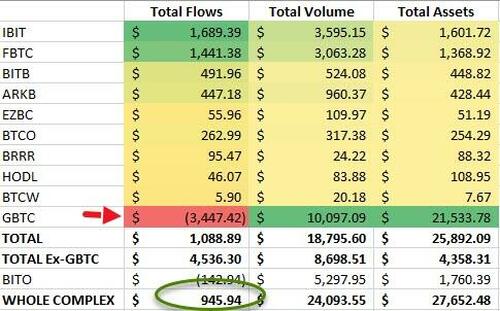

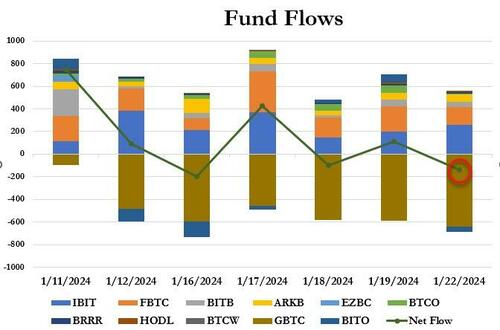

First things first, net of GBTC outflows, the whole spot bitcoin ETF complex has seen overall inflows of around $1 billion since inception…

The assumption in the above table is that the GBTC outflows are simply being recycled into the new ETFs and should therefore be netted off against the inflows into the new ETFs ($4.5BN inflows into new ETFs vs $3.5BN outflows from GBTC).

GBTC has been the dominant factor in outflows since inception (and yesterday saw the highest outflows since the new ETFs began with GBTC seeing a $640mm reduction…

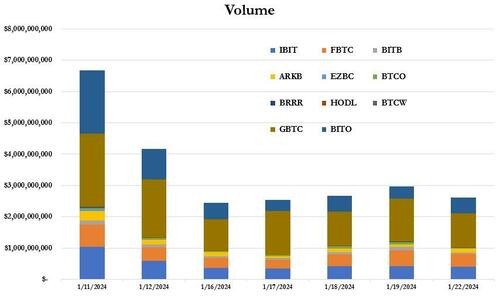

Volumes have stabilized at around $2.5BN per day (again with GBTC accounting for around 40% of that)…

However, there could be another factor involved.

As CoinDesk reports, a large chunk of the exodus from GBTC was FTX’s bankruptcy estate dumping 22 million shares, according to private data CoinDesk reviewed and two people familiar with the matter.

The 22 million shares it sold – which took FTX’s GBTC ownership down to zero – were worth close to $1 billion.

So, instead of the GBTC outflows being recycled and netted off, a large portion of them is FTX liquidation-based – a one-off event, not a systemic pressure on the underlying crypto asset.

#FTX Shocks Market with $1B #Grayscale ETF Sell-Off & Alameda Drops Bombshell Lawsuit Against Grayscale! 🚨💥💰📉 $GBT

• 🚨 FTX’s bankruptcy estate offloaded approximately $1 billion of Grayscale’s Bitcoin ETF, shedding light on recent GBTC outflows.

• 📊 Since the conversion… pic.twitter.com/iipXsgXnef— RichQuack (@RichQuack) January 22, 2024

Interestingly, reports of the GBTC liquidation has sent prices of claims on the crypto exchange FTX soaring ahead of a Jan. 25 estimation hearing, where creditors expect the ruling to favor their demand for “in kind” repayments in cryptocurrency.

FTX claims are now trading at almost 80 cents to the dollar, according to Cherokee Acquisition, an investment banking firm that specializes in bankruptcy claims and providing liquidity on FTX claims.

FTX claims: prices for #FTX claims over $1mm continue to increase. Market prices as of January 12 were 72 bid, 75 ask, up 2 points from the prior week.

Prices continue to increase in anticipation of the #bankruptcy Claims Estimation Hearing on January 25.… pic.twitter.com/NZiuUUVnpA

— Claims Market (@claims_market) January 17, 2024

In theory, as CoinDesk concludes, now that FTX is done selling its substantial holdings, the selling pressure could ease since a bankruptcy estate liquidating holdings is a relatively unique event.

However, there’s another ‘one-off’ event that could be weighing on underlying bitcoin prices – the Mt. Gox trustee is reportedly getting ready to start repayments of BTC and BCH on Bitstamp and Kraken accounts.

As CoinTelegraph reports, numerous Mt. Gox creditors reported receiving new emails from Mt. Gox about the completion of identity verification for crypto exchange accounts that are set to be used to repay Bitcoin and Bitcoin Cash

The email says that the exchange is now expected to accept the user’s subscription to the agency receipt to receive repayment in BTC/BCH.

Mt. Gox is expected to repay its creditors 142,000 Bitcoin and 143,000 in the forked cryptocurrency, Bitcoin Cash, in addition to 69 billion Japanese yen ($510 million) by October 2024.

So, GBTC supply pressure added to MtGox supply pressure – both theoretically unique events – are weighing on crypto (but, as the following X user notes, the April Halving will reduce supply significantly)…

MtGOX BTC distribution is expected to hit the market over the next 2 months, 200K BTC unlock.

This is in addition to 600K + GBTC repricing.

2024 April halving will reduce annual supply by 160k.

Interesting supply dynamics in play in coming months. pic.twitter.com/0ZNC52YbAH

— Mindao (@mindaoyang) January 23, 2024

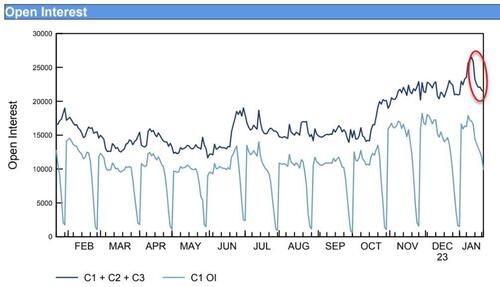

There is another aspect to the bitcoin complex – the legacy bitcoin futures ETFs.

Many assumed that investors would rotate from futures to spot ETFs but – so far – that has not been the case at scale.

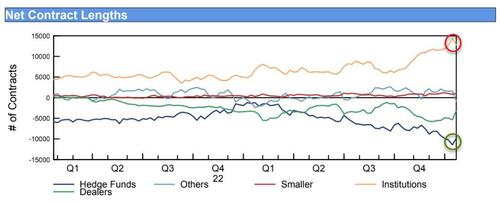

Institutional funds have modestly reduced their large long position and hedge funds have marginally covered their large short position…

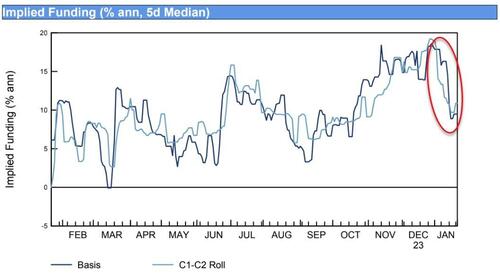

But, implied funding rates – a measure of relative demand from longs vs shorts – has fallen significantly recently (suggesting less demand from longs on leverage) after soaring in Q4 ahead of the SEC approvals.

However, the positive funding rate signals overall bullishness remains towards the bitcoin complex:

Since $GBTC conversion to #BitcoinETF investors have sold > $2 Billion

FTX bankruptcy liquidation has led to > $1 Billion in selling $BTC

GBTC discount to NAV arbitrage trade led to > $1 Billion selling to lock in profits.

All of that selling in a relatively short time and… pic.twitter.com/e0I0ms3y3D

— CJK (@CJKonstantinos) January 22, 2024

We shall see…

Tyler Durden

Tue, 01/23/2024 – 09:38

via ZeroHedge News https://ift.tt/orVjOJE Tyler Durden