Big-Tech Bid, Bonds & Bullion Battered As ‘Better’ Data Made Doves Cry

European PMIs screamed stagflation (weaker growth and rebounding prices) but US PMIs unexpectedly ripped (for all the wrong reasons – no longer lead-times are not a sign of demand outstripping supply, it’s a sign of the shitshow in the Red Sea and storm-shutdowns in the US slamming supply chains).

Disruption-driven increases in supplier lead-times are not – we repeat not – a positive… After the debacle during the COVID lockdown supply-chain collapse (and soaring PMIs), you’d think they’d figured this shit out by now!!

Source: Bloomberg

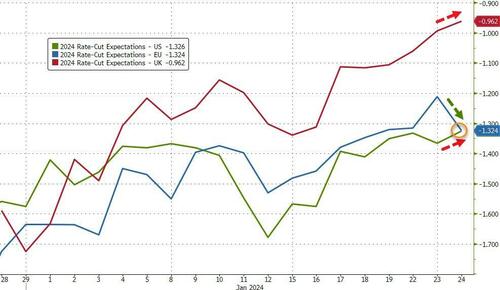

But no one cared to look below the surface. That ‘strength’ sent rate-cut expectations (and the odds of a March rate-cut) reeling hawkishly lower…

Source: Bloomberg

Notably, the market’s expectations for ECB cuts in 2024 has converged with expectations for The Fed (while BoE expectations are pushing notably hawkish)…

Source: Bloomberg

The hawkishness spread to bond-land (not helped by an ugly 5Y auction) with yields up across the curve (long-end underperforming 30Y +4bps, 2Y +1bps) after overnight buying…

Source: Bloomberg

The 5Y briefly broke down below 4.00% ahead of today’s ugly auction but ended 11bps off the lows of the day…

Source: Bloomberg

And that sent bear-steepened the curve (2s30s), dis-inverting it once again…

Source: Bloomberg

And that lack of dovishness slammed gold back below its 50DMA ($2025)…

Source: Bloomberg

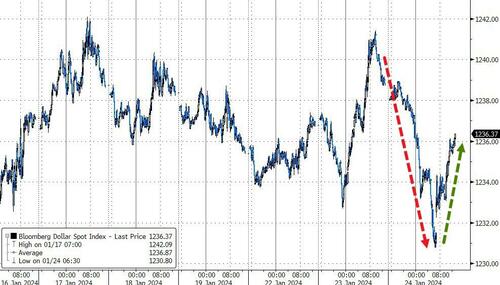

The dollar dived overnight buit was bid during the US session…

Source: Bloomberg

The higher yields hit stocks broadly speaking but traders sought the safe-haven of mega-cap tech, enabling Nasdaq to close green. The S&P barely held on to gains as Small Caps lagged (and The Dow closed red)…

‘Most Shorted’ stocks were clubbed like a baby seal today. This is the first day in a week that did not see an afternoon re-squeeze…

Source: Bloomberg

As MAG7 stocks ripped (NFLX) then dipped a bit…

Source: Bloomberg

Bitcoin managed gains, but was unable to hold above $40,000…

Source: Bloomberg

Oil rallied up to one-month highs, breaking out of its YTD range…

Source: Bloomberg

Finally, the big news overnight was China’s surprise RRR cut (after it promised trillions of yuan in rescue for stocks the day before and banned short-selling the day before)…

Source: Bloomberg

…and while 0-DTE traders weren’t playing along, traditional options traders were buying Calls (and covering puts) with both hands and feet today, with someone large stepping in around 1400ET…

Tyler Durden

Wed, 01/24/2024 – 16:00

via ZeroHedge News https://ift.tt/xCzXL0g Tyler Durden