Dotcom History Rhymes For Nasdaq As Fed Cuts Loom

Authored by Ven Ram, Bloomberg cross-asset strategist,

History shows that stocks are well poised to gain before the Federal Reserve starts slashing rates, but daunting valuations for technology names suggest that the S&P 500 may outperform the Nasdaq in the first half of the year.

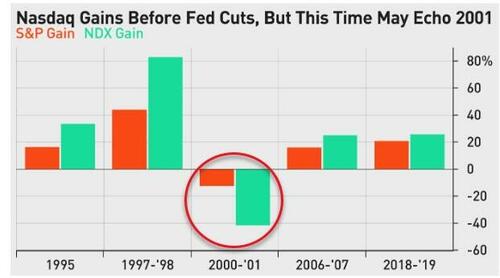

Both the S&P 500 and Nasdaq 100 baskets have traditionally rallied in the interregnum between the end of a Fed tightening cycle and the start of policy loosening, except on one occasion: the 2000-01 cycle, when the markets were caught deep in a bubble.

In the run-up to the rate cuts of 2001 — when the Fed slashed its benchmark rate by a whopping 475 basis points – the S&P slid more than 12%, while the Nasdaq slumped 42% as buyers’ remorse start to grip the markets after the dotcom mania had run its course. Given the humongous rally in technology stocks over the past year, we may well see a repeat of that cycle.

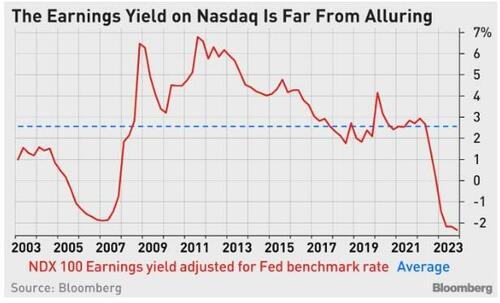

While valuations of technology stocks may not be as daunting as they were then, the Nasdaq is trading far from levels that many investors would consider reasonable.

At current levels, the Nasdaq 100 offers an earnings yield that is the lowest in relation to the Fed funds rate since the days before the dotcom bubble burst.

In fact, the 3.25% prospective earnings yield on stocks is tantamount to the basket trading as though the Fed’s fund rate has already fallen to those levels, even assuming that they can trade pari passu with the benchmark rate.

The fair value of the Nasdaq is 12,877 when the technology basket is viewed as a long-duration bond.

Under conditions of stable long-term interest rates and steady dividend growth rates, that valuation can’t turn on a dime.

That fair value suggests that technology stocks are now trading at a rich premium of more than 30%. That excess may be thought of as the price that the markets are assigning to the growth potential of artificial intelligence.

While some of that enthusiasm may be condoned, history shows us that traders often have he right idea, but the wrong price — and that may be the case with estimating the potential of AI-related stocks, too.

In comparison, the S&P 500 is trading more or less where it is indicated fair.

While fully valued at current levels, the froth — given a fair value of 4,632 — is within acceptable limits, especially against a backdrop where a Fed pivot may stoke earnings growth.

The Nasdaq 100 has rallied about 3% so far this year ahead of expected rate cuts.

Coming on top of stunning gains of almost 55% last year, technology stocks have priced in all the good news out there and more — making them vulnerable to a bigger correction than brick-and-mortar stocks.

Tyler Durden

Wed, 01/24/2024 – 15:25

via ZeroHedge News https://ift.tt/OyL9Neh Tyler Durden