Ron Paul: Don’t Tax The Rich. End The Fed!

Authored by Ron Paul via The Ron Paul Institute for Peace & Prosperity,

Select politicians, government officials, economic elites, and experts arriving at the annual World Economic Forum meeting in Davos, Switzerland were greeted with an open letter signed by more than 250 billionaires and millionaires.

The signers request their respective governments raise their taxes.

The letter signers are concerned about “inequality” that they say “has reached a tipping point.”

The cost of this inequality “to our economic, societal and ecological stability risk,” the letter continues, “is severe — and growing every day.”

They may have a point. Since the 2008 market meltdown, resentment against those at the top of the income ladder has been growing. However, this is not because people are envious of those able to profit in a free market.

Rather, the resentment is rooted in the corporatist system that rewards those who manipulate the political process.

If the signatories to the letter want to truly end the type of inequality that fuels populist rage, they should stop calling for tax increases and instead call for an end to government programs and policies that benefit the rich and powerful.

Included are programs like the Export-Import Bank that subsidize large corporations, health and safety regulations that cartelize markets while failing to protect consumers, and interventionist foreign policy that enriches the military-industrial complex while making the rest of us poorer and more vulnerable to terrorist attacks.

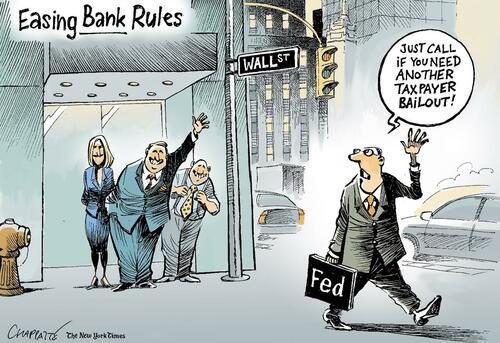

The Federal Reserve is the leading cause of inequality. This is not surprising considering it was created at the behest of bankers and rushed through Congress just before Christmas when few Americans were paying attention. Many Americans became aware of how the central bank tailors its policies to benefit the financial elites following the 2008 meltdown. Then, the US government, enabled by Fed money printing, bailed out large financial institutions while average Americans suffered.

The Fed had been helping big firms for many years. In the 1990s it was common for the Federal Reserve, then under the leadership of Alan Greenspan, to pump money into the market in response to apparent crises. This was named the “Greenspan put” by the financial press. The new money would help some companies and their wealthy owners, while reducing most Americans’ purchasing power.

Middle- and working-class Americans suffer the brunt of inflation, which is properly defined as the central bank pumping money into the economy thus reducing the dollar’s purchasing power.

In a free market, most people will be able to have a satisfactory standard of living and recognize that the “super rich” earned their fortunes by offering goods and services that served the needs and wants of consumers while providing good jobs at good wages to fellow citizens. In contrast, in a “mixed economy” supported by a fiat money system, the average person will suffer a steady erosion of his standard of living thanks to the central bank’s inflationary policies, while the crony capitalists prosper. This is a recipe for social instability.

Those concerned with the detrimental effects of rising resentment of income inequality should support repealing all federal programs that reward crony capitalists — including programs masquerading as providing national defense.

They should also work to audit then end the Fed.

Tyler Durden

Wed, 01/24/2024 – 07:20

via ZeroHedge News https://ift.tt/mZ9HGlB Tyler Durden