Tech Euphoria Sparked By ASML Surge To All-Time High On Flood Of Chinese Orders… There’s Just One Problem

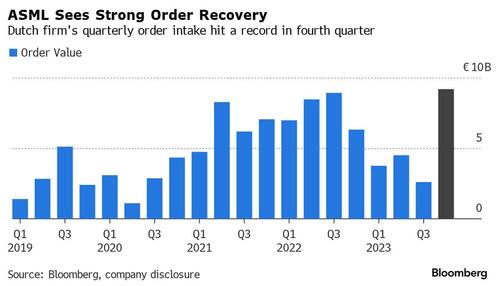

Tech stocks are soaring again today in a repeat of last Wednesday’s action, only instead of a stellar outlook from Taiwan Semi which was the catalyst for last week’s tech reversal, today it was Dutch chip giant ASML – Europe’s most valuable technology company said in a statement on Wednesday – which sparked the buying frenzy. And on the surface, the results were stellar: according to its earnings release this morning, ASML Holding NV said orders more than tripled last quarter from the previous three months, as the order backlog rose to a record €9.19 billion ($9.98 billion) in the fourth quarter from €2.6 billion in July to September, driven by demand for its most sophisticated machines which use deep-ultraviolet lithography (EUV) needed to make the most sophisticated semiconductors, where orders hit a record €5.6 billion.

The surging backlog reversed a trend of 4 quarters in declines, meanwhile the historical orderbook led to a surge in sales which rose 30% YoY to €27.6 billion in 2023, the company said.

“2023 was our top year,” Wennink said. “We won’t see another 30% growth in 2024.” ASML has previously forecast flat growth this year before a banner year in 2025.

That may well be, but one has doubts.

It is true that ASML is the only company that produces equipment needed to make the most sophisticated semiconductors, and demand for its products is a bellwether for the industry’s health. Record orders for its top-of-the-line extreme ultraviolet lithography machines show optimism among the biggest customers for the technology, including Intel Corp., Samsung Electronics and Taiwan Semiconductor. It’s also why the Biden admin has been explicitly targeting ASML exports to China, realizing that these are a backdoor way for Beijing to build it own latest generation of chips and bypass current chip sanctions.

The company was also happy to piggyback on all the AI euphoria that has gripped the market in the past year, and as CEO Peter Wennink told Bloomberg, Artificial intelligence, which requires massive amounts of computing power, is going to be a “big driver for our business and the business of our customers.” Unless, of course, it all proves to be a giant bubble.

But nobody is paid to worry – or think for that matter – when you have a historic bubble on your hands, which is what AI is, and analyst commentary took the results in stride to extrapolate the surge in backlog as virtually unlimited AI-driven demand. Indeed, in its commentary, Bloomberg said that the ASML results were “a sign that the semiconductor industry may be recovering” adding that “chipmakers are increasingly optimistic the sector’s outlook following a slump that dates back to the Covid-19 pandemic, with TSMC last week projecting strong revenue growth in 2024.”

Only, that’s not true as anyone who look at Texas Instruments’ dismal results last night realized (TXN shares tumbled after it gave a disappointing quarterly forecast, indicating that sales of chips for industrial and automotive uses haven’t recovered).

Instead, what is happening as we explained in “Behind The Tech Meltup: A One-Time Chinese Chip Buying Frenzy To Frontrun Export Curbs“, is that China has been flooding the market with chip purchase orders, knowing that the door is closing amid a barrage of sanctions limiting exports of high tech chips – and chipmaking devices – and that it needs to buy today what it may need for the next few years, if not indefinitely.

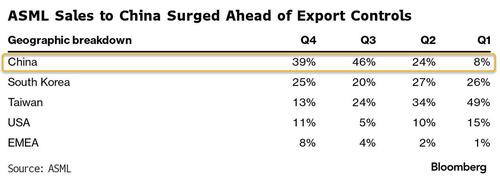

And buy it did: China accounted for 39% of ASML’s sales in the fourth quarter and became the Veldhoven-based company’s largest market in 2023! Before speculation of chip sanctions, China accounted for only 8% in January to March.

The company was not shy about its biggest customer: “The business in 2023 with China was very, very strong,” said CFO Roger Dassen said.

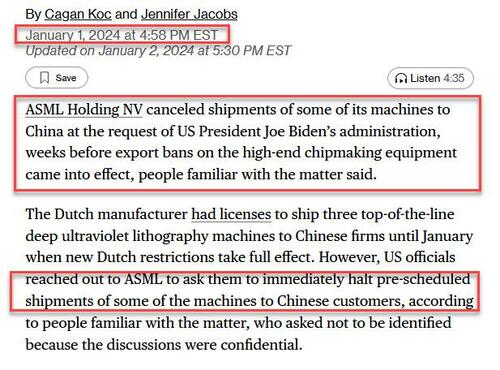

Unfortunately, for ASML, that’s as good as it gets. As reported previously, ASML has been targeted by the US effort to curb exports of cutting-edge technology to China. Last year, US President Joe Biden’s administration urged the Dutch government to prevent ASML from shipping some immersion deep ultraviolet lithography machines, its second-most capable machinery, to China without a license.

Then, a few weeks ago, Bloomberg reported that ASML exports to China have now effectively been halted, vaporizing whatever portion of the order backlog is thanks to China. ASML had licenses to ship three top-of-the-line DUV lithography machines to Chinese firms before this month, when the new restrictions took full effect. However, US officials reached out to ASML late last year to ask them to immediately halt scheduled shipments of some of the machines to Chinese customers, Bloomberg News reported previously, citing people familiar with the matter.

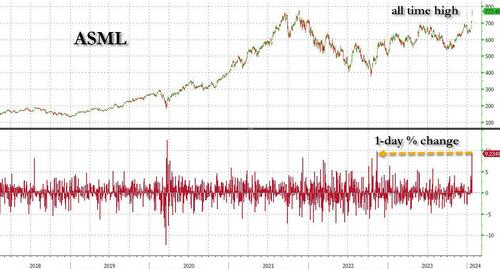

And so with China now scrubbed from the list of ASML clients – forget being its top customer – the question is who will fill the void. Luckily, demand for AI is keeping the chip sector afloat… or so the experts say, the same experts who fawned over ASML’s result today which sparked a buying frenzy in the shares, which soared over 9% today, the biggest increase since November 2022, and hitting an all time high.

Good luck keeping that all time high with your largest customer now barred from future purchases by the State Department. As for “record AI chip demand”, this quarter will prove very informative how much is real and how much is vapor once the volatility from China’s erratic orderflow is finally removed.

Tyler Durden

Wed, 01/24/2024 – 11:45

via ZeroHedge News https://ift.tt/8B6CUEr Tyler Durden