ECB Keeps Rates Unchanged, Sees “Declining Trend In Inflation” Continuing: Press Conference Live Feed

Following yesterday’s dastardly stagflation signals from EU PMIs (weaker growth but prices rebounding), it was no surprise to anyone that The ECB held monetary policy unchanged today, while also providing little color (in the statement, the Lagarde presser may be a different matter) on the outlook for inflation. Specifically, in its statement, the ECB kept all three key rates on hold (Deposit Rate at 4.0%, Refi Rate 4.5%, Marginal Lending Rate 4.75%), and said that “aside from an energy-related upward base effect on headline inflation, the declining trend in underlying inflation has continued” where we find the ECB sounding moderately positive about price pressures, as the line warning that “domestic price pressures remain elevated” is now gone. This firms up the case for coming rate cuts are coming as expected, however whether this will be in March, April or beyond, remains to be determined (expect April odds to drop after Lagarde speaks).

Some more details from the statement:

On inflation:

- Aside from an energy-related upward base effect on headline inflation, the declining trend in underlying inflation has continued, and the past interest rate increases keep being transmitted forcefully into financing conditions.

- Tight financing conditions are dampening demand, and this is helping to push down inflation.

On economy:

- The incoming information has broadly confirmed its previous assessment of the medium-term inflation outlook.

On rates:

- The Governing Council considers that the key ECB interest rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to this goal.

- The Governing Council’s future decisions will ensure that its policy rates will be set at sufficiently restrictive levels for as long as necessary.

Outlook:

- The Governing Council’s interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission.

Overall, the language on interest rates is largely identical to what the ECB has said in the past, and for the most part, this policy statement is very straightforward.

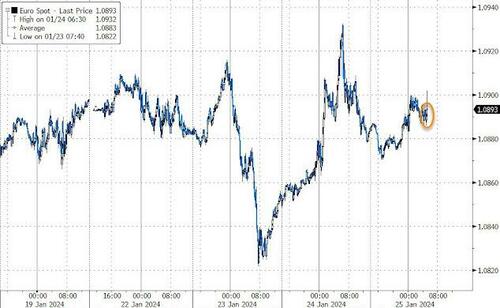

In kneejerk response, the markets is not doing much on the statement, as expected. The euro briefly rose to a fresh day high at $1.092…

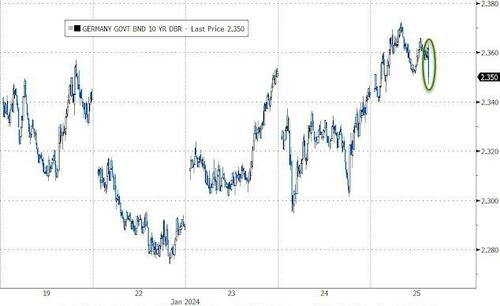

… while Bunds read the statement as mildly dovish, with yields dipping a touch.

The question everyone is asking is – will Christine Lagarde drop any hints at whether April or June is on the table for cuts?

Watch the ECB press conference below (due to start at 0845ET):

Tyler Durden

Thu, 01/25/2024 – 08:25

via ZeroHedge News https://ift.tt/9uU5JYn Tyler Durden