Fed Suddenly Kills Banks’ ‘Free Money’ Bailout-Fund Arbitrage Scheme

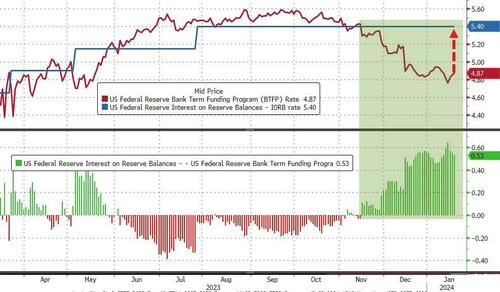

The arbitrage of The Fed’s various balance sheet facilities – which we have exposed in detail for weeks – first appeared after The Fed’s November 1st meeting made it clear that peak-rates were in (and the Treasury announced a lower than expected refunding plan). That was when the market started to price in lower rates in the year ahead, dragging the one-year overnight index swap rate lower (which The Fed’s Bank Term Funding Program – BTFP) is predicated on.

As we explained before, a completely perfect and riskless ‘free money’ arbitrage was available to those banks who could lodge collateral with The Fed at its BTFP facility receiving cash at par (at a cost of OIS+10bps) and then post that cash earning Fed Funds rate on it, pocketing the difference.

The difference – at its peak – amounted to over 60bps of free money from you, Mr. and Mrs.Taxpayer (implicitly), to the bankers for doing absolutely nothing at all.

Since the arbitrage became worthwhile – really the start of December – bankers have been able to throw $47.6BN at this arbitrage (we are assuming most the incremental rise in the BTFP was arb-driven since it had been only very incrementally drifting higher for months before)…

With the program due to expire in March, this free-money arb made it extremely hard for The Fed to extend this program (with $162BN in bailout fund usage outstanding):

“In justifying the generous terms of the original program, the Fed cited the ‘unusual and exigent’ market conditions facing the banking industry following last spring’s deposit runs,” Wrightson ICAP economist Lou Crandall wrote in a note to clients.

“It would be difficult to defend a renewal in today’s more normal environment.”

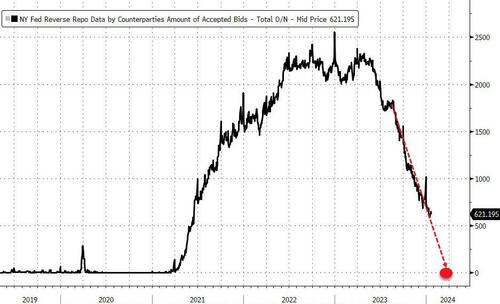

And that March expiration of the facility lines up with another potential crisis moment for the banking system – The Fed’s Reverse Repo facility being drawn down to zero – at which point reserves get yanked which means huge deposit flight.

Which leads us to today, when with just two months until the March threat looming, The Fed has changed the terms on the BTFP to kill the free-money arb.

“…the interest rate applicable to new BTFP loans has been adjusted such that the rate on new loans extended from now through program expiration will be no lower than the interest rate on reserve balances in effect on the day the loan is made.

This rate adjustment ensures that the BTFP continues to support the goals of the program in the current interest rate environment. This change is effective immediately. All other terms of the program are unchanged.”

This out of the blue decision comes just a week after regulators were readying themselves for the end of the facility by attempting to de-stigmatize the use of the discount window (but a sudden $160BN plus demand from discount window would be anything but reassuring to the general public and their mobile banking apps).

This expanded on earlier plans that we detailed here to reduce banks’ ability to use FHLB as an implicit funding tool.

The question is why… or why now?

Yes, the optics of being arbitraged by bankers – giving them free money for even less than they normally do – is terrible, but it’s been going on for two months and $47BN…

Is this The Fed laying the groundwork for extending the emergency, temporary, one-time-only program indefinitely?

As a reminder, the regional banks are already deep in crisis without the BTFP (as the red line in the chart below shows), and large bank cash needs a home – green line – like picking up a small bank from the FDIC?

To avoid their need for more emergent liquidity stabilization in March – ending QT and restarting QE?

March will be lit:

1. Reverse repo ends

2. BTFP expires

3. Fed cuts (allegedly)

4. QT ends (allegedly)— zerohedge (@zerohedge) January 8, 2024

We leave with one question – who could have seen this coming?

Tyler Durden

Wed, 01/24/2024 – 20:00

via ZeroHedge News https://ift.tt/4e1h7yd Tyler Durden