‘Need Moar War’ – GDP-Driving Capital Goods Shipments Are Down Year-Over-Year

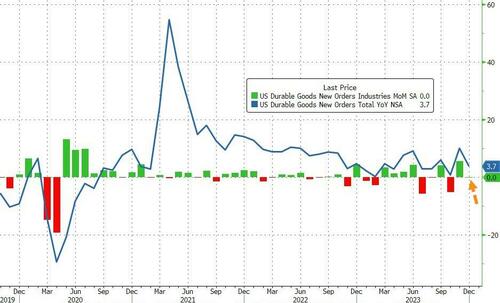

After November’s huge jump (thanks to a surge in non-defense aircraft and parts orders – which we suspect we won’t be seeing anytime soon given the shit-show at Boeing), analysts still expected another significant (+1.5% MoM) rise in preliminary December Durable Goods Orders data.

Disappointingly, orders printed unchanged (a notable miss) with November’s data revised up to +5.5% MoM. The unchanged MoM in December left 2023’s durable goods orders up 3.7% YoY…

Source: Bloomberg

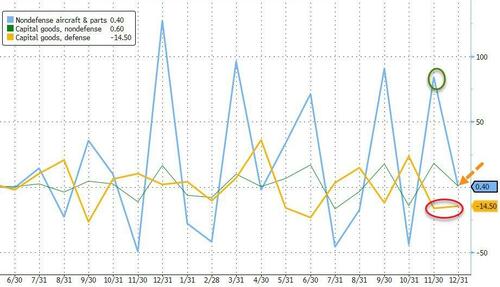

Non-defense aircraft orders rose 0.4% MoM (after rising over 80% in the prior month) – and with Boeing’s issues, we would be surprised to see it rise much anytime soon.

Defense orders fell MoM for the second straight month…

However, core capital goods shipments, a figure that is used to help calculate equipment investment in the government’s gross domestic product report, declined for the third month in a row – down 0.1% YoY – the first YoY decline since Jan 2021…

Source: Bloomberg

Not a good sign for manufacturing (which saw its PMI surge because supply chain disruptions are being interpreted as a positive!!?)

We’re gonna need moar war!

Tyler Durden

Thu, 01/25/2024 – 08:50

via ZeroHedge News https://ift.tt/kdg6xct Tyler Durden