Bonds Away: Rate-Cuts & Junk-Debt In 2024

After a delicate dance of interest rate increases, Jerome Powell has declared victory on inflation and says to expect looser monetary policy this year. But with junk bond spreads not widening nearly as much as one would expect during an era of economic tightening, you’ve got to wonder if money is still actually looser than the Fed’s last round of hikes would lead you to believe.

As Marc Faber pointed out late last year:

“If money was tight, the spread between junk bonds and Treasuries would be much wider. It hasn’t widened much…So, I think the monetary policies are still inflationary at the present time.”

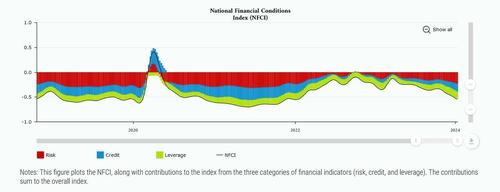

Indeed, the Chicago Fed’s current National Financial Conditions Index (NFCI) continues to confirm this, with numbers still in the negative range indicating relatively loose financial conditions as we start 2024:

And the Fed’s confidence in its mastery of an infinitely complex economy is, as usual, misplaced. But investors are responding to the rate cut news with a refreshed interest in junk debt as spreads remain relatively narrow. Reuters reported earlier this month:

“Junk bond spreads, or the premium investors charge over U.S. Treasuries for taking on the risk, have on average tightened 38 basis points since September to 343 basis points…”

There has been an unusual disconnect between spreads and dollar prices, as described recently by Lord Abbett’s Riz Hussain:

“Treasury yields typically have rallied (on factors such as a flight to the safety of U.S. government debt, expectations of Fed easing, etc.)…We’ve had just the opposite this time around. Specifically, given the worries around persistent inflation that have not vexed investors for many decades to the same extent, the correlation of U.S. Treasury bond prices and risk assets has flipped to positive.”

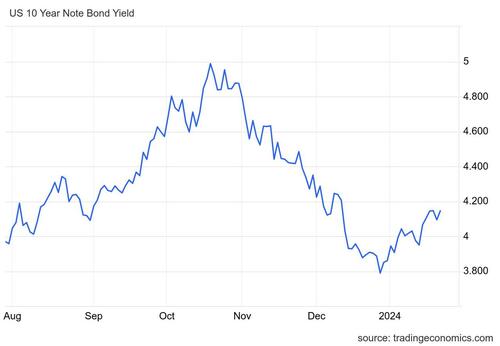

Bullish bond traders are now starting to bet on lower US Treasury yields in response to expected rate cuts in 2024. For junk bonds issued by companies with low credit ratings, a lower cost of borrowing could lend a sigh of relief by increasing the relative attractiveness of their low-rated corporate debt.

The question is whether or not investors will respond by being even more willing to shoulder the higher risk of junk bonds in pursuit of higher returns, compressing yield spread, or if they will step back in recognition of broader economic weaknesses and become risk-averse despite a lower interest rate environment.

Widening fiscal deficits, new rounds of money printing to finance a rapidly expanding Middle East war, and accelerating global de-dollarization are only a few of the dangerous economic trends shaping up for 2024.

A lower cost of borrowing often provides relief for companies that have been squeezed by higher interest rates, but if a collapsing dollar causes increased costs and a debt that’s harder to service, it could also contribute to a wave of defaults. This is particularly true for companies in more inflation-sensitive industries.

But higher inflation doesn’t necessarily mean more corporate defaults, especially as the use of leverage decreases. The question is whether or not other risks have sufficiently destabilized the broader system to cause an unraveling. Riz Hussain at Lord Abbett doesn’t think so:

“…we believe at least part of the resilience we have seen in high yield credit this year can be attributable to supportive fundamental factors that surface in a higher inflation and nominal growth environment.”

Hussain expects that resilience to continue, but also doesn’t expect inflation to worsen significantly in 2024 — a forecast I’m not nearly as confident about. If inflation starts to heat up enough that the Fed reverses course on cutting rates, companies with low credit ratings could see lowered demand for their debt. This seems unlikely, however, as the Fed has little choice but to start cutting rates now despite it being too little, too late to prevent a “hard landing” for the fragile economy.

But if inflation starts looking really bad, maybe the Fed will just look for rosier ways to present it. When the sum perception of economic well-being becomes so dependent on Central Bank data and FOMC announcements, there’s a natural incentive to make that data look as positive as possible. Gina Bolvin of Bolvin Wealth Management said as much in a recent CNBC article about declining Treasury yields, all without much hint of concern for the implications:

“I’ve never really seen a market, in a very long time, that hinges so much on economic data coming out…The market just clings to every single piece…And it keeps cheering it along.”

The trouble is, no matter what the Fed says or how accurate the data it presents is, economic reality always has a way of rearing its head as the chickens of monetary policy inevitably come home to roost. If we encounter a full-blown recession combined with runaway inflation, junk bonds could be some of the hardest-hit assets.

Tyler Durden

Fri, 01/26/2024 – 13:40

via ZeroHedge News https://ift.tt/Z1ENzlH Tyler Durden