Government Worker Wage Growth Hits Record High As Fed’s Favorite Inflation Signal Slows

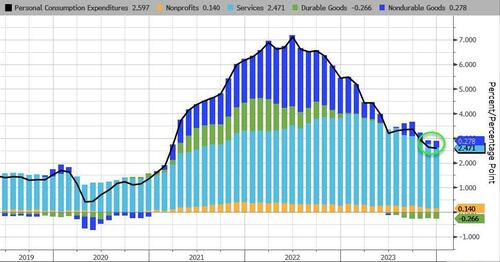

One of The Fed’s favorite inflation indicators – Core PCE Deflator – tumbled to +2.9% YoY in December (below the 3.0% exp and down from 3.2% in November) – the lowest since March 2021.

Headline PCE Deflator rose 0.2% MoM, holding at +2.6% YoY in December …

Source: Bloomberg

While Durable Goods YoY deflation continued in December, non-durable goods costs actually accelerated YoY. Services inflation slowed modestly…

Source: Bloomberg

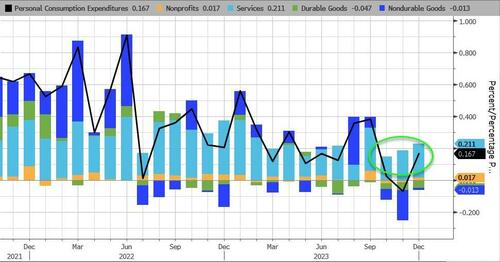

But on a MoM basis, Services costs accelerated…

Source: Bloomberg

Even more focused, from The Fed’s perspective, is Services inflation ex-Shelter, and the PCE-equivalent shows that it has broken down from its ‘sticky’ levels to its lowest since March 2021 (thanks in larg epart to base effects). But, we did see a 0.3% MoM jump, considerably bigger than the last few months increases….

Source: Bloomberg

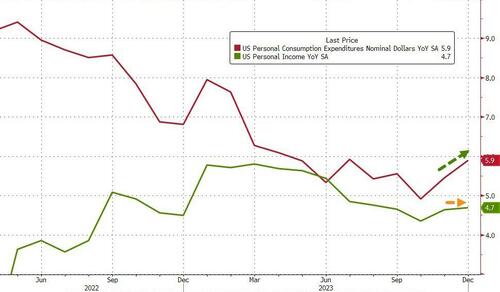

Income and Spending both rose MoM in December but spending significantly outpaced incomes (and expectations) – income +0.3% MoM (as expected), spending jumped 0.7% MoM (above 0.5% exp)…

Source: Bloomberg

Spending is up 5.7% YoY, well ahead of income growth of only 4.7%…

Source: Bloomberg

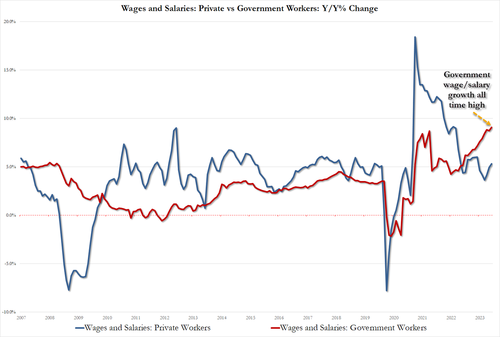

While wage growth overall was modest, it is government wage growth that is driving it – now at a record high!

Source: Bloomberg

And on the back of that, the savings rate tumbled from 4.1% of DPI to 3.7%…

Does that seem like a good thing?

Finally, while the markets are exuberant at the disinflation – and the coming Fed rate-cut avalanche – we do note that it’s not all sunshine and unicorns. The vast majority of the reduction in inflation has been ‘cyclical’…

Source: Bloomberg

Acyclical Core PCE inflation remains extremely high, although it has fallen from its highs.

Is The (apolitical) Fed really going to cut rates by 140bps next year with a background of strong growth (GDP) and still high Acyclical inflation?

Tyler Durden

Fri, 01/26/2024 – 08:43

via ZeroHedge News https://ift.tt/YkU5sva Tyler Durden