“God Help Us In The Next Crisis”

Submitted by QTR’s Fringe Finance

Friend of Fringe Finance Lawrence Lepard released his most recent investor letter this week. He gets little coverage in the mainstream media, which, in my opinion, makes him someone worth listening to twice as closely.

Larry was kind enough to allow me to share his thoughts heading into Q4 2023. The letter has been edited ever-so-slightly for formatting, grammar and visuals.

This is the most recent investor letter from my good friend Lawrence Lepard, which contains a detailed writeup on the following and will be broken up into two parts:

-

2023 Year in Review

-

The FED and Treasury Blink in Q4

-

Inflation

-

Gold and Bitcoin Got the Memo

-

US Fiscal Position Not Improving

-

Catalysts for a Full Fed Pivot

-

When The Fed Pivots, We Get Paid

-

Gold’s Outlook Is Improving

Part 2 of this letter can be found here.

2023 YEAR IN REVIEW

Here are the major developments of 2023:

• No Recession – the rapid rate hikes of 2022 (basically from zero to 4.33% at year-end 2022) did not have the negative impact that we expected on the economy in 2023. “Fiscal Dominance” / “Bidenomics” (fiscal spending of $6.2 Trillion, not far off the COVID high of $7.2 Trillion) more than offset the Fed’s hawkishness as GDP growth was solid (+2.8%) and unemployment remained low (3.7%). There was very little spending restraint this year with continued “can kicking” on budget decisions ongoing until perhaps after the election.

• Stock Market Nears Record High – this one really surprised us. Despite the massive increase in interest rates, the S&P 500 rallied +26 % ending just shy of its January 3, 2022 all-time high. Our view is the US stock market is expensive and at risk of a major decline. Notice in the chart below the current 19.5x PEx with 10 year UST yields at 3.9%. This compares to the October 2007 (just prior to 2008 crash) 15.1x PEx when treasury yields were at 4.7%. Recall that following the 2000 bubble and the 2007 peak, the S& P500 declined 49% and 57%, respectively.

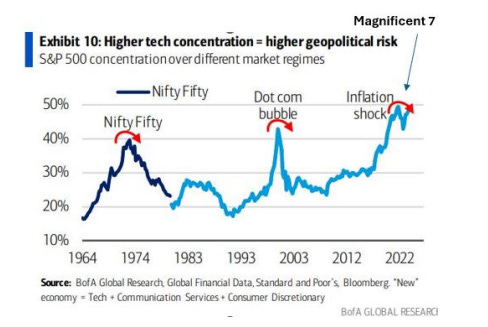

Most of the S&P 500 gains were in the “Magnificent 7” large tech stocks, each of which was up between 48%-239%! It’s reminiscent of the early 1970s and the concentration of market capitalization in “The Nifty Fifty” stocks back then. As the chart below shows, the Nifty Fifty did not end well, and we suspect the Mag 7 will have a similar fate.

• Silicon Valley Bank – in March 2023, two of the largest bank failures in US history transpired. We covered this in our Q1 report. At the time, the US banking system was on the verge of a run as Treasury Secretary Yellen flip flopped several times on the possibility of guaranteeing the entire $17.6 Trillion US deposit base. Instead, the government violated the Dodd Frank law and created a new funding mechanism the BTFP1 which rapidly grew to $80 Billion, and it continues to grow to this day — increasing significantly in the past several months to $140 Billion. It is set to expire (require repayment) in March of 2024. We will believe it when we see it.

This credit event was very severe and shows how shaky the system is and how the Fed and Treasury will always provide a financial liquidity “put” (print money) for financial players and banks in times of trouble.

The BTFP was only the small visible part of the bail out. Pam Martens at “Wall Street on Parade” highlighted that the real bail out came via the Federal Home Loan Bank as it provided over $1 Trillion of liquidity to the banking system in March 2023, $100 billion more than provided in the GFC of 2008.

• Geopolitics – generally the markets have ignored (perhaps at their own peril) various geopolitical hot buttons –the ongoing Ukraine war, the growing unification of the BRICs bloc, the Israel Hamas war, or even the Red Sea happenings as the Houthis (likely backed by Iran/Russia) continue to create havoc in the Freight markets. Some speculate that this is the work of others trying to draw the US into the war in support of Israel vs. Iran.

• US Politics – the polarization of politics continued, with more “can-kicking” budget resolutions and the fight over the Speakership/removal of Kevin McCarthy. As far as the upcoming 2024 election, perhaps it’s apathy or just how polarizing politics are, but it seems to us that very few people want to discuss it. The most important political takeaway for us is that while political news will certainly grow this spring and summer, the outcome is unlikely to affect the fiscal spending trajectory, regardless of which party wins. Debt is debt, and math is math.

THE FED (AND TREASURY) BLINK

We start the discussion of current events by referring you to our Q3 report. In that report, we presented how the US Government Fiscal doom loop was getting worse and how mathematically US Federal borrowings were crowding out the debt markets – sending interest rates higher.

The nearly parabolic growth in US Federal interest costs is making the deficit worse and without monetary accommodation, we suggested that the debt and equity markets were headed for real trouble. Lyn Alden’s chart (below) points out that it is only a matter of time before the Fed will be forced to grow its balance sheet again (print money). In a heavily indebted system, the supply of money needs to continually grow or the debt becomes unserviceable.

The Fed began to blink in Q4. This is enormously important and supports our thesis that the Fed and Treasury have no choice but to loosen monetary conditions (further debase the currency) in order to prevent market dysfunction. Let’s review what happened.

The US 10 Year Treasury Bond yield broke a technically important level (4.368%) on September 20, 2023 and quickly rose to 5.00%. This rate increase drove the S&P 500 down 7% in a matter of weeks, and down 11% from the recent peak. Both events set off alarm bells at the Fed and the Treasury.

The move in the US 10-year yield from September 1 to mid-October was dramatic, a 20% increase in the yield in roughly 6 weeks. We recall the vibe at this time, and it reminded us of the UK Gilt Crisis in the Fall of 2022 as UK bond yields began to spike.

The Fed quickly came with the fire trucks. In rapid succession, we got the following “dovish” comments out of no less than 8 Federal Reserve Governors:

Fed’s Williams: central bank may be done with rate rises.

-

Bloomberg 9/29/2023

Fed’s Logan: higher yields may mean less need to raise rates.

-

Bloomberg, 10/9/23

Fed’s Daly: rise in bond yields may substitute for a rate hike.

-

Bloomberg, 10/10/23

Federal Reserve Bank of Atlanta President Ralph Bostic reiterated that he doesn’t think policymakers need to raise interest rates any further and that policy is restrictive enough to bring inflation back to their 2% goal. “I think that our policy rate is at a sufficiently restrictive position to get inflation down to 2%.” Bostic said Tuesday during a conversation held at the annual convention for the American Bankers Association. “I actually do not think that we need to increase rates anymore”.

-

Bloomberg 10/10/23

“We are in a sensitive period of risk management, where we have to balance the risk of not having tightened enough, against the risk of policy being too restrictive” Fed Vice Chair Philip Jefferson said, nodding to the rise in US Treasury yields and the need for the central bank to “proceed carefully” with any further increases in the benchmark federal funds rate.

-

Reuters 10/10/23

Minneapolis Fed President Neel Kashkari noted it is “possible” that further rate hikes may not be required.

-

Reuters 10/11/23

U.S. Federal Reserve Governor Christopher Waller on Wednesday said higher market interest rates may help the Fed slow inflation and let the central bank “watch and see” if its own policy rate needs to rise again or not. Waller, who has been among the most vocal advocates for higher interest rates to fight inflation, said price data seem to now be moving back towards the Fed’s 2% target, with financial markets adding further credit tightening on their own.

-

Reuters 10/11/23

Fed’s Harker says rate hikes likely over amid ongoing disinflation.

-

Reuters 10/13/23

Fed’s Lorie Logan: Pump the brakes on quantitative tightening.

-

American Banker 1/8/24

(h/t Luke Gromen, FFTT for summarizing these Fed comments)

Based upon the number and consistency of these comments, we assume that it was a three-alarm fire that the Fed had detected in the bond market, as the Bond Volatility Move Index ramped up to levels which indicate severe stress. Several analysts have pointed out that bonds are now more volatile than gold. This is not supposed to happen.

But wait, there is more: The Fed Governors jawboning rates lower on the anticipation of no further rate increases, and possible rate cuts, was just the first act in a three-act play.

Act II opened up with US Treasury Secretary Janet Yellen upon the release of the Treasury Borrowing Advisory Committee (TBAC) report on November 1, 2023. This report comments on the market for US Treasury securities and estimates the amount and nature of the debt sales that the US Federal Government will conduct in order to fund its debt and deficits.

The TBAC report is highly technical with a lot of inside macro baseball. But several things in this most recent report stood out:

First, a much larger percentage of the debt is now being bought by US hedge funds and others who are participating in the “basis trade”.2

Second, the Treasury indicated that they intend to fund a much larger proportion of the debt via short term bills and notes as opposed to longer term bonds. This implies: (i) that the Treasury is having a hard time finding demand for longer term bonds (it is, we will discuss a recent 30-year auction below); and (ii), the market interprets the tilt toward shorter term notes to be an indication that the Treasury expects short duration yields to decrease soon. Markets viewed this as a sign of more monetary accommodation coming soon.

The Treasury has been worried about some weak government bond auctions in Q4 when the Bid to Cover was only 2.24x, much lighter demand than usual. Given this anemic demand, primary dealers (i.e., Wall Street banks) were forced to buy 25% of the bonds auctioned (vs. in normal times perhaps they only have to buy 10-15%). Many have realized that bonds are not a great investment in an inflationary world, where the US money supply has grown at 7% per year over the last 50 years, on average. So, we can debate whether CPI is < 3% or not, but the reality is – debasement is running at 7% on average! Higher interest rates will be needed to stimulate demand for US Treasuries. Watch for weak bond auctions as a major risk factor to global markets over the next few years.

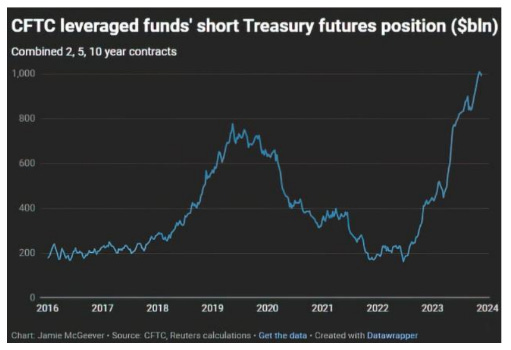

The basis trade mentioned above is also a risk that bears watching given it’s a small cadre of highly levered hedge funds playing this arbitrage game of shorting US Treasury Futures while buying US Treasury on-the-run bonds. Given the > 50x leverage employed, there is real risk if this basis trade went afoul. Recall, Long Term Capital Management was a “can’t miss” back in 1998, until it wasn’t. But, we are dealing with much larger sums of capital than LTCM’s $1bn of equity levered 100x. As you can see in the following chart, there appears to be $1 Trillion of Levered Short US Treasury Futures positions.

Note in the above chart, as rates were rising in 2019/2020, this same levered basis trade was present and coincided with the September 2019 Repo rate blowout which led to the original Powell pivot. Furthermore, several hedge funds at that time were rumored to be insolvent and received emergency Fed swap lines. It would not shock us to see this movie come to a theater near you again soon.

Act III began with the Federal Reserve meeting on December 13, 2023. As expected, they held the Fed Funds policy rate constant at 5.25%, but very importantly they adjusted the “dot plot” of expected future rate levels to reflect that a majority of the Fed Governors now believe the Fed will be cutting rates next year. Perhaps even more importantly, the following exchange took place in the Q&A session with Fed Chair Powell:

Jennifer Schonberger of Yahoo Finance: You said back in July that you needed to start cutting rates before getting to 2% inflation. As you mentioned PCE inflation is now running at 3.5% on core. On a six-month annual basis, core PCE is running at 2.5%. Though when you look at supercore and shelter, they are, of course, stickier. So, when looking in the different components of the data, how much closer do you have to get to 2% percent before you consider cutting rates?

Chair Powell: the reason you wouldn’t wait to get to 2% to cut rates is that policy would be too late… you’d want to be reducing restriction on the economy well before (EMA emphasis added) 2%…..so you don’t overshoot, if we think of restrictive policy as weighing on economic activity. It takes a while for policy to get into the economy, affect economic activity, and affect inflation.

That, ladies and gentlemen is the “Powell pivot” (notably the second one, since he also pivoted in 2019). Chair Powell is looking less like Paul Volcker and more like Arthur Burns.

The Chair of the Federal Reserve just told us that they will not wait for PCE to hit 2% before beginning to cut interest rates and loosen monetary policy. As we predicted, the Fed has once again changed the narrative to suit their purpose. And let’s be clear, their purpose is to keep the bond and stock markets functioning well. So, we can add “higher for longer” to the prior Fed mis-directions of:

-

Inflation is too low.

-

Inflation is transitory.

-

We are not even thinking about thinking about raising rates.

-

We will stay higher for longer to make sure inflation is under control.

As we have said before, they have a tiger by the tail and are swerving between the two extremes of severe inflation and severe deflation. Given policy lags, they are making a mess of it.

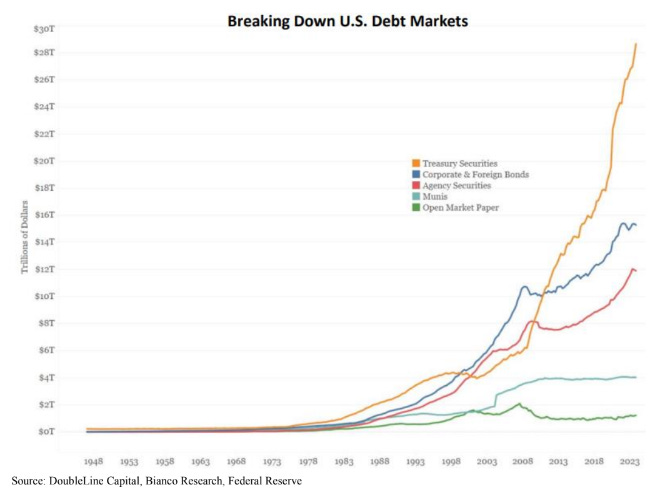

All we can say is good luck, particularly when looking at the next chart below. Notice the parabolic increase in US Treasury issuance since 2009. In one snapshot here, we can see just how much the government not only has to finance its own increasing government expenditures, but also the back door assistance it has increasingly needed to provide over the past 14 years to support this levered system we have. This is only going to compound even more rapidly, and God help us in the next crisis. Again, debt is debt and math is math.

INFLATION

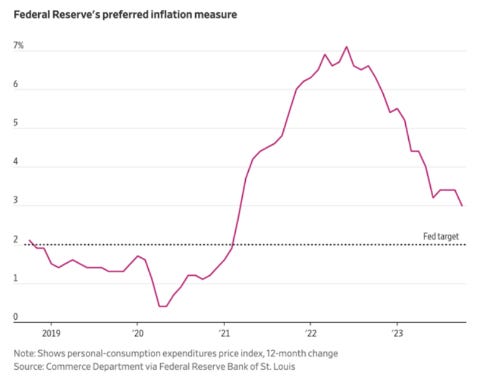

The level of reported PCE inflation has come down substantially (see chart below). Don’t get us started on whether these numbers are accurate or not, just remember that this is the gauge which the Fed uses.

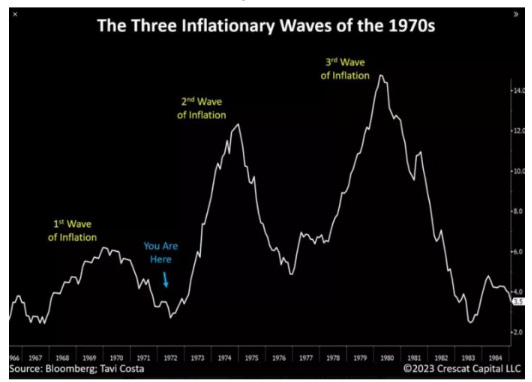

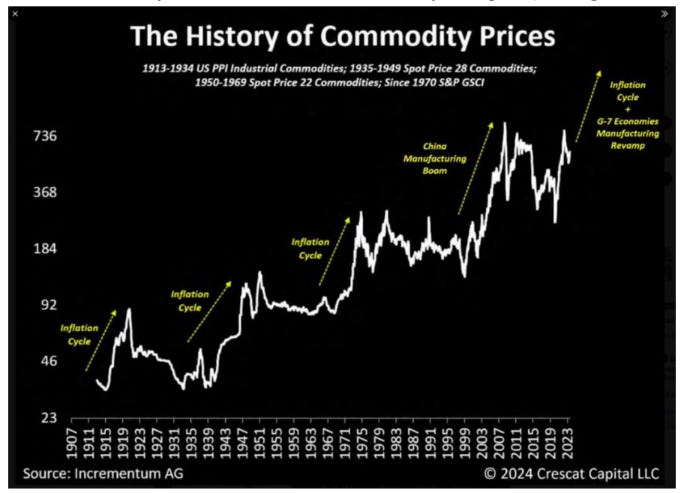

In essence, the Fed Chair is implying that inflation taming has been good enough for Government work. And perhaps it is. Some think inflation will continue to fall and could perhaps even go negative – particularly as owner’s equivalent rent is ~35% of CPI and its impact is lagged by nearly a year (OER is down over the past year). Anything is possible in this out-of-control system. However, inflation only goes negative if we have a system wide deflationary collapse which will surely lead to record monetary accommodation. The highly irresponsible 2002 “Helicopter Money” speech by Bernanke on preventing deflation indicated the Fed will never let deflation occur. The system would collapse. We are not sure of the path of the next Fed printing, or timing, but we can clearly see the issue. The odds are good that the next wave of accommodation leads to a resurgence of inflation, similar to the 1970’s.

Our view is that we have left the deflationary years of 1980 to 2020 behind and that in March of 2020 with the US 10-Year bond yielding only 54 basis points, we achieved peak deflation. We now live in an inflationary world until these debt issues are resolved. Or, said another way the only way we get deflation is if the Fed and other monetary authorities allow a deflationary collapse. (not impossible, but unlikely).

Part 2 of this letter can be found here.

QTR’s Disclaimer: I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have not been fact checked and are the opinions of their authors. They are either submitted to QTR, reprinted under a Creative Commons license or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Larry’s Disclaimer: These presentation materials shall not be construed as an offer to purchase or sell, or the solicitation of an offer to purchase or sell, any securities or services. Any such offering may only be made at the time a qualified investor receives from EMA formal materials describing an offering plus related subscription documentation (“offering materials”). In the case of any inconsistency between the information in this presentation and any such offering materials, including an offering memorandum, the offering materials shall control.

Securities shall not be offered or sold in any jurisdiction in which such offer or sale would be unlawful unless the requirements of the applicable laws of such jurisdiction have been satisfied. Any decision to invest in securities must be based solely upon the information set forth in the applicable offering materials, which should be read carefully by prospective investors prior to investing. An investment in EMA not suitable or desirable for all investors; investors may lose all or a portion of the capital invested. Investors may be required to bear the financial risks of an investment for an indefinite period of time. Investors and prospective investors are urged to consult with their own legal, financial and tax advisors before making any investment.

The statements contained in this presentation are made as of the date printed on the cover, and access to this presentation at any given time shall not give rise to any implication that there has been no change in the facts and circumstances set forth in this presentation since that date. These presentation materials may contain forward-looking statements within the meaning of US securities laws. The forward-looking statements are based on EMA’s beliefs, assumptions and expectations of its future performance, taking into account all information currently available to it, and can change as a result of known (and unknown) risks, uncertainties and other unpredictable factors. No representations or warranties are made as to the accuracy of such forward-looking statements. EMA does not undertake any obligation to update any forward

looking statements to reflect circumstances or events that occur after the date on which such statements were made. Historical data and other information contained herein, including information obtained from third-party sources, are believed to be reliable but no representation is made to its accuracy, completeness, or suitability for any specific purpose.

No representation is being made that any investment will or is likely to achieve profits or losses similar to those shown. Past performance is not indicative of future results. This report is prepared for the exclusive use of EMA investors and other persons that EMA has determined should receive these presentation materials. This presentation may not be reproduced, distributed or disclosed without the express permission of EMA.

Tyler Durden

Sat, 01/27/2024 – 10:30

via ZeroHedge News https://ift.tt/IoG7y1E Tyler Durden