Goldman Trading Desk: Theme Of The Week Was Increased Appetite For Stocks Ex Mag 7

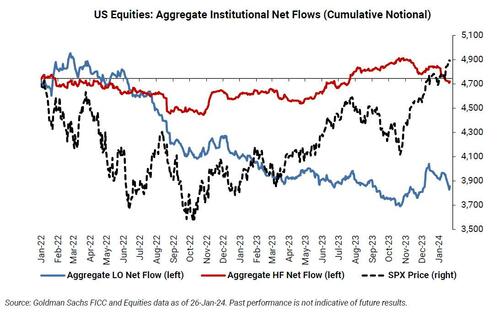

According to the most comprehensive recap of relevant recent market flows, last week hedge funds were subdued with buying driven almost entirely by short covers in Macro Products while flow in Single Stocks ended flat, as trading activities pointed to increased dispersion and sector rotation. Perhaps more importantly, Goldman’s Sales Trading desk notes that the theme of the week was an increased appetite for equities ex mega cap tech, as markets digested better economic growth, benign inflation data, and mixed tech earnings. SPX finished the week with 328 names up on the week vs 175 down. Compare that to the first 2 weeks of the year where SPX showed 197 up, and 305 names down – aka investors are rotating away from defensive tech, and into other names. Finally, the Goldman trading desk saw $4bn of net supply from the LO community, largely driven by Info Tech and Comm Services selling throughout the week. Energy and Industrials were the only net bought sectors on the pad. HFs finished the week balanced.

All this and much more is discussed in what we have dubbed Goldman’s weekly “must-read” report that aims to consolidate the latest positioning and flows intelligence, market themes, and actionable ideas from thought leaders and traders across the GS franchise, and is an indispensable piece for every serious trader.

Below we excerpt from the latest full report for the benefit of our premium and professional readers (full analysis available to our pro subscribers in the usual place).

* * *

The S&P 500 fell marginally on Friday after closing at ATHs for 5 straight sessions, as market participants digested better economic growth, benign inflation data, and mixed tech earnings. China ADRs, Value, and Commodity Sensitive names were among the biggest gainers this week, while Housing Exposure, High Retail Sentiment, and Onshoring stocks underperformed.

Next, here are the key observations from across the key divisions inside Goldman’s trading desk.

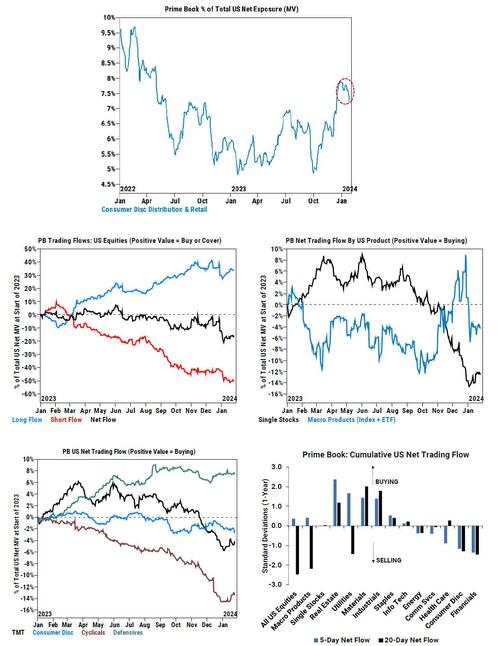

- Prime: US equities were modestly net bought this week, driven almost entirely by short covers in Macro Products. While Single Stocks net flow ended ~flat, trading activities point to increased dispersion and sector rotation – Industrials, Real Estate, Utilities, and Materials were the most net bought sectors, while Consumer Disc, Financials, and Health Care were the most net sold.

- Shares Sales Trading: The theme of the week was an increased appetite for equities ex mega cap tech. SPX finished the week with 328 names up vs 175 down (compared with the first 2 weeks of Jan where 197 names were up vs. 305 down). Our trading desk saw $4bn of net supply from the LO community, largely driven by Info Tech and Comm Services selling throughout the week, while Energy and Industrials were the only net bought sectors on the pad. HFs net activity finished the week balanced.

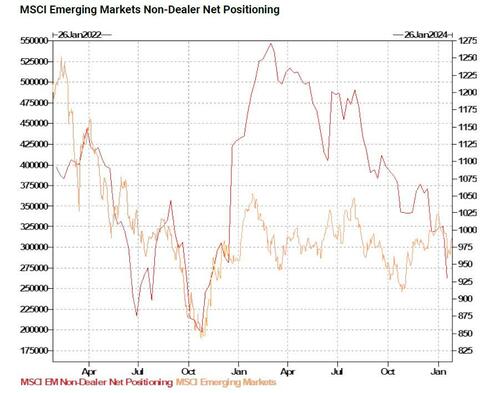

- Futures Sales Trading and Strats: Various actions implemented by Chinese policymakers appear to have supported price action in equities (MSCI EM) and commodities (High Grade Copper), as bearish China sentiment afflicted various futures contracts entering this week. In Energy, ongoing geopolitical strains prompted meaningful risk infusions in the Low Sulphur Gasoil contract.

- Derivatives Sales Trading: The US equity market will pay attention to what happens between now and Feb 2nd: QRA, FOMC, and earnings (32% of SPX market cap reports next week) are among the notable catalysts. We still like IWM upside despite the recent pullback, and with China potentially turning a corner on the policy front, some investors are warming up to Energy stocks again.

- ETF Trading: This week’s focus was an RIA-tracked model portfolio rebalance that came through multiple platforms. Domestic equities saw supply in US growth (IVW) and quality (QUAL) vs. demand for US Value (IVE) and a factor rotation strategy (DYNF). International equities saw demand for DM growth (EFG) vs. supply in DM value (EFV). Fixed income saw supply in USD IG Corps (LQD), treasury floaters (TFLO) and 20+ year treasuries (TLT) vs. demand for Core Bond+ (IUSB) and actively managed FI (BINC).

- Baskets & Macro Themes: Take a look at High Beta 12M Laggards (GSCBLMOM). The momentum factor has been sensitive to the odds of a March rate cut, and for investors who think a March cut will happen and are long momentum, it may make sense to hedge. With Gross exposure in our PB book at record highs, this can leave crowded positions and momentum at risk of a de-grossing. Outside of short momentum, a March rate cut would be best for residual vol, beta, value, and leverage related factors.

- Sector Specialists: A mixed week for Health Care, as the early innings of the 4Q EPS season brought significant volatility/debates around Managed Care, Med Devices and Tools subsectors, while IPO/capital markets picked up after a long drought. In Consumers, we think most of the earnings results in the next 2 weeks will likely continue to support the building notion that the consumer is in a pretty healthy place and that comments from the card companies about a volume slowdown are explainable.

* * *

Some more details on each of these segments below:

1. Prime Services

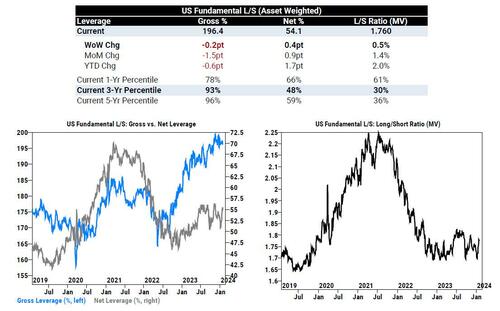

Asset Weighted Risk Exposures: US Fundamental L/S Gross leverage decreased -0.2 pts to 196.4% (93rd percentile three-year), while US Fundamental L/S Net leverage rose for a 3rd straight week by +0.4 pts to 54.1% (48th percentile three-year). Aggregate US Fundamental long/short ratio increased +0.5% on the week to 1.76 (30th percentile three-year).

Trading Flows: US equities were modestly net bought on the week (+0.4 SDs vs. the past year), driven almost entirely by short covers in Macro Products (Index + ETF), as net flows in Single Stocks finished ~flat.

Macro Products – Index and ETF combined – were net sold in 4 of the past 5 sessions, driven mainly by short sales. On the other hand, Single Stocks were modestly net bought on the week, driven by long buys outpacing short sales 1.2 to 1.

While Single Stocks collectively saw muted net activity, trading flows point to increased dispersion and sector rotation – Industrials, Real Estate, Utilities, and Materials were the most notionally net bought sectors, while Consumer Discretionary, Financials, and Health Care were the most net sold.

Consumer Discretionary stocks were net sold for a 2nd straight week (5 of the last 6), driven by long-and-short sales (~4.5 to 1). Broadline Retail and to a lesser extent Specialty Retail were the most net sold subsectors this week, driven by long sales and short sales, respectively.

After being net sold in 4 of the previous 5 weeks, Real Estate was the most net bought sector on the week in standard deviation terms (+2.4 SDs), driven by short covers and long buys (1.6 to 1). Nearly all subsectors were net bought this week, led by Retail REITs, Specialized REITs, and Real Estate Management & Development

* * *

2. US Shares Sales Trading

RTY finished the week +1.7%, vs SPX +1.1% and NDX +62bps. The theme of the week was an increased appetite for equities ex mega cap tech, as markets digested better economic growth, benign inflation data, and mixed tech earnings. SPX finished the week with 328 names up on the week vs 175 down. Compare that to the first 2 weeks of the year where SPX showed 197 up, and 305 names down – aka investors are rotating away from defensive tech, and into other names.

Our trading desk saw $4bn of net supply from the LO community, largely driven by Info Tech and Comm Services selling throughout the week. Energy and Industrials were the only net bought sectors on the pad. HFs finished the week balanced.

* * *

3. Futures Sales Trading and Strategies

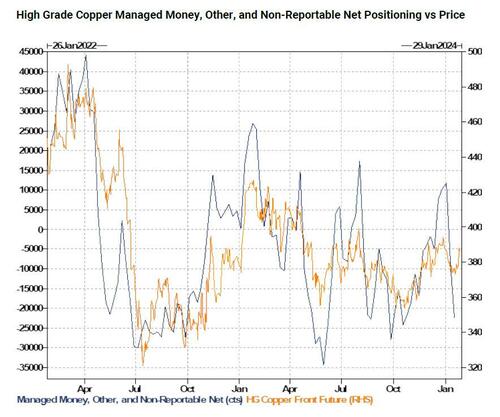

Entering this week, bearish China sentiment afflicted various futures contracts. For equities, Commitment of Traders exhibited $3.2bn of Non-Dealer net selling in MSCI Emerging Market from January 9th – 16th, due to liquidation (-$2bn) and new shorts (+$1.2bn). By category, Asset Manager dominated. This, combined with bearish flows in other leveraged products, pressured funding spreads. Similarly in commodities, High Grade Copper net length across Managed Money, Other, and Non-Reportable nosedived $3.2bn – the 3rd largest 2 week fall over the past 2 years. New shorts ($2.3bn) were the main driver.

Therefore, it was no surprise that various actions implemented by Chinese policymakers, including equity market support and a cut in the reserve requirement ratio, were well received. As of the January 25th close, High Grade Copper and MSCI EM were +0.6% and +2.2% on a 4 day look back. From a momentum perspective, the swing in Copper may prove more impactful near-term. Per GS Futures Strategists’ CTA model, sizeable buying is projected over the coming week if prices sustain current levels. However, discretionary portfolios seem reluctant to implement longs ahead of the Q1 seasonal surplus and with carry still firmly negative.

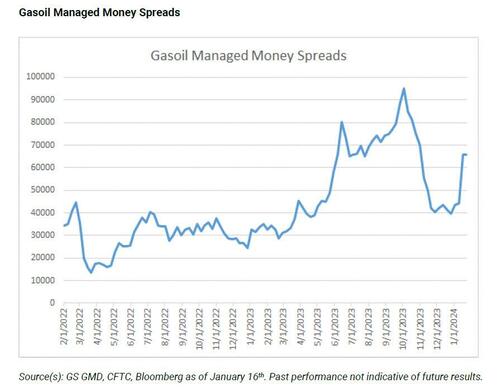

In Energies, ongoing geopolitical strains – Red Sea bickering plus Ukrainian strikes on Russian refineries – prompted meaningful risk infusions in the Low Sulphur Gasoil contract. Extrapolating from recent Commitment of Traders data and viewing the extreme curve strength, Managed Money spread buying was potentially responsible for some bullish posturing. But GS Futures Strategist’s model also forecasted reasonable CTA purchases due to a change in trend. Interestingly, inventory data has yet to reflect draws, causing some to question the curve shift.

* * *

4. ETF Trading

Model Portfolio Rebalance Spotlight

This week’s focus in ETF flows was an RIA-tracked model portfolio rebalance that came through multiple platforms across both equity and fixed income ETFs. Total primary flows were ~$14.4bn across both creates and redeems, coming through the system both via outright risk blocks and benchmark working orders. The desk was active and engaging with clients around these flows, leveraging house expertise in the underlying constituent portfolios across equities and bonds.

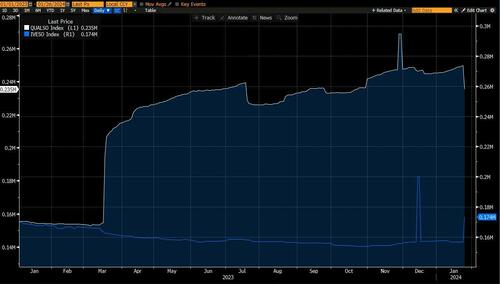

In domestic equities, saw $3.5bn of supply out of US growth (IVW) and quality (QUAL) and $4.8bn of demand into US Value (IVE) and a factor rotation strategy (DYNF). The graph below showcases the shares outstanding change on the back of the $2bn tactical switch out of quality and into value.

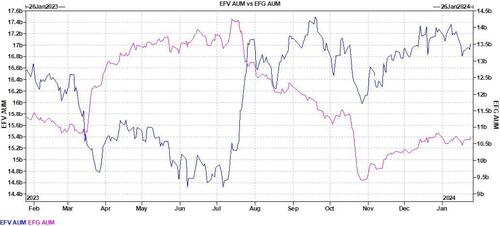

In international equities, saw demand for DM growth (EFG) / supply in DM value (EFV). Since July last year, there was a systemic shift out of growth and into value – with this allocation shift, it could be a signal for a reversal:

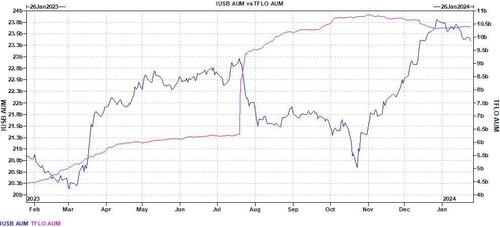

In fixed income, saw supply in USD IG Corps (LQD), treasury floaters (TFLO) and 20+ year treasuries (TLT) / demand for Core Bond+ (IUSB) and actively managed FI (BINC). This allocation into BINC doubled the size of the fund, hitting just over $1bn in total AUM (as of Thursday night).

* * *

5. Derivatives Sales Trading

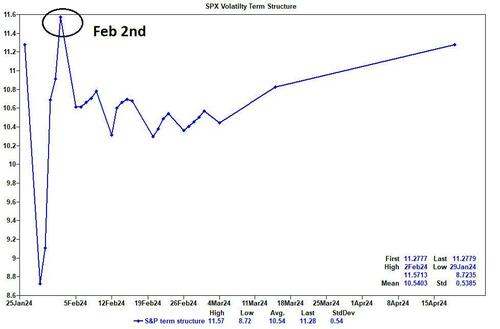

In the near-term, the US equity market will pay attention to what happens between now and Feb 2nd… among other catalysts, we get:

- QRA

- FOMC

- Earnings – nearly 40% of the S&P’s market cap reports, the biggest week of earnings.

The equity vol market is now pricing the biggest premium on this date – the S&P implied move from now thru next Friday’s close = > 1.50%

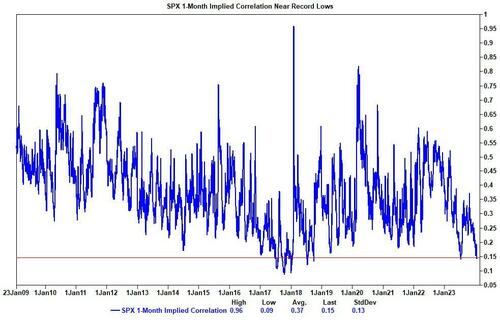

If that sounds low, it’s because it is … The options market is currently implying near record-low correlation amongst S&P constituents, as high gross leverage and index vol selling products have led to much more dispersion.

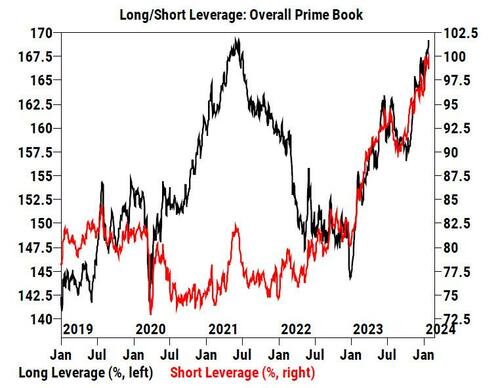

Underscoring the micro volatility: both long and short exposures have risen sharply to their respective multi-year highs.

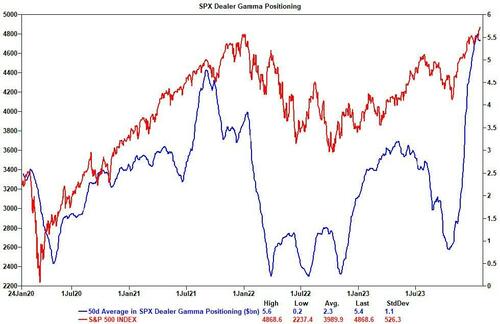

The other prevalent trend of more options selling remains thematic at the S&P index level, which continues to provide dealers with more gamma (this has a braking effect on the SPX market moves, as dealer hedging flows lead to more buying on dips, and more selling on rallies).

So where does the desk think we can move? We still like IWM upside despite the recent pullback. With short exposure at multi-year highs and looming catalysts, the case for owning calls here is attractive.

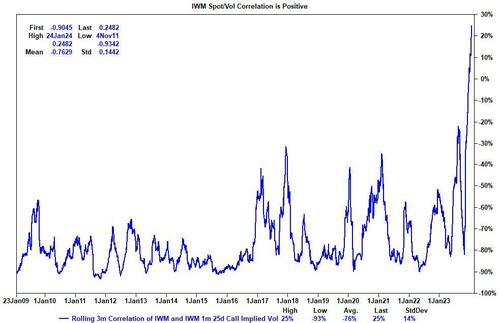

Similar to other short proxies (namely China equities), we are seeing positive spot/vol correlation in IWM as investors rush to hedge shorts on rallies. This phenomenon has never before occurred in small-caps.

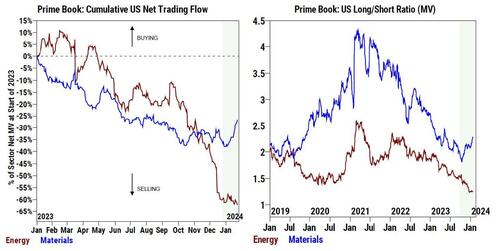

Where else could shorts be vulnerable? Managers have continued to sell and press shorts in Energy stocks – our PB data has shown consistent selling here to start the year as part of the re-grossing theme, and with China potentially turning a corner on the policy front (more on those recent flows here), we’re seeing some investors warming up to this space again.

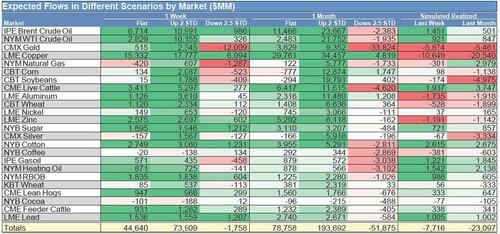

It’s also worth noting that commodities in general are starting to see some positive flow signals. Unlike our equity CTA model that shows a downside asymmetry, in the commodities space:

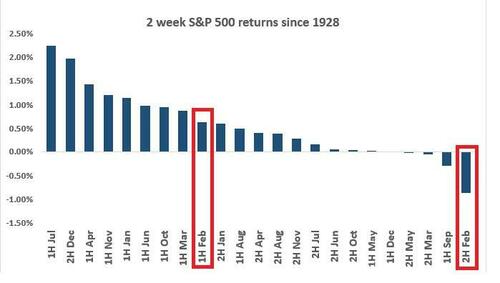

Last point: the dichotomy between the first half of February and the second half from a seasonal perspective. For those worried about any froth in the US markets, the last two weeks in February are historically the worst 2 weeks of the year. Given how well markets followed the historical analog last year, it’s something to have on the radar.

Simulated results are for illustrative purposes only. GS provides no assurance or guarantee that the strategy will operate or would have operated in the past in a manner consistent with the above analysis. Past performance figures are not a reliable indicator of future results.

Past performance is not indicative of future results / charts sourced from Goldman Sachs FICC and Equities, GS Research, and Bloomberg as of Jan 25th 2024.

* * *

6. Thematic Baskets and Macro Observations

After this morning’s data, the 6-month annualized rate of core PCE inflation is below 2%. At the same time, the odds of a March rate cut have declined YTD. Will that change?

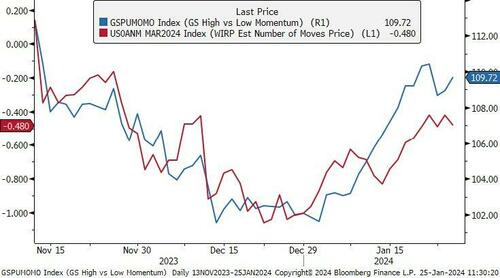

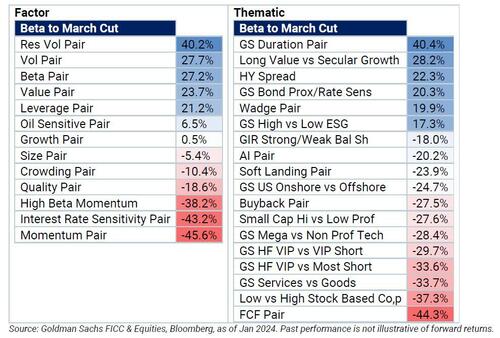

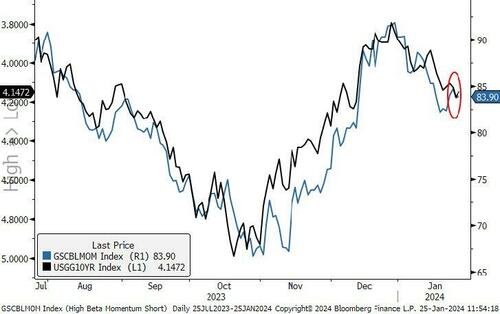

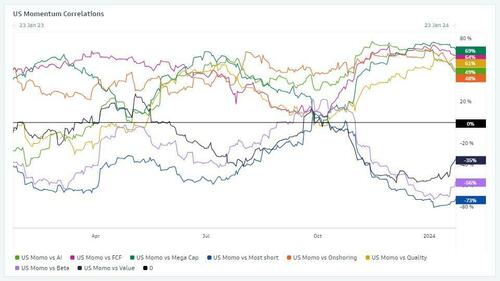

We wanted to flag just how sensitive the momentum factor has been to the odds of a March rate cut (visual below). If you think a March cut is happening and you are long momentum, it may make sense to hedge. Outside of short momentum, a march rate cut would be best for res vol, beta, value and leverage related factors (tables below). We recommend looking at High Beta 12M Laggards {GSCBLMOM Index}

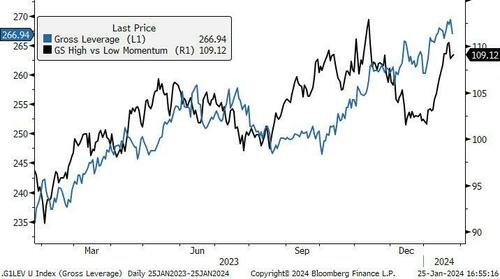

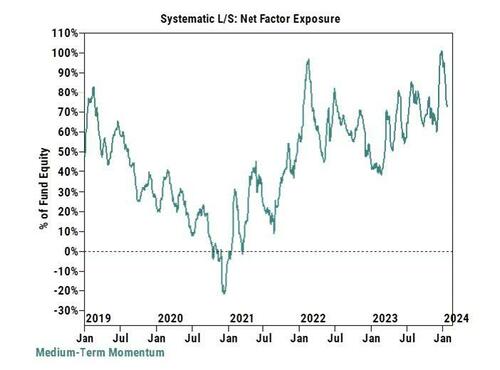

Overall Gross exposure in our PB Book has risen to new record high and this can leave crowded positions and momentum at risk of a de-grossing, especially as Momentum factor exposure of Systematic is in the 88th percentile vs 5y history.

- Other items that could be favorable for low momentum, high beta, small cap stocks:

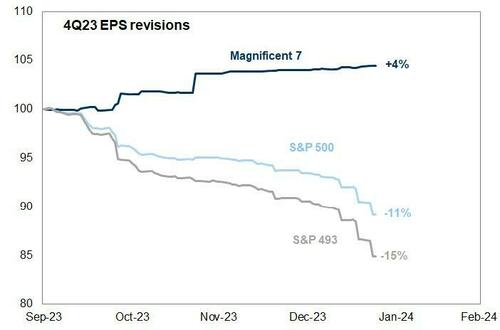

- The negative revisions of 4Q Earnings for 493 imply a low bar for earnings the next two weeks

- Indices at all time highs should be supportive of breadth improvement at some point

- Dealer gamma positioning keeps S&P contained, allowing for more factor rotation under the surface.

- Many short quality trades are 12-15% below December levels, and quality factor appears to be topping out.

- The yield curve is close to un-inverting, and unless this steepening is viewed as the start of the recession (’01, ’07), it is typically good for beta, weak b/s, small size, value, tech and financials and basically the opposite of what is working YTD.

Momentum has been sensitive to odds of a March cut

Momentum could be at risk of a de-grossing

Momentum Factor exposure of Systematic is in the 88th percentile vs 5y historical

Beta to March Cut:

Short Momentum (GSCBLMOM Index) is decoupling from 10yr yields

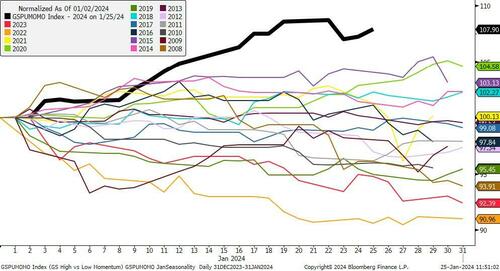

Momentum is off to its best start in 15 years and strongly rebounded post December selloff

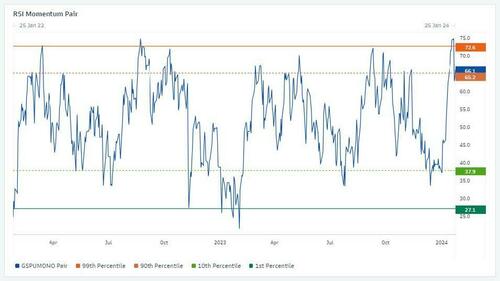

Momentum has become overbought in January and RSI remains elevated vs history

Correlation of momentum to popular Themes are very elevated

7. Sector Specialists Highlights

Health Care

A mixed week for the healthcare sector, as the early innings of the 4Q EPS season brought significant volatility/debates around Managed Care, Med Devices and Tools subsectors, while IPO/Capital markets picking up after a long drought.

Most in-focus was the Managed Care group, where the Medicare Advantage market remains the epicenter of debate around a historic rise in costs. After negatively preannouncing the prior week, HUM provided formal 2024 and initial 2025 commentary well below even subdued expectations. Commentary from the company suggested a heightened cost trend environment into 2024 and an elongated period with which the company could re-price/adjust their risk book. This comes partly in contrast to peer UNH who saw similar spike in cost trend in 4Q, though suggested more seasonal impacts rather than something more durable, while peer ELV largely confirmed cost issues are MA-centric issue.

Medtech updates on the week had some puts/takes, with topline trends remaining strong + corroborating elevated cost environment – though sell-the-news dynamics (ISRG, ABT) and/or weaker margin execution (JNJ) drove volatility within the complex.

Debates around the Life Sciences/Tools subsector remains high, with the solid 4Q + initial 2024/mid-range guidance from EU peer Sartorius driving a late in the week bounce in the broader Tools sector, particularly bioprocessing levered names within the group – though focus quickly shifting towards the mega cap bellwethers within the complex (TMO, DHR) reporting next week to confirm or deny signs of stabilization across key life sciences end markets.

Consumers

Consumers spending choppier, but fine. While there was some inbounds and concern around comments from Visa about their January trends, the group was able to successfully brush off any view that it was a narrative chance. As a desk, we have heard inbounds for the last 2 weeks now about weak traffic trends in retail in January in restaurants and retailers. Much of it can be simply attributed to weather and tougher compares. As a result, we think any slightly sluggish January updates will not come as too much of shock to the consumer specialist and community. We do not think there is any true change to the soft landing narrative for the market or consumer spending.

Corporates this week generally sounded a constructive tone. The most surprising came from airlines, who largely guided to in-line or above consensus 1Q results. Another area of unexpected strength was from Proctor & Gamble (PG), who highlighted +4% volume growth in the US and said they had expectations for further improvements. That is a change from their tone in 2H23. While we do not think the next 2 weeks of earnings results will be perfect, most will likely continue to support the building notion that the consumer is in a pretty healthy place and that comments from the card companies about a volume slowdown are in fact explainable.

More in the full note available to pro subscribers.

Tyler Durden

Sun, 01/28/2024 – 15:45

via ZeroHedge News https://ift.tt/QsOmh1u Tyler Durden