Dovish ECB Signaling Emboldens Firmer Pricing For April Rate Cut

Authored by Ven Ram, Bloomberg cross-asset strategist,

Traders in the euro region reckon that the base case is for the European Central Bank to cut interest rates in April, with a tail risk that we don’t get one. Pricing has been emboldened by some dovish statements from officials.

Meeting-dated swaps are now fully pricing in a rate-cut in April, compared with some 87% at the end of last week.

The ramping up of expectations follows Bank of France Governor Francois Villeroy de Galhau remarking over the weekend that “regarding the exact date, not one is excluded, and everything will be open at our next meetings.”

ECB Vice President Luis de Guindos added to that view by remarking that monetary policy will reflect the good news on inflation.

Those remarks are in contrast to President Christine Lagarde’s comments on Thursday, when she stood by her earlier remarks on a first rate cut in the summer.

There are factors that may compel the ECB to loosen policy sooner, contends Adrien Letellier at Bordier & Cie.

Germany is already in recession and will probably drag the euro zone down with it, Letellier, a fixed-income portfolio manager, writes in response to an earlier post.

“It’s increasingly plausible for the ECB to meet its inflation target by April, and I would not completely rule out that it could be close to the target after the February figure,” he reckons.

So we could be in a situation by early March where inflation is back to target or very close, which would should put pressure on the ECB that meets six days later. The ECB can, therefore, still change its mind, he contends.

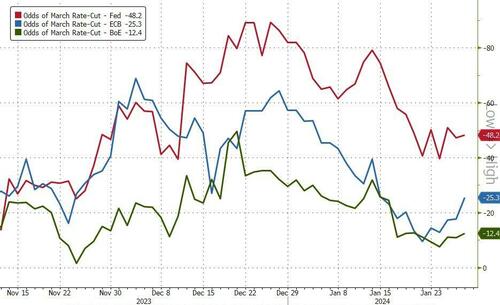

The odds of a March rate-cut remain low for the ECB and BoE, but the market is pricing a coin-toss for The Fed…

Which will likely swing more positive as the reality of the end of BTFP and Zero-RRP starts to hit the banking system

Tyler Durden

Mon, 01/29/2024 – 09:00

via ZeroHedge News https://ift.tt/3aXhJMe Tyler Durden