Incentives Are Everything

Authored by Mark Jeftovic via BombThrower.com,

How it started / How it’s going…

Yet, elites think that individual incentives are irrelevant.

One of the holy writs of the Bitcoin and crypto-currency space is The Sovereign Individual, written over twenty years ago, before the Global Financial Crisis, before the Satoshi white paper, before clown world and before “The Jackpot” (COVID-19).

Written by James Dale Davidson (still active and writing), and the late Lord Rees-Mogg (whose son is a prominent figure in the UK Tory party), the book predicted a future wherein the centralized, hierarchical, top-down model of nation state governance would break down and be forced to yield to a type of free market competition for citizens, producers and tax revenues.

The reason why was simple: asymmetric public key encryption.

They likened it to the “gunpowder revolution” of the Information Age, because it flipped the cost of un-doing something on its head – it was now more expensive to decrypt data (if not impossible) than to encrypt it.

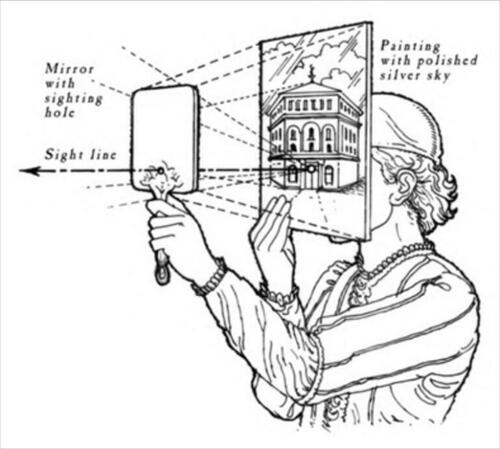

That may sound like an innocuous enough innovation, but to Davidson and Rees-Mogg, the ramifications were enormous. It would change everything – and if you haven’t read the book already, take the time to do so. (The Canadian analyst W R Clemens ascribed the entire Enlightenment Era as being ignited by something just as seemingly innocuous: the discovery of perspective in Medieval art, which I’ve written about here and here).

Whenever the Sovereign Individual comes up in conversation, or when I’m on a podcast, I always quip that the entire book can be summed up in one word: incentives.

Incentives are everything, and the reason why is because today, more than any other point in modern history – we live in a world where everybody has the ability to act on their incentives. In the past, there may have been very real, overpowering constraints that barred most people from acting in their own self-interest: slavery, feudalism, and serfdom took many forms, and will continue morph into new forms of mass servitude today with debt bondage, mass media propaganda, operant conditioning and soon, CBDC’s and personal carbon footrprint quotas.

But at the same time, the world we live in now contains numerous, publicly available levers that individuals can use to both express their autonomy as well as amplify it. As I mentioned on a recent podcast, now “everybody has the bomb”.

The “bomb” being: literacy, effectively free access to all the information and knowledge ever accumulated by humanity, peer-to-peer communications at the speed of light, encryption, decentralized non-state money (Bitcoin), and now, AI.

What next? Who knows – but whatever it is won’t be trickled out to us from on high. It’ll just explode onto the scene like everything else has over the last few decades. Top-down, is basically over. At least for those who choose to take the reigns over their own lives.

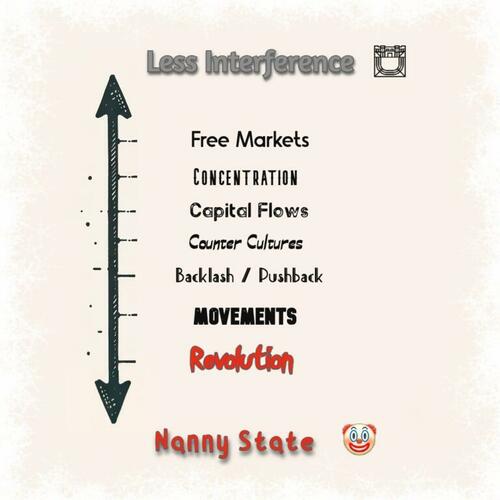

The Continuum of Individual Incentives at a Macro Level

For policy makers, increasingly imperious nation state governments and out of touch globalists like the WEF , incentives seem to be a total blind spot for them. They spend all their time coming up with grand, sanctimonious moonshot objectives for “reimagining” and “recontextualizing” everybody else’s lives.

You will own nothing, we will ration your meat consumption, take away your car, limit your ability to travel, and force you to take experimental vaccines because if you don’t, the world will end.

Aside from vague lip service to “inclusivity”, what is absent from all this is any understanding of individual incentives and motivations. To the centralized, globalist mindset, individual incentives are irrelevant (a 2010 clip of WEF darling Yuval Harari recently resurfaced wherein he claims that the idea of individual human rights are an illusion).

But I’m here to tell you, not only are incentives everything – the only way they can be expressed are through individuals. It’s what happens when those incentives align for multiple individuals at the same time that it starts to get really interesting.

My mental model for this is The Continuum of Mass Incentives, penciled out below:

The Continuum of Mass Incentives

The axis that drives this is the level of external interference into individual incentives and aspirations. Typically this means the level of state oversight from laissez-faire to Big Government authoritarianism.

On one end, it’s “Life, Liberty and the Pursuit of Happiness” – the Free Market – represented by an agora symbol in my chart, a common space where individuals come together for the free flow of ideas, goods and services.

Absent coercion, it is here in the agora where the building block of capitalism occurs: a transaction. An event freely entered into and agreed upon by multiple parties, each of which is acting in their own self-interest, each of which finishes more value than they went in with.

This is alchemy: the output providing more total value than the inputs. It’s why you’re reading this on the internet over a cup of coffee instead of banging rocks together to stay warm.

The “concentration” phase is where we see increased government regulations start to thin out competition. The higher regulatory burdens incentivize both consolidation and regulatory capture – culminating in the ability for incumbents (those who recognized what was happening and move first) to “pull the ladder up behind them” as I described in my eulogy for Charlie Munger (one of the most successful cantillionaires of the last century).

Capital Flows is when holders of wealth begin to move in anticipation of where they see the wind blowing. If they aren’t able to move inside the oligarchy – they’re frozen out either politically, ideologically or just because of an excess of elites – they begin to look for greener pastures elsewhere.

A nascent example of this is The People’s Republic of Canada where wealth planners and lawyers report doing increasingly more work for Canadian entrepreneurs and HNW individuals making preparations to expatriate.

I count myself among this group as I’ll finalize my Barbadian citizenship this year while casting a sidelong glance at the Liberal-NDP coalition appearing intent on jerry-rigging the next election…

This doesn’t wreak of desperation at all.

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) January 27, 2024

You’ll note that in the first few steps in the gradient, incentives are expressed via capital flows. If I can be so blunt, it’s basically the smart money staying ahead of an increasingly predatory inner sanctum of elites. At this stage of the game, the public is still mentally invested in the establishment narrative and the official zeitgeist.

They still believe in public institutions, which still enjoy credibility. They still believe the government is there to help them. They still believe the corporate press reports news instead of gaslighting them with establishment agitprop.

The counter-culture and backlash phases are different levels of intensity for the same realization among the public: “this isn’t really working for me anymore”.

In the more subtle, counter-culture it gets expressed on late night TV and stand-up comedy. Think George Carlin.

By the time you get to “backlash” it’s things like Occupy Wall St. and movements form around constructs like The Tea Party.

As the incentives begin aligning across a larger cross-section of the public, the elites and establishment institutions become ever more imperious, tone-deaf and out of touch. They don’t see increasing disenfranchisement of the public as legitimate discontent. It all has to be infantile ignorance, since their stewardship of the economy (which by now has become mostly wholesale plunder) is beyond question.

It can take a society decades or even generations to move along this continuum – all the while wealth disparity is increasing and the system becomes ever more rigged against the general population.

Suddenly… The Revolution.

Finally, the establishment gets to a point where it feels so threatened by public discontent that the only recourse seems to be greater control, more asymmetry and less incentive for the public to go along with it. That which is not expressly permitted is forbidden – which doesn’t sound so far-fetched given that we were already there for two years under Covid.

A lot of people worry that with digital IDs, CBDCs and their inevitable social credit systems coming, the political class will have total control, public incentives be damned (“You will own nothing and be happy“).

However, because of the advancements unleashed as described in the Sovereign Individual thesis, the opposite seems more likely – just when it seems that The Powers That Be are most the powerful and on the cusp of consolidating it even further, it all comes unglued in some manner of non-linear phase shift.

Those “bombs” I referred to earlier, that every member of the public now has access to, have already manifested into real world applications that exist in the wild today. Containment is a non-starter: capital flight, 3D-printing, drones, AI, biotech… and soon nanotech: we now live in a world where one guy in a garage can come up with something that can literally Burn It The Fuck Down (“#BITFD” as Ben Hunt liked to quip).

Burn what down?

Everything.

The elites, typically insular and coddled know this, and they fear it (and frankly the public should also know this and fear it).

Paradoxically, the remedy to having rando garage hackers and mad scientists going rogue is not greater control over the public and further plundering their wealth.

You don’t prevent somebody from Burning It All The Fuck Down by stomping all over the entire population’s rights, aspirations and incentives. All you do then is create more people who have the means and inclination to BITFD.

What you have to do instead is cultivate an economy where fewer people are incentivized (there’s that word again), to BITFD. Ideally, none.

I don’t know how realistic that is, but if we can nudge the numbers in the right direction, we may be able to confine the next revolutions to a straight forward bulldozing of the existing centralized, nanny state architecture and still have a functioning civilization left that fits better with the decentralized, non-linear world we’re now residing in.

Following on this theme, my next piece covers The New Rules of The Non-Linear World, hop on the mailing list to get that when it drops.

* * *

My forthcoming ebook The CBDC Survival Guide will give you the tools and the knowledge to navigate coming era of Monetary Apartheid. Bombthrower subscribers will get free when it drops, sign up today.

Tyler Durden

Mon, 01/29/2024 – 15:00

via ZeroHedge News https://ift.tt/MIJPaC7 Tyler Durden