EU Miraculously Avoids Recession In Q4 As Spain’s Gain Offset Germany’s Drain

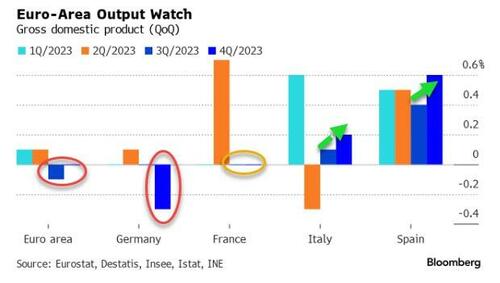

After Q3’s 0.1% decline, the euro-zone was expected to see a similar economic growth (contraction) of -0.1% in Q4, crystallizing the ‘technical’ recession, giving The ECB the ‘all-clear’ for rate-cuts.

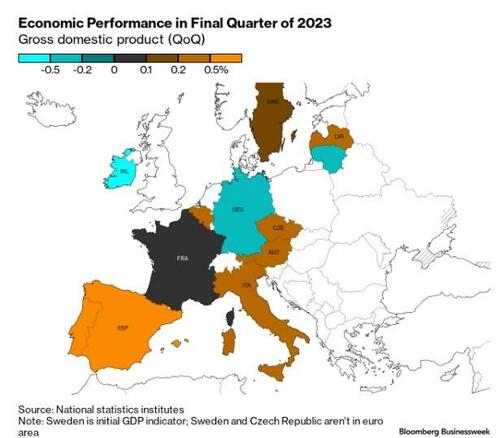

But thanks to surprising gains in Spain (and an improvement in Italy) – which offset Germany’s ugliness and France’s stagnation – the Eurozone economy was unchanged in Q4, technically – and miraculously – avoiding recession.

Spain’s gains,however, had a double-edged sword as Spain’s statistics office also said higher electricity prices, reflecting a phasing out of tax breaks, caused inflation to unexpectedly pick up from 3.3 per cent in December in January to 3.5 per cent. Economists had expected a slowdown to 3.1 per cent.

Germany was joined by Ireland and Lithuania in economic contraction in Q4…

That left the bloc trailing the US, which last week established itself as the world’s fastest-growing advanced economy in 2023 with annual growth of 3.1%.

China’s government recently estimated its economy grew 5.2%last year.

“Europe is still recovering from a lingering energy shock and has not experienced the same degree of fiscal stimulus as the more resilient US economy in recent years,” said Nicola Mai, a sovereign credit analyst at investor Pimco.

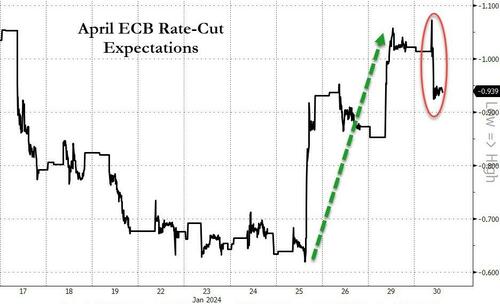

Finally, this surprise non-recessionary print prompted traders to modestly reduce the odds of a rate-cut in April…

…but, as is clear, expectations are still very high for Lagarde and her pals to pull the trigger – even she keeps telling the market that they’re not ready (until the summer). Forward-looking service indicators signal “a pickup in further growth ahead,” she said.

But, governments are withdrawing many of the energy and food subsidies they introduced to cushion the impact of the recent surge in the cost of living that followed Russia’s full-scale invasion of Ukraine, which could weigh on any rebound.

Tyler Durden

Tue, 01/30/2024 – 09:30

via ZeroHedge News https://ift.tt/3ZBRnTy Tyler Durden