“Path To Profitability”: GM Shares Soar As Higher Profits Forecasted For 2024

Shares of General Motors jumped 7% in premarket trading in New York after the Detroit automaker reported forecast adjusted earnings per share for 2024 that exceeded the average analyst estimate on Wall Street and fourth-quarter EPS and net sales that beat consensus estimates.

GM reported Tuesday that adjusted earnings before interest and taxes for fiscal 2023 reached $12.4 billion, at the high end of the automaker’s November forecast of up to $12.7 billion. In the current year, it sees adjusted EBIT between $12-14 billion, which nearly eclipses 2022’s record $14.5 billion.

“Consensus is growing that the US economy, the job market and auto sales will continue to be resilient,” Chief Executive Officer Mary Barra told investors in a statement. She noted that GM expects industry-wide auto sales for the US to top 16 million vehicles “with the mix of EVs continuing to grow.” And that figure is up from 15.5 million cars last year.

Four-quarter adjusted profits were $1.24 per share, beating Wall Street estimates of $1.16. However, this was below $2.12 per share compared with the same quarter a year ago and $2.28 per share in the third quarter, primarily because of factory shutdowns in the fall period following the 1.5-month auto union strike.

Here’s a brief overview of GM’s fourth-quarter results (list courtesy of Bloomberg):

-

Adjusted EPS $1.24 vs. $2.12 y/y, estimate $1.16

-

Net sales and rev. $42.98 billion, estimate $39.53 billion

-

Cruise net sales and revenue $25 million vs. $25 million y/y, estimate $26.8 million

-

Automotive net sales and revenue $39.26 billion, -1.4% y/y, estimate $36.19 billion

-

GM Financial net sales and revenue $3.74 billion, +14% y/y, estimate $3.49 billion

-

North America adjusted Ebit $2.01 billion, -45% y/y, estimate $2.09 billion

-

International operations adjusted Ebit $269 million, -1.1% y/y, estimate $338.3 million

-

GM financial adjusted EBT $707 million, -8.8% y/y

-

Adjusted automotive free cash flow $1.34 billion, -70% y/y

-

GMNA vehicle sales 782,000 units, -0.6% y/y, estimate 697,577

-

GMI vehicle sales 161,000 units, -11% y/y, estimate 211,339

-

Adjusted Ebit $1.76 billion, estimate $1.87 billion

For fiscal 2024, GM guides well above the Bloomberg Consensus as it forecasts stronger profits:

-

Sees adjusted EPS $8.50 to $9.50, estimate $7.70 (Bloomberg Consensus)

-

Sees adjusted auto free cash flow $8 billion to $10 billion

-

Sees adjusted Ebit $12 billion to $14 billion, estimate $10.96 billion

-

Sees net income $9.8 billion to $11.2 billion, estimate $9.17 billion

As for profitability, GM’s core petrol-burning vehicle business was stable last year, but the company stumbled to achieve profitability in its electric and driverless cars segments.

Barra noted in the letter: “It’s true the pace of EV growth has slowed, which has created some uncertainty.” However, she said: “We believe our competitive position will improve throughout the year, based on higher production” of core models.

Financial Officer Paul Jacobson told investors the automaker’s bottom line on the EV segment will likely improve this year as the company introduces new models and scales factory production.

“What we don’t want to do is get into a position where we’re so focused on ramping up production that we’re not thinking about where the consumer is,” Jacobson said. “But so far, when you look across our models, we feel good at the way that they’re being received.”

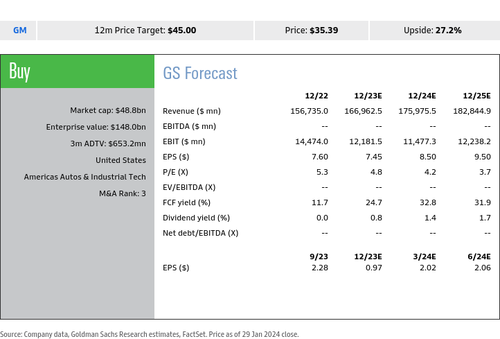

Goldman told clients this morning: “We expect the EV ramp and path to profitability, its 2024 outlook and the industry backdrop/cycle, margins/cost reductions, capital allocation, and Cruise to be focus areas on the call.”

Separate from earnings, auto dealers recently warned GM this week that customers are hesitant to purchase EVs and search for a “middle ground between conventional gas-engine cars and EVs,” such as hybrids.

Tyler Durden

Tue, 01/30/2024 – 09:45

via ZeroHedge News https://ift.tt/G15QEkD Tyler Durden