Authored by Brandon Smith via Alt-Market.us,

If you want to know if a society is on the verge of great and tumultuous change you need to ask two very important questions – Are the people angry? And, are the people hungry?

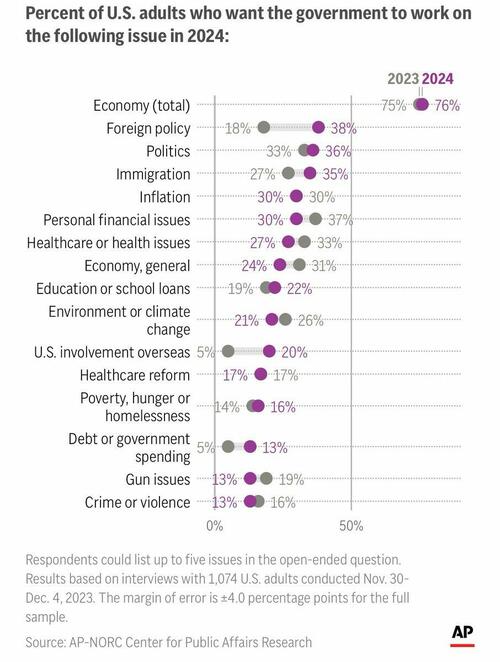

In the US (and in many parts of Europe) the people are indeed very angry, for different reasons depending on their political affiliations.

On the other hand, they aren’t hungry, at least not to the extent that they are desperate.

This could very well change in 2024 given the confluence of events that are swirling as we enter the new year.

I continue to see 2024 as a nexus point of our era for a number of reasons. The globalist timeline for their “Great Reset” mentions 2030 as the prime year for total centralization. This is the year they plan to put their carbon controls in place, remove most oil and gas energy, bring in their digital currency framework, finalize their 15 Minute City programs, establish the IMF and BIS as the overseers of the global CBDC structure, launch their cashless society and integrate ESG related goals into every aspect of the economy.

2030 is only six years away, and that’s a lot to accomplish in such short amount of time. The globalists are going to have to either admit failure and change their timeline, or, create a substantial crisis in the near term to facilitate the Reset. But before I get too far into the potential ugliness waiting in the next year, lets talk about two of the biggest positive developments for 2024…

The Good…

The Defeat Of The Covid Agenda

I don’t think many people understand how epic and important the battle over covid lockdowns and vaccine passports actually was. The western world was on the verge of complete authoritarianism – Not a totalitarian tip-toe like we have been experiencing for many years, but full bore medical dictatorship and mass censorship. I believe covid WAS the Plan A attempt to create reset conditions, and it failed.

If the establishment had achieved their goal of vaccine passports the fight for freedom would be over. The passports would have made economic participation impossible for anyone that did not submit to the agenda, creating a secondary class of citizens (mostly conservative) that could then be targeted for systematic elimination.

Luckily, enough people stood up and refused to comply that the plan was derailed. Apparently, the establishment realized there were far too many patriots willing to take up arms and fight if they kept pushing the covid farce. Remember that bizarre moment when most of the covid propaganda simply stopped? Like someone flipped a switch and the media changed narratives overnight?

I remember, and this event was the ultimate vindication for all of us in the anti-mandate movement. All the fear, all the dread, all the doom mongering over “millions of deaths”, it all meant nothing and they proved that the moment they shut down the hype machine and everything immediately went back to normal.

The Public Is Fed Up With The Woke Cult

It took longer than it should have, mainly because too many people refused to believe that the conspiracy was real, but the woke cult has finally crossed the line enough times for the general public to get fed up. The activist insurgency has violated every boundary of decency and truth and they have alienated a large contingent of the population. Their time is quickly coming to an end.

Signs include the ongoing collapse of woke media giants like Disney, the successful boycotts of products like Bud Light and companies like Target. But if you know how to read social trends you can see more subtle signs. There is a growing disdain for third-wave feminism, LGBT cultism and the insane trans movement. People are less afraid to ridicule SJWs, less afraid of cancel culture and more willing to criticize their delusions.

This is what happens when you target children with sexualized indoctrination and you argue against biological reality. This is what happens when you try to force people to embrace and normalize mental illness. This is what happens when you spend years trying to control people’s speech with “neo-pronouns” and terrorize the internet with cancel culture. This is what happens when you invade every corner of pop-culture and try to hijack it or sabotage it through propaganda. This is what happens when you declare war on traditional western values – Everyone starts to hate you and eventually they will organize to kick your ass.

The only thing keeping the woke movement afloat at the moment is their alliance with corporations and the establishment media. Globalist think tanks still spend billions of dollars funding social justice programs and the current government provides cover for the exploits of far-left zealots. Without the elites, the woke ideology would not exist. Millions of Americans are ready to snuff it out for good.

The Bad And The Ugly…

Election 2024

As I have mentioned in past articles, I still believe there might not be a presidential election in November. Though, current conditions would allow for one as long as nothing changes dramatically in the next several months. There hasn’t been this level of national division over an election since the Civil War and regardless of what happens or which side “wins” there will be a high potential for a violent reaction.

The election of 2024 is developing into its own Black Swan event. Any indication that Donald Trump will be arrested before November or any widespread blue state plans to remove him from the ballot will be seen as election interference and I have no doubt that many Americans will seriously consider armed revolt.

Then again, Trump’s mere presence as a candidate will be used by far-left groups as a rationale to stoke riots. His re-entry into the Oval Office would mean endless mob actions and perhaps even terrorist attacks. So, in this regard it doesn’t really matter if we end up with Biden or Trump, the eventual outcome will probably be the same – Civil unrest followed by a declaration of martial law in the next couple of years.

My position on Trump has always been one of skepticism, primarily due to his terrible cabinet choices (including Anthony Fauci). However, I recognize that after four horrendous years of Joe Biden’s woke authoritarian empire there is no way that half the country is going to tolerate another term, especially if that term is achieved through perceived sabotage.

Then there is the potential for shock events, such as Biden stepping down at the last minute. Trump being arrested but winning anyway. Or, a major geopolitical crisis which is used by the Democrats as an excuse to “postpone” the election. And make no mistake, there are many of these triggers in place today.

Geopolitical Tensions Soaring

The potential for war on multiple fronts, including Ukraine, Israel, and perhaps Taiwan is extraordinary in 2024. For now, I am focused on Israel’s conflict in Gaza and the chances of retaliation from surrounding Islamic states. As I’ve mentioned in previous articles, Gaza has no chance whatsoever of stopping Israel militarily and they never did, but that’s not really relevant. What matters is how their neighbors respond.

Lebanon and Hezbollah appear poised to commit to war on Israel in the near term, but Iran is the big question mark. Would they openly engage the Israelis? Such a move would completely destabilize all of the Middle East, disrupt a massive portion of the world’s oil supply and probably draw the US and Europe into the fray.

The biggest threat, for now, is the shutting down of shipping lanes through the Red Sea and the Strait of Hormuz. This could disrupt supply chains and energy resources for many months and accelerate the economic crisis. And, this could in turn be used by the establishment as a rationale to put boots on the ground in the region.

Economic Powderkeg

The economic situation is far more distressed than international relations, believe it or not. There is a precarious game being played by the Federal Reserve with US debt and interest rates, culminating in a Catch-22 that I have been warning about for years.

Some analysts argue that the Fed is about to cut rates in 2024 (I remain doubtful); but if they do, get ready for an immediate and renewed spike in inflation. If they don’t commit to substantial rate cuts then the national debt will continue climbing by around $600 billion per month (around $7 trillion a year). This is unsustainable and it threatens the world reserve status of the dollar.

If the Fed’s intent is to influence elections (again, I highly doubt this), then they aren’t going to be helping Joe Biden much by cutting rates. Biden is already known as the inflation president; creating another ramp in CPI by the end of 2024 would be a disaster for his campaign. And, keeping Biden in office would only further cement public outrage over socialist policies as the economy continues to dive into either stagflationary crisis or deflationary depression depending on which path the central bank chooses.

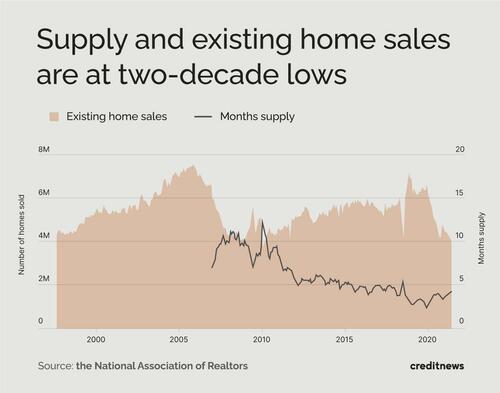

And remember, the 30%-plus price increase we have seen across the board on necessities in the past few years is going to remain in place for quite some time. It doesn’t matter what the Fed does, you are going to continue paying 30% more to survive compared to 2019-2020, and for many people this is swiftly killing their standard of living. This is why no one takes “Bidenomics” seriously – Until they see a return to cost normalcy it doesn’t matter what kind of spin Biden places on jobs numbers or CPI.

Nobody cares.

Catch-22

I suspect the Fed will continue down the path of deflation. They might try to cut rates once or twice, but when CPI jumps they will go right back to higher rates and tighter credit. This is exactly what they did in the 1970s and early 1980s, though, the US wasn’t adding $600 billion in debt every month during that particular crisis.

How this deflation translates will depend on other factors including geopolitical factors (as mentioned above). I predict we are about to see an aggressive resurgence of unemployment by the end of the year. Americans are not buying more, they are merely spending MORE for the same amount of stuff. The stagflationary process always leads to a painful decline in overall consumption and standard of living – We had our three-year boost due to covid helicopter money, and now that boost is fading. Any action by the Fed on rates at this point will not help retail or the service sector, it will only serve to keep stock markets afloat a little longer.

Again, the end result is the same no matter what the central bankers do, and this is by design. If the US elections play into the establishment’s plans at all, I suspect it would be more in line with the optics of a renewed Trump presidency. It might serve globalist interests more to keep the system intact, not to protect Biden but in preparation for Trump’s return, only to collapse the entire house of cards once he enters office (or even right after he wins). Setting up conservatives as scapegoats for full spectrum economic crisis makes a lot more sense than trying to maintain the facade for Biden for another four years.

If the globalists fail to set the stage for the Reset in 2024, then they may be facing a mounting movement to bring them to justice. The juggling act is about to come to an end.

* * *

If you would like to support the work that Alt-Market does while also receiving content on advanced tactics for defeating the globalist agenda, subscribe to our exclusive newsletter The Wild Bunch Dispatch. Learn more about it HERE.