The US Is Living On Borrowed Time

Authored by Matthew Piepenburg via VonGreyerz.gold,

In late December, I published a final report on the themes of 2023 while looking ahead at their implications for the year to come.

I repeated my claim that debt markets and debt levels made the future of Fed policies, currency moves, rate markets and gold’s endgame fairly clear to see.

Of course, as facts change, opinions change as well.

But the facts are only worsening, which means my opinions in late 2023 are only growing stronger as we conclude the first month of 2024.

Then as now, the debt-soaked US is tilting ever more toward policies which will weaken its currency, wound its middleclass and reward its false idols (and false markets) with even greater desperation.

In particular, some recent facts below are emerging which further support my otherwise sad conviction that the American economy (not to be confused with its Fed-supported stock exchanges) is literally living on borrowed time.

The Latest Bits of Crazy from the CBO

Almost a year ago to date, I was shaking my head and rubbing my eyes as the Congressional Budget Office (CBO) announced a staggering $422B Federal budget deficit for Q1 2023.

Now that’s a lot of borrowing in a short amount of time…

For some strange reason, this bothered me in early 2023, as I was still under this odd impression that debt, and hence deficits, actually mattered.

Fast forward to January 2024, and that same CBO has just announced a $509B Federal budget deficit for Q1 2024.

Folks, that adds up to annual deficit run rate of $2.2T.

Please: Re-read that last line again.

Do the Math: DC is Getting Even Dumber

In this 12-month interim, fiscal revenues did increase by about 8%, but outlays (i.e., expenses) for that same period rose by 12%, which is just a mathematical way of saying that either: 1) Uncle Sam is out of his mind in debt; or 2) that I am out of my mind in common sense.

But it seems I’m not the alone in saying out loud what no one DC can say to themselves, namely: The US is now in an open and obvious debt spiral.

Uncle Sam’s embarrassing bar tab of debt is now racing at a rate that far exceeds his GDP, pushing the deficit to GDP ratio toward 8% and higher–ratios we’ve never seen except during the GFC of 2008 and the “COVID” (i.e., hidden bond) crisis of 2020.

From Debt Spiral to Super QE

If recent memory serves me correctly, in both of those embarrassing years (and ratios), what followed was QE to the moon and the ongoing fantasy that every debt problem can be solved with trillions of fiat dollars mouse-clicked out of thin air.

And this time around will likely be no different, as I and others like Luke Gromen have been warning week after week, and month after month.

Such warnings, which NO ONE can time, are not merely bearish “opinions” and don’t require a crystal ball or sensational guessing.

They just require a calculator and a basic understanding of history.

Simple Math

As to basic math, one can have their own opinions but not their own facts, and the facts (i.e., math) tell us that the current cost of servicing the aforementioned debt is 16% of Federal tax receipts.

Again: Please re-read that last line. It matters, because, well…debt destroys nations.

Nor am I alone in this sober understanding.

As the former head of European block trading at Goldman Sachs, Alex Harfouche, just warned, these sickening debt ratios mean the US economy’s ability to shoulder such debt is both “horrible” and “crippling.”

Which means we all know (or should know) what’s coming next.

The Patterns of the Foolish

As in 2008 and 2020, we can now see a pattern playing out in 2024, namely an inevitable shift from rate hikes and pauses toward rate cuts and the inevitable shift from QT to QE.

Why inevitable?

Because stupidity combined with a Will to Power that would make Nietzsche blush are the profile traits of nearly all math-ignorant but ego-savvy policy makers seeking re-election or a Nobel Prize in Economics (fiction?).

That is, and especially in an election year, policy makers will not cut spending but increase it in a desperate bid to bribe the gullible masses into a Pavlovian voting pattern based on generations of political over-promising and grotesque under-delivering.

This political inability to cut entitlement spending makes a US debt spiral (and hence QE to the moon) as foreseeable as the NY Yankees beating my high-school baseball team.

DC Cutting Rates Rather than Spending

Furthermore, since the DC children running our country into the ground won’t cut spending, the only thing they can (and will) cut is interest rates.

Why?

Because cutting rates not only takes pressure off Uncle Sam’s IOUs (USTs), but also eases the pain of those complicit S&P zombies staring down the barrel of over $740B in debt rollovers in 2024.

Main Street Screwed Again

Remember: The Fed serves TBTF banks and exchanges, not citizens and their realities.

Interest rate cuts + QE = a further debased USD and rising inflation (with a deflationary recession in the middle).

And this means the voters on Main Street are about to feel the darker side of DC’s real mandate: Covering their own A$$’es while keeping Wall Street on a respirator.

Meanwhile, the masses feel pain, but can’t quite see from where it’s coming, as the media, MMT hucksters and political Ken and Barbies keep telling them that deficits don’t matter.

Deficits Don’t Matter?

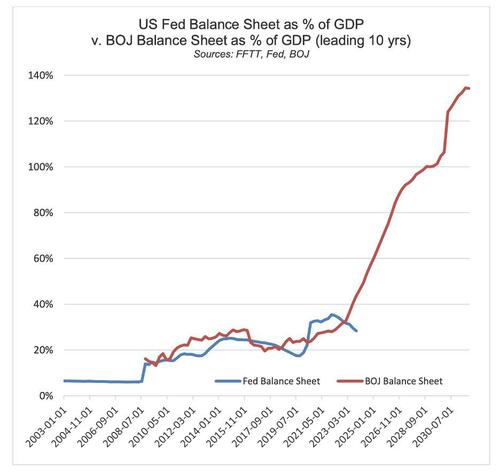

Even worse, there are those sitting in private wealth management suites smugly reminding their clients that Japan is in much worse debt (see below) than Uncle Sam, and if Japan can muddle through, certainly the US has nothing to fear.

But as I recently reminded the attendees at the Vancouver Resource Investment Conference, Japan does not have twin deficits, a negative 65% Net International Investment Position nor an externally financed bond market.

In short: Japan aint America. But even if it were, it’s nothing of which to boast…

Whistling Past the Debt Graveyard with More Spending

Like Luke Gromen, I am of the sober and math-based view that unless the US cuts entitlement and defense spending by 40% (unthinkable in an election year and a world of beating [US?] war drums almost everywhere), such austerity is about as likely as an honest man in Congress…

Failing such needed cuts and sound budget honesty, policy makers will merely whistle past another year of multi-trillion deficit levels and pass the bill on to current and future generations while inflating their way out of debt with more of the debased money in your pockets.

As I’ve written before, this is no surprise. In fact, it was the plan all along, despite Powell’s efforts to pretend otherwise.

Keep It Simple: Powell Will Pivot

Debtors, including Uncle Sam, need inflation and need a debased currency.

They need negative real rates whereby inflation outpaces the yield on 10Y bonds.

Powell, of course, tried pushing real rates to a positive 2% to allegedly “fight inflation,” but, and as in 2018-19, the net result was that he simply broke nearly everything but the USD in the process.

In fact, Powell was merely raising rates and thinning the Fed balance sheet so that he’d have something (anything) to cut (rates) and fatten (balance sheet) when the recession that his higher-for-longer policies ushered in (and then denied) became too impossible to ignore.

Or stated more bluntly: His recent QT was a planned precursor to more QE, and his recent rate hikes were a planned precursor to more rate cuts.

Keep It Simple: A Future of Debased Currency

Thus, and long before hitting “target 2%,” Powell will once again throw in the towel in 2024 on rate hikes for the simple reason that Uncle Sam can’t afford them.

Or stated (and repeated) more simply, his “war on inflation,” waged in the last 2 years, will ultimately (and ironically) end in even greater inflation.

Ahhh the ironies. Or better yet: “The horror, the horror…”

History confirms this pattern in one debt-failed nation after the next.

In fact, and without exception, currencies are always sacrificed to save a broken regime. And folks, our regime is objectively broke(n).

Thus, for those who know the math (above), and the history of yesterday, preparing for tomorrow is simple.

Projected rate cuts (and the scent of more synthetic liquidity) can and (already have) sent inflated risk assets higher as the inherent purchasing power of the currency gets weaker.

Keep It Simple: Natural Gold vs. An Un-Natural Dollar

This simply means gold, though never marching in a straight line, will reach higher highs and lower lows for no other reason than paper currencies like the USD will get more debased.

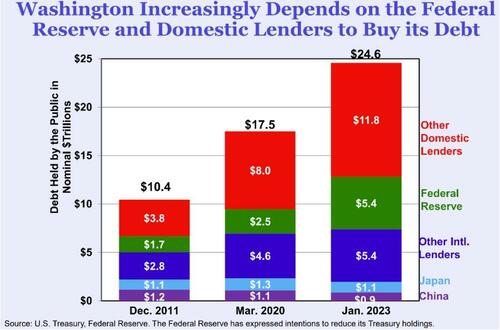

And this is all because the issuance of unloved sovereign USTs will become greater and greater, as the opening data from the CBO in Q1 now makes factually clear.

Soon the Fed will run out of tricks within Treasury General Account (Yellen’s game) and the Reverse Repo Markets to generate fake liquidity for those over-supplied and under-demanded USTs.

And this means Powell will once again crank out the money printers at the Eccles Building to “buy” those IOUs.

Fortunately, Powell has no machine in DC to produce physical gold, which means this natural precious metal of unlimited duration yet finite supply will rise, while USTs, an unnatural asset of finite duration yet infinite supply, will continue to sink.

It’s just that simple.

Tyler Durden

Thu, 02/01/2024 – 06:30

via ZeroHedge News https://ift.tt/e28Z0My Tyler Durden