Treasuries May Look Past Non-Farm Payrolls To Powell’s Interview

Authored by Ven Ram, Bloomberg cross-asset strategist,

The non-farm payrolls data for January is unlikely to move the needle much for the rates markets so long as the narrative of economic resilience remains intact.

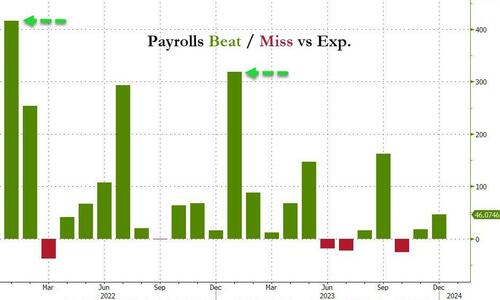

The labor market has traditionally fared well in the first month of the year, with the actual headline number coming in way higher that forecast over the past two January iterations.

A better-than-forecast reading today won’t tell the Fed anything that it doesn’t already know about the strength of the labor market.

The jobless rate has been close to historical lows at 3.7% and a marginal uptick to that number, in line with the forecast, isn’t exactly going to bring the labor market back into balance immediately.

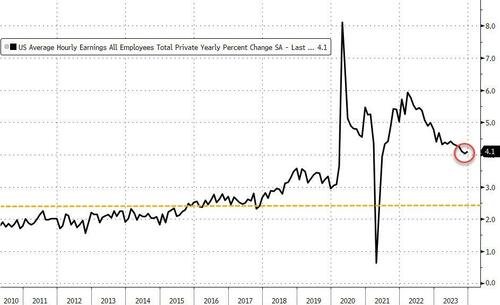

Hourly wage earnings are still growing at a 4%+ clip, which is largely incongruent with the Fed’s overall inflation target.

That is perhaps one reason why Chair Jerome Powell suggested earlier this week that policymakers are “looking for more good data on inflation” and need continued evidence price pressures are waning.

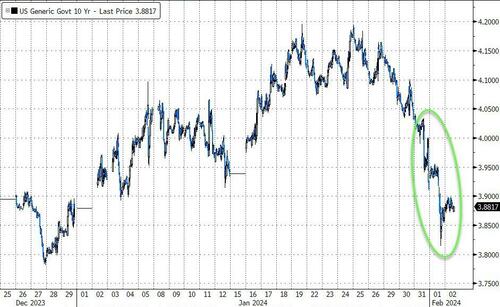

Absent a shocker from today’s jobs report, Treasuries may decide to march to a drumbeat that has been dictated by concerns about the health of the banking industry.

The bid tone has also been pronounced ahead of Powell’s upcoming TV interview over the weekend, where, as colleague Mark Cranfield points out, the chatter seems to be focused on the Chair using the opportunity to persuade wavering voters within the FOMC that it is time for a rate cut.

Tyler Durden

Fri, 02/02/2024 – 08:10

via ZeroHedge News https://ift.tt/d9VW2Bx Tyler Durden