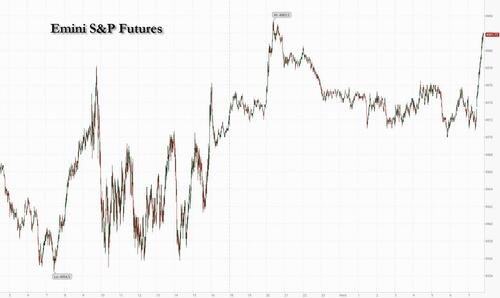

Futures Rebound To Session High After NY Community Bank Reverses Overnight Rout; Record 10Y Auction Looms

US equity futures and global markets were mixed, while bond yields rose as the Treasury prepared to auction a record $42 billion in 10-year bonds that may indicate if a recent selloff was overdone. As of 7:50am ET, S&P futures rose 0.2%, reversing earlier losses and trading near session highs…

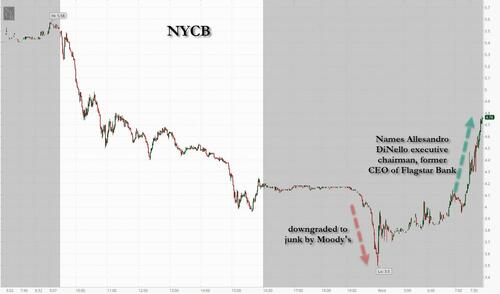

… trading in lock step with sentiment surrounding the latest troubled regional bank, NY Community Bancorp, which tumbled by 16% overnight to the lowest since 1997 after it was downgraded to junk before rebounding more than 10% after announcing it hired Flagstar bank’s Alessandro Dinello as executive chairman.

In premarket trading, Ford rallied 6% after reporting fourth quarter results that soundly beat expectations and forecast higher profits in 2024. Other automakers are up: General Motors (GM) +1%, Stellantis (STLA) +2%. Snap crashed 30% after yet another terrible company in which the parent company of the Snapchat app reported disappointing revenue in the holiday quarter. Pinterest (PINS) falls in sympathy, -4%. Here are some other notable premarket movers:

- Cognizant Technology (CTSH) falls 7% after the IT services company gave an outlook that analysts say reflects a weak backdrop.

- Enphase Energy (ENPH) jumps 13% as investors look past disappointing fourth-quarter revenue and toward a recovery post first-quarter 2024 in Europe and the US, excluding California.

- FuboTV (FUBO) tumbles 15% after Fox, Warner Bros. Discovery and Walt Disney’s ESPN announced plans to launch a sports-focused streaming service that will feature college and pro games.

- Ford (F) rises 6% after reporting fourth quarter results that soundly beat expectations and forecast higher profits in 2024.

- Other automakers are up: General Motors (GM) +1%, Stellantis (STLA) +2%

- Fortinet (FTNT) climbs 9% after the cybersecurity company reported stronger-than-expected fourth-quarter billings.

- Perion (PERI) tumbles 11% after the advertising technology company’s full-year projections for revenue trailed the average analyst estimates.

- Sonos (SONO) jumps 10% after the audio products company’s earnings beat the projections of analysts.

- Triumph Group (TGI) slides 22% after the maker of aircraft components lowered its projections for net sales and operating income for its fiscal year.

- VF Corp (VFC) slumps 10% after the owner of Vans reported third-quarter adjusted earnings per share that missed estimates.

- WestRock (WRK) climbs 5% after analysts see upside potential ahead of a merger with Irish paper and packaging firm Smurfit.

- Yum China (YUMC) soars 14% after the fast-food restaurant owner and operator reported fourth-quarter comparable sales that beat estimates. Jefferies viewed the increase to dividend per share as a “nice positive surprise.”

US Treasury yields rose ahead of the sale on Wednesday, with the 10-year yield hovering around 4.10%. The latest auction comes after a sale of three—year notes saw stronger-than-expected demand. Treasuries steadied after strong economic data triggered a two-day slump and market bets on the speed of Fed rate cuts were dialed back. Central bank officials kept to their cautious tone on Tuesday, indicating that more progress is needed on inflation though rate reductions may be possible later in the year.

“The sale should go well given the sizable yield concession that has been factored in following the selloff,” said Marc Ostwald, chief economist & global strategist at ADM Investor Services Int. Ltd. “It would only impact markets if the take-up is weak. Central bank speakers are very much in focus.”

European stocks and US futures trade in narrow ranges as investors wait for the next batch of Fed speakers later on Wednesday. Auto shares outperformed in Europe as Ford rallies ~6% in the premarket after 4Q profit topped estimates. Meanwhile, shares of European lenders including Deutsche Bank declined on Wednesday amid renewed fears over exposure to the commercial real estate market. The Stoxx 600 Banks Index slipped 0.7%, underperforming the broader market, with declines led by Deutsche Bank, Bawag, Intesa Sanpaolo and Commerzbank. State-owned German lender Deutsche Pfandbriefbank also fell, extending Tuesday’s slump. German banking regulator BaFin said Wednesday that it is monitoring turmoil in the commercial real estate market, while Deutsche Pfandbriefbank, or PBB, said in a statement today that it increased risk provisioning in 4Q in light of persistent weakness of real estate markets. Bonds in PBB and some other real estate-focused German lenders have been slumping this week after Bloomberg reported that Morgan Stanley analysts recommended clients sell senior bonds issued by PBB because of its exposure to the CRE market in the US.

Earlier in the session, the Asian rally slowed as Hong Kong shares dipped amid doubts over the potency of Beijing’s measures to stabilize the market. Volatility is likely to be elevated as Chinese markets are closed for a weeklong Lunar New Year holiday starting Friday. The MSCI Asia Pacific Index rose as much as 0.9% to the highest level since Jan. 2, as traders ignored cautious remarks from a number of Federal Reserve officials. Toyota, AIA Group and Samsung were among the biggest contributors as the regional benchmark advanced for a second day. Key gauges rose more than 1% in South Korea, Singapore and the Philippines.

- Hang Seng and Shanghai Comp were mixed despite early momentum following the latest support efforts from China which were targeted at real estate financing and new energy vehicles. Nonetheless, Chinese stocks gradually faded some of their initial gains and the Hong Kong benchmark ultimately turned negative.

- Nikkei 225 was indecisive amid a slew of earnings and with the BoJ reportedly on track for a policy shift by April.

- ASX 200 gained with the index led by outperformance in mining and property sectors amid lower yields.

- Indian stocks experienced a bout of volatility after opening higher with lenders rallying while technology stocks dragged. Paytm surged 10% in its second day of recovery, while Adani Green ended 8.4% higher, after briefly erasing all its losses since the Hindenburg report. The S&P BSE Sensex index closed little changed at 72,152.00, while the NSE Nifty 50 Index was also steady at 21,930.50. The regional trend was overwhelmingly higher.

In FX, the Bloomberg Dollar Spot Index drifted as the market awaited fresh trading impetus from Fed speakers. The Kiwi dollar led gains against the greenback, while the franc and yen fell. The term structure in USD/JPY shows relatively low demand for long-gamma exposure in the front-end, which picks up when the two-month tenor comes in, as that captures the BOJ and Fed March meetings.

In rates, US Treasuries traded lower ahead of the sale on Wednesday, with the 10-year yield rising to 4.12%. Gilts are nursing larger declines after the BOE’s Breeden signaled she’s likely to wait before cutting rates. Her comments also look to have helped the pound, which is the best performer among the G-10 currencies, rising 0.3% versus the greenback.

In commodities, oil prices advance, with WTI rising 0.6% to trade near $73.80 after two days of gains as geopolitical risk in the Middle East was partially offset by a report showing stockpiles expanding in the US. Spot gold fell 0.1%.

Looking to the the day ahead now, European data releases include German industrial production and Italian retail sales for December, while in the US we get the trade balance for December. From central banks, we’ll hear from the Fed’s Harker, Kugler, Collins, Barkin and Bowman, as well as BoE Deputy Governor Breeden and the ECB’s Muller. Finally, earnings releases include PayPal, Walt Disney and Uber.

Market Snapshot

- S&P 500 futures little changed at 4,975.25

- STOXX Europe 600 little changed at 486.42

- MXAP up 0.4% to 168.08

- MXAPJ up 0.4% to 514.41

- Nikkei down 0.1% to 36,119.92

- Topix up 0.4% to 2,549.95

- Hang Seng Index down 0.3% to 16,081.89

- Shanghai Composite up 1.4% to 2,829.70

- Sensex little changed at 72,164.41

- Australia S&P/ASX 200 up 0.5% to 7,615.84

- Kospi up 1.3% to 2,609.58

- German 10Y yield down 1 bp at 2.28%

- Euro up 0.1% to $1.0769

- Brent Futures up 0.6% to $79.10/bbl

- Gold spot down 0.1% to $2,034.59

- U.S. Dollar Index down 0.16% to 104.04

Top Overnight News

- Stocks and bonds fluctuated as the US Treasury prepared to auction a record $42 billion in 10-year bonds that may indicate if a recent selloff was overdone.

- Losses in the commercial property market, which have already sent some banks in New York and Japan into a tailspin, moved to Europe’s biggest economy this week.

- Treasury Secretary Janet Yellen said that while losses in commercial real estate are a worry, US regulators are working to ensure that loan-loss reserves and liquidity levels in the financial system are adequate to cope.

- Recent economic figures and aggressive market bets on rapid interest-rate cuts mean the European Central Bank should be patient before loosening borrowing costs, according to Executive Board member Isabel Schnabel.

A more detailed look at global markets courtesy of Newsquawk

Asia-Pacific stocks were mostly positive after a decline in global yields and further Chinese support efforts. ASX 200 gained with the index led by outperformance in mining and property sectors amid lower yields. Nikkei 225 was indecisive amid a slew of earnings and with the BoJ reportedly on track for a policy shift by April. Hang Seng and Shanghai Comp were mixed despite early momentum following the latest support efforts from China which were targeted at real estate financing and new energy vehicles. Nonetheless, Chinese stocks gradually faded some of their initial gains and the Hong Kong benchmark ultimately turned negative.

Top Asian News

- China’s MOFCOM issued guidelines to support the new energy vehicle industry and will optimise credit support for the NEV sector, as well as improve management for exports. MOFCOM encourages NEV firms to set up R&D centres overseas and will optimise export procedures for NEVs and batteries, while it will guide banks to provide domestic and overseas financial services for the NEV supply chain.

European equities are generally lower and have been edging lower since the open; the FTSE MIB remains firmer with banks assisted by gains in BMPS (+5.6%). European sectors are mixed; Autos hold the top spot, with several names benefitting from strong Ford (+6%) earnings after-hours. Meanwhile, China’s MOFCOM has issued guidelines to support the EV industry. Optimised Personal Care is hampered by Sainsbury’s (-3.6%) after its trading update. US equity futures (ES U/C, NQ +0.1%, RTY -0.5%) meander the unchanged mark, with underperformance in the Russell and investors jittery after Moody’s downgraded New York Community Bancorp (-9.3% pre-market) to junk status of Ba2.

Top European News

- UK may have narrowly slipped into a technical recession at the end of 2023, according to NIESR estimates cited by FT.

- UK will wave through animal products from the EU without checks under a contingency plan if there are capacity issues as ports, according to documents cited by FT.

- ECB’s Schnabel said lower borrowing costs risk flare-up of inflation and that the last mile in bringing down inflation could be the most difficult one. Schnabel also noted that commercial lenders are reducing borrowing rates on mortgages in expectation the ECB will start cutting interest rates soon and that if demand is held back by restrictive monetary policy, it will be much harder for firms to pass through higher costs to consumers, according to FT.

- BoE’s Breeden says she has become less concerned that rates might need to be tightened further; focus shifted to how long rates need to remain at their current level

Earnings

- Ford Motor Co (F) Q4 2023 (USD): Adj. EPS 0.29 (exp. 0.14), Revenue 46bln (exp. 40.12bln); declares Q1 regular dividend of 0.15/shr and supplemental dividend of 0.18/shr. KEY METRICS: Ford Blue revenue 26.2bln (exp. 24.52bln). Ford Model E revenue 1.6bln (exp. 1.91bln). Ford Pro revenue 15.4bln (exp. 13.86bln). Adj. EBIT 1.1bln (exp. 997.4mln). FY24 GUIDANCE: Adj. EBIT 10-12bln (exp. 9.24bln). Ford Pro EBIT at least 8-9bln (exp. 7.05bln). Ford Blue Ebit 7-7.5bln (exp. 6.34bln). (Newswires) Shares +6.1% in pre-market trade

- Gilead Sciences Inc (GILD) – Q4 2023 (USD): Adj. EPS 1.72 (exp. 1.76), Revenue 7.12bln (exp. 7.10bln). Sees FY adj. EPS USD 6.85-7.25 (exp. 7.21). Sees FY total product sales 27.10bln-27.50bln (exp. 27.66bln). (Newswires) Shares -1.7% in pre-market trade

- Snap Inc (SNAP) – Q4 2023 (USD): Adj. EPS 0.08 (exp. 0.06), Revenue 1.36bln (exp. 1.38bln). KEY METRICS: Adj. EBITDA 159.1mln (exp. 111.8mln). DAUs 414mln (exp. 411.59mln). ARPU 3.29 (exp. 3.33). GUIDANCE: Q1 revenue 1.10-1.14bln (exp. 1.11bln). Q1 adj. EBITDA loss 55-95mln (exp. loss 32.7mln). Q1 DAUs 420mln (exp. 418.55mln). COMMENTARY: “While we are encouraged by the progress we are making with our ad platform and the improved results we are delivering for many of our advertising partners, we estimate that the onset of the conflict in the Middle East was a headwind to year-over-year growth of approximately 2 percentage points in Q4.” (Newswires) Shares -30.7% in pre-market trade

- Siemens Energy (ENR GY) – Q1 (EUR): Net 1.88bln (exp. 813mln, prev. -384mln Y/Y), Revenue 7.65bln (exp. 7.42bln, prev. 7.06bln Y/Y), Orders 15.4bln +23.9%. Affirms outlook. (Newswires) Shares +0.8% in European trade

- TotalEnergies (TTE FP) – Q4 (USD) adj. net 5.23bln (exp. 5.66bln), adj. EBITDA 11.69bln (exp. 11.66bln). Final dividend of 0.79/shr. Plans a USD 2bln share buyback in Q1, which will remain the base level for quarterly buybacks in the current environment. Shares -2.2% in European trade

- BMPS (BMPS IM) – Q4 (EUR): Net 1.12bln (exp. 340mln), Revenue 993mln (exp. 953mln), Resumes dividend first time in 13 years. CET1 Ratio 18.1% (prev. 15.6% Y/Y). (Newswires) Shares +5.5% in European trade

FX

- Dollar trades within tight parameters of 104.01-16 after yesterday’s pullback from Monday’s 104.60 YTD peak. Sits below its 100DMA at 104.20 with support seen at 104 and Monday’s 103.96 trough.

- EUR is steady against the USD after printing a YTD low of 1.0722 yesterday. Comments from Schnabel suggest that imminent rate cuts are not forthcoming; Upside sees 100DMA at 1.0784.

- GBP managing to eke out modest gains vs. the USD after printing a YTD low on Monday at 1.2519. Interim catalysts for the UK are light ahead of a raft of data next week.

- NZD once again the better performer of the two, this time thanks to stronger-than-expected job metrics overnight. NZD/USD back on a 0.61 handle but needs a more sustained pick-up to reverse the 2024 downtrend.

- PBoC set USD/CNY mid-point at 7.1049 vs exp. 7.1858 (prev. 7.1082).

Fixed Income

- USTs are pivoting the unchanged mark with newsflow slow thus far though banking fears remain in view after NYCB was cut at Moody’s. In a similar fashion to peers, within 110-22+ to 111-21+ WTD bounds; US 10yr due, 3yr was well received.

- Gilts were unreactive to commentary from BoE’s Breeden who said her focus is now on how long to keep rates at current levels, but added little on the timing of easing aside from emphasising the need for more data around pay growth and demand; within WTD levels of 97.71-98.79 with the accompanying 10yr yield yet to reclaim 4.0%.

- Bunds are at the unchanged mark with initial upside stalling a handful of ticks above Tuesday’s 134.55 best and someway shy of the WTD 134.98 peak; EGBs unreactive to soft German Industrial Output; a strong German 2030 outing led to marginal upticks in the complex, but this ultimately proved fleeting.

- UK sells GBP 4bln 3.75% 2027 Gilt: b/c 3.04x (prev. 3.44x), average yield 4.131% (prev. 3.887%) & tail 0.5bps (prev. 0.2bps)

- Germany sells EUR 2.476bln vs exp. EUR 3.0bln 2.40% 2030 Bund: b/c 2.15x (prev. 1.92x), average yield 2.22% (prev. 2.7%) & retention 17.47% (prev. 19.0%)

- Guidance for the Belgium 30yr EUR-denominated syndication at the June 2054 benchmark +7bps.

Commodities

- Crude is firmer but upside remains somewhat limited amid a lack of fresh fundamentals in the mid-week European morning; Brent Apr sits between a USD 78.49-79.04/bbl parameter. Complex ultimately unreactive to reports that Hamas has proposed a 135-day truce which will be in three phases, via Al Arabiya.

- XAU is flat and within a particular narrow USD 5/oz range thus far, largely moving in tandem with the Dollar with traders on standby for a slew of Fed speakers in the European afternoon.

- Base metals are contained in the run-up to the Chinese New Year, but prices have been edging into slightly negative territory in recent trade in tandem with the performance across European equities.

- IEA Executive says seeing delays of oil product deliveries impacting European markets in particular due to Red Sea attacks; global oil markets comfortable with supply with growth from Non-Opec producers and demand not robust due to macroeconomic concerns

- OPEC executive sees global oil demand to grow by 2.2mln bpd this year and to taper to 1.8mln bpd next year, while the executive added to expect 2022-2045 to see incremental additional demand of at least 60mln bpd, according to Reuters.

Geopolitics

- Hamas proposes 45 day phase where remains and bodies will be exchanged; proposes indirect talks with Israel in the first stage to end military operations and restore total calm, in document seen by Reuters.

- Hamas has proposed a 135-day truce which will be in three phases, via Al Arabiya.

- Saudi’s Foreign Ministry said there will be no diplomatic relations with Israel without recognising an independent Palestinian state and ending Israeli aggression in Gaza, according to Reuters.

- Iraq’s Foreign Minister stressed in a call with US Secretary of State Blinken a need to return to the negotiation table over the future of the US-led coalition in Iraq and asked Blinken for the US to reconsider sanctions imposed on Iraqi banks, according to Reuters.

US Event Calendar

- 07:00: Feb. MBA Mortgage Applications 3.7%, prior -7.2%

- 08:30: Dec. Trade Balance, est. -$62b, prior -$63.2b

- 15:00: Dec. Consumer Credit, est. $15.9b, prior $23.8b

Central Bank Preview

- 11:00: Fed’s Kugler Speaks at Brookings Event

- 11:30: Fed’s Collins Speaks at Boston Economic Club

- 12:30: Fed’s Barkin Speaks on Outlook, Regional Economy

- 14:00: Fed’s Bowman Speaks on Supporting Small Businesses

- 15:15: Fed’s Remache Delivers Keynote Remarks at NY Fed Conference

- 16:30: Fed’s Nordstrom Speaks at NY Fed Conference

DB’s Jim Reid concludes the overnight wrap

The market has had a lot thrown at it (positive and negative) over the last week, but the last 24 hours have felt like a pause in proceedings ahead of some very important US inflation data coming up. In the last week alone we’ve had 25% of the S&P 500 report across 5 “Mag 7” stocks, Meta see the largest single day gain in dollar terms of any stock in history, New York Community Bank fall over -60%, US Regional Banks fall more than -10%, payrolls unexpectedly go into orbit, and 10yr USTs having their 6th largest 2-day yield increase in the last decade. So a fair amount to keep up with.

For yesterday, the S&P 500 (+0.23%) posted a modest gain while 10yr yields rallied back -5.8bps after the aggressive 2-day sell-off Friday and Monday. The next major planned events are perhaps the 10yr Treasury auction today and then US CPI revisions on Friday, followed by the January CPI release next Tuesday. Last year, the revisions showed that i nflation had fallen less aggressively in the second half of 2022 which influenced rate cut pricing at the time so one to watch.

Even though US equities were subdued in aggregate, beneath the surface there was some reversal of recent trends, with the Russell 2000 (+0.85%) posting a sizeable advance and rebound from a weak 2024 to date (-3.62%), whereas the FANG+ index (-0.52%) lost ground for a second day running (but +9.31% YTD). There were further sharp losses for New York Community Bancorp (-22.2%), which closed at its lowest level since 1997, whilst the KRW Regional Banking Index fell a further -1.41%.

After the closing bell, Moody’s downgraded New York Community Bancorp’s long-term debt rating by two notches from Baa3 to Ba2 and into HY territory. It remains on watch negative. Its shares fell another -15% after the bell. So certainly one to watch today. This story doesn’t feel like it’s over in terms of wider market attention by a long stretch.

By contrast in Europe, there was a much more upbeat session, with the STOXX 600 (+0.63%) closing at a two-year high and Germany’s DAX (+0.76%) also reaching a new all-time high.

Fed speakers were a big focus yesterday. First up, Cleveland Fed President Mester struck a cautious tone, saying that “It would be a mistake to move rates down too soon or too quickly without sufficient evidence that inflation was on a sustainable and timely path back to 2%”. Minneapolis Fed President Kashkari noted that “there’s been very good news” on inflation though “we’re not all the way there yet”. In the evening, Philadelphia Fed President Harker struck an optimistic tone, saying that the Fed’s approach “has put us on the path to a soft landing” although he did not comment on rate cut prospects.

The comments did little to prevent a partial recovery from the sharp rates sell-off seen over the two previous sessions. Investors dialled up the chance of a rate cut by March from 16% on Monday to 20% by the close. And looking at the year as a whole, the number of rate cuts priced by the December meeting moved up to 122bps, +8.9bps from Monday. That helped Treasury yields fell back again, with the 10yr yield down -5.8bps to 4.10%. Overnight, yields are another basis point lower.

Over in Europe it was a similar story, and investors raised the expected number of ECB cuts this year to 133bps, up +8.2bps on the day. That helped yields fall across the continent, with those on 10yr bunds (-2.3bps), OATs (-1.6bps) and BTPs (-2.9bps) all moving lower. But it was gilts that saw the largest outperformance, with the 10yr yield down -5.8bps to 3.94%, which marked a reversal from its underperformance the previous day. The ECB Schnabel has warned against cutting rates too soon in the FT today so we’ll see if that gets traction. Her views are already known.

In Asia, mainland Chinese stocks are extending this week’s gains with the CSI (+0.45%) and the Shanghai Composite (+0.91%) higher on stimulus and stabilisation expectations. However, the momentum looks slightly weaker in Hong Kong as the Hang Seng (-0.07%) is slightly lower after an opening gain of +1.5%. Elsewhere, the KOSPI (+0.98%) and S&P/ASX 200 (+0.48%) are trading higher while the Nikkei (-0.51%) is lower. US futures are largely unchanged. .

Looking at yesterday’s other data, Euro Area inflation expectations were mixed in December, according to the ECB’s Consumer Expectations Survey. On the one hand, 1yr expectations were down to 3.2%, but 3yr expectations were up to +2.5%. Separately in Germany, factory orders expanded by +8.9% in December (vs. -0.2% expected), but the construction PMI fell to 36.3 in January. The factory orders ex large orders series was -2.2% which wasn’t so great and more in line with the weak economy.

To the day ahead now, and data releases include German industrial production and Italian retail sales for December, along with the US trade balance for December. From central banks, we’ll hear from the Fed’s Harker, Kugler, Collins, Barkin and Bowman, as well as BoE Deputy Governor Breeden and the ECB’s Muller. Finally, earnings releases include PayPal, Walt Disney and Uber.

Tyler Durden

Wed, 02/07/2024 – 08:14

via ZeroHedge News https://ift.tt/GaDv9Qr Tyler Durden