BLS Releases Revised CPI Data: Here’s What’s In It

As we previewed yesterday, today’s most anticipated economic event was the annual revision to the BLS’s seasonal adjustment factors used to calculated the seasonally adjusted headline and core CPI data, and while traditionally this is a non-event for the market, with all attention on the trend in CPI (not to mention Fed governor Waller building up expectations when he said on Jan 16 that “one piece of data I will be watching closely is the scheduled revisions to CPI inflation due next month. Recall that a year ago, when it looked like inflation was coming down quickly, the annual update to the seasonal factors erased those gains”) and also due to the substantial upward revisions last year which had a major impact on Fed market pricing, there was a lot of attention being paid to today’s data.

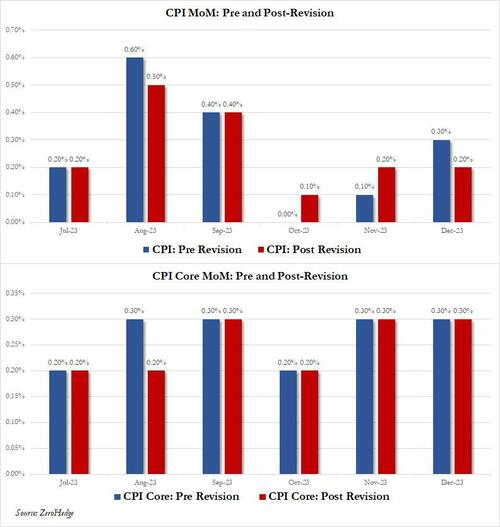

In retrospect, there should not have been, because as we previewed last night, the annual revision was a nothingburger with revised core inflation at the end of 2023 unchanged compared to what was previously reported on a 3M annualized basis as shown below…

… while the monthly core data was also unchanged for much of late 2023, and the modest changes that did take place in headline MoM CPI did nothing more than to smooth the data.

The uneventful revision may come as a relief to the Fed after last year’s upward revisions which some had expected to be repeated, at a time when inflation has been dropping rapidly according to BLS measurements (whether these are accurate before any seasonal adjustments are applied is a different question entirely).

The results certainly came as relief to the market which sent S&P futures surging to a new all time high, rising as high as 5,043 and yields and the USD dipped sharply when headlines hit that the December Headline CPI print was revised lower by 0.1%, however much of the move was unwound when it became clear that there were virtually no changes between the pre and post-revision data.

Tyler Durden

Fri, 02/09/2024 – 09:04

via ZeroHedge News https://ift.tt/QG08LRK Tyler Durden