Futures Flat As Tech Stocks Extend Gains

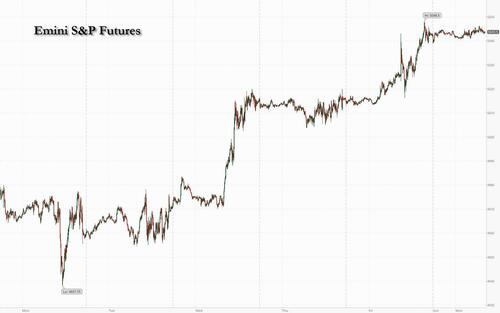

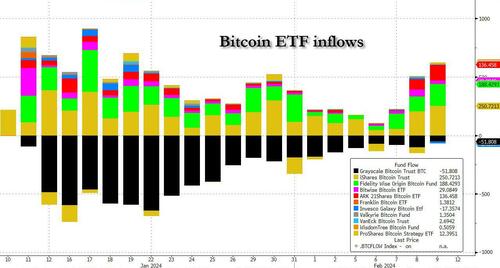

After a record-matching 14 weeks of gains in the past 15 pushed the S&P to a new all-time high above 5000 last week on unbridled optimism about eventual Fed rate cuts and easing inflation pushed, S&P futures traded flat and near the top of Friday’s range, as traders paused their relentless buying after That said, the rally in Big Tech that lifted the S&P 500 above 5,000 for the first time on Friday looked set to extend, as Amazon.com. Nvidia Corp. and Tesla ticked higher in premarket trading. Moves beyond those standouts were muted, in S&P 500 and Nasdaq 100 futures trading as well as for US Treasuries and the dollar. Bitcoin traded around $48,000 after almost reaching $49,000 during the weekend on accelerating inflows into various bitcoin ETFs.

In premarket trading, Diamondback Energy shares edged up 1% after the company reached an agreement to buy fellow Texas oil-and-gas producer Endeavor Energy through a $26 billion deal. Bioxcel Therapeutics gained 24% after the company said it received fast track designation from the FDA for a treatment aimed at small cell neuroendocrine prostate cancer. Here are some other notable premarket movers:

- Joby Aviation rises 5.2% as the company signed an agreement with Dubai’s Road and Transport Authority that grants it the exclusive right to operate air taxis in the Emirate for six years.

- Monday.com falls 9.7% after 4Q results weren’t enough to push the application software company higher as shares have soared nearly 90% since October.

- Rivian slips 4% after Barclays cut the recommendation on the electric vehicle maker’s stock, citing increased signs of pessure in demand amid a broader EV slowdown.

- Trimble drops 4.9% after providing a 1Q forecast that disappointed.

The market’s next highlights will be Tuesday’s CPI report and follows Friday’s historical CPI revisions, which proved to be a non-event. US inflation rate is forecast to have dropped to 2.9% YoY in January from 3.4% the prior month, according to the median economic estimate. That would be the first reading below 3% since March 2021, supporting a disinflationary trend that will determine the scope and timing of Federal Reserve rate cuts.

“As long as we see this gradual progress down, they should be in a position where they can feel confident of wanting to cut,” said Pooja Sriram, US economist at Barclays, referring to Fed policymakers. “It still looks like we are at a place where interest rates are elevated, they could bite into the economy and maybe there is scope for those to start to be pared. There really is no reason to keep rates at these levels for very long,” she added in an interview with Bloomberg TV.

Meanwhile, swaps markets suggest the Fed will carry out just four rate cuts in 2024, down from seven forecast at the end of last year, and only slightly more than the three penciled in by policymakers.

“Market pricing is trying to encourage central banks to get going and start cutting rates. Arguably, the market has been overexuberant in its encouragement recently,” Iain Stealey, international chief investment officer for fixed income at J.P. Morgan Asset Management, wrote in a note to clients. “Employment has remained strong, purchasing managers’ surveys are healthy and economic growth is robust.”

European stocks start the week on the front foot, following another record Wall Street close on Friday. The Stoxx 600 adds 0.4%, led by gains in real estate, consumer product and construction shares while technology shares are the biggest laggards. Here are the biggest movers Monday:

- Thule rises as much as 1.7%, extending Friday’s 6.8% earnings-triggered gains, after the Swedish bicycle and outdoor accessories maker saw its price target increased by several brokers

- Nordex shares rise as much as 6.8% after delivering a stronger finish to 2023 following the cautious commentary issued in 3Q, with analysts saying this should bolster confidence

- SSP Group advances as much as 2% after announcing it has bought Airport Retail Enterprises, which runs 62 bars, restaurants and cafes across seven Australian airports

- Tod’s rises as much as 18% in Milan and trades just below the value of an offer from LVMH-backed buyout firm L Catterton’s for a 36% stake in the luxury shoe firm. Citi sees the news fueling M&A speculation across the sector

- UK Commercial Property REIT gains as much as 6.1% to hit its highest level since September 2022 after agreeing terms on a possible all-share merger with peer Tritax Big Box REIT, which falls as much as 1.7%

- Komax gains as much as 2.1% after UBS raised the recommendation to neutral from sell, saying the contraction is now priced in and adding it sees a potential inflection in 2H of this year for the Swiss wire processing machine manufacturer.

- Saras shares drop as much as 7.3% after the Moratti family agreed to sell its controlling stake in the oil refiner to Vitol at €1.75/share, well below the €2.20 level reported last week

Earlier in the session, Asian stocks were little changed amid muted trading volumes with many markets in the region closed for holidays, as investors look ahead to US inflation data for clues on Federal Reserve policy. The MSCI Asia Pacific excluding Japan Index dipped less than 0.1%, with CSL and Fisher & Paykel among the biggest drags while ANZ Group and Bank Rakyat rose. Markets in Greater China, Japan, South Korea and Singapore were shut. Stocks fell in Australia, New Zealand and the Philippines while shares in Indonesia rose and Indian benchmarks were little changed. With Chinese trading paused for Lunar New Year, cues on the US interest rate trajectory from consumer price figures due Tuesday will be key for regional market sentiment this week.

- Australia’s ASX 200 declined amid underperformance in healthcare and the commodity-related sectors, with the former the worst-hit amid losses in CSL after top-line results from the Phase 3 trial of its cardiovascular drug failed to meet the primary efficacy endpoint.

- Indian stocks slid for the third time in four sessions, led by media firms and state-owned lenders. The S&P BSE Sensex fell 0.7% to 71,072.49 as of 3:45 p.m. in Mumbai, while the NSE Nifty 50 Index declined 0.8% to 21,616.05. Mid- and small-cap gauges saw deeper cuts, with the latter falling by more than 3% in its worst-single day slump since Dec. 20.

In FX, the Bloomberg Dollar Spot Index is flat. The Kiwi is the biggest mover among the G-10s, falling 0.4% versus the greenback – it was the biggest gainer on Friday. The yen held near a two-month low reached on Friday following comments from central bankers that the Bank of Japan will take its time raising rates. Japan’s currency has weakened against all its Group-of-10 peers this year.

In rates, Treasuries slightly richer across the curve amid bigger gains in core European rates. 10-year TSY yields are hovering around 4.17% while Bunds and gilts are higher. US yields richer by 1.5bp-2bp across the curve leaving spreads within 1bp of Friday’s close; 10-year around 4.155% trails bunds and gilts in the sector by 2.5bp and 3bp. Bunds led the move after ECB’s Fabio Panetta in weekend comments said the time for interest-rate cuts “is fast approaching.” Monday’s US session has few scheduled events, although corporate issuance slate is expected to be busy ahead of Tuesday’s CPI data. The Dollar issuance slate empty so far, though $30 billion is projected for week, anticipated to be concentrated on Monday ahead of January CPI release Tuesday; Treasury auctions resume Feb. 21 with 20-year bond sale.

In commodities, oil prices decline after the Iranian foreign minister said the war in Gaza could be nearer to a diplomatic solution. WTI drops 0.9% to trade near $76.20. Spot gold falls 0.2%.

Bitcoin (+0.9%) is modestly firmer and holds just beneath USD 48k, while Ethereum is softer on the day

Looking at today’s US calendar, we get the January New York Fed 1-year inflation expectations (11am) and monthly budget statement (2pm); ahead this week are CPI, retail sales, industrial production and PPI

Market Snapshot

- S&P 500 futures little changed at 5,044.00

- STOXX Europe 600 up 0.3% to 486.43

- MXAP little changed at 167.25

- MXAPJ down 0.2% to 510.83

- Nikkei little changed at 36,897.42

- Topix down 0.2% to 2,557.88

- Hang Seng Index down 0.8% to 15,746.58

- Shanghai Composite up 1.3% to 2,865.90

- Sensex down 0.6% to 71,162.93

- Australia S&P/ASX 200 down 0.4% to 7,614.92

- Kospi up 0.4% to 2,620.32

- German 10Y yield little changed at 2.37%

- Euro down 0.1% to $1.0773

- Brent Futures down 0.5% to $81.74/bbl

- Gold spot down 0.1% to $2,022.88

- U.S. Dollar Index little changed at 104.14

Top Overnight News

- China’s carbon emissions could peak years earlier than previously anticipated (and perhaps as soon as this year) thanks to the country’s staggering adoption of renewables. WSJ

- Egypt warns Israel the decades-old peace pact between the two countries could be compromised if IDF actions in Gaza send a flood of refugees into the Sinai. NYT

- Biden and Netanyahu are closer to a breach than at any point in the Gaza war as the White House no longer views the Israeli PM as a productive partner. WaPo

- US and UK air strikes have reduced the risk to vessels from attacks by Yemen’s Houthis in the Red Sea but there is little prospect of many shipping companies making a swift return to the Suez Canal, security experts and a senior executive have said. FT

- Saudi Arabia decided to halt its oil capacity expansion plans because of the energy transition, its energy minister said on Monday, adding that the kingdom has plenty of spare capacity to cushion the oil market. RTRS

- Italy’s new central bank chief has said the time for cutting interest rates is “fast approaching” and dismissed fears of a fresh inflationary spiral, in the latest sign that pressure is mounting to loosen eurozone monetary policy. FT

- The Federal Reserve is set to press ahead with plans to cut rates despite an unexpected surge in jobs growth in January, with a $7tn immigration-led economic boost and fewer job vacancies convincing officials the labor market is unlikely to trigger inflation. FT

- Donald Trump said he had warned Nato allies that he would encourage Russia to do “whatever the hell they want” if alliance members failed to meet defense spending targets, highlighting the risk to the military pact if he wins a new term in the White House. FT

- Diamondback will buy Endeavor in a $26 billion deal that’ll create the largest pure-play operator in the Permian Basin. Diamondback will fund the deal through a combination of cash and stock. WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were subdued amid quiet weekend newsflow and mass closures in the region as markets in China, Hong Kong, Taiwan, Japan, South Korea, Singapore, Malaysia & Vietnam were all shut for holiday. ASX 200 declined amid underperformance in healthcare and the commodity-related sectors, with the former the worst-hit amid losses in CSL after top-line results from the Phase 3 trial of its cardiovascular drug failed to meet the primary efficacy endpoint. Nifty 50 was pressured with some of the worst-performing stocks in the index suffering post-earnings.

Top Asian News

- RBNZ Governor Orr said it is concerning that the population is growing so rapidly at a time when residential construction is slowing, while he added that inflation is still too high which is why they have kept the Cash Rate at 5.50%

- RBNZ Deputy Governor Hawkesby said New Zealand’s financial system remains strong and prices have stabilised in house markets over the last six months, as well as noted that the system can cope with high interest rates.

European bourses, Stoxx600 (+0.4%), are generally firmer, with the exception of the FTSE 100 (-0.3%), which is hampered by losses in AstraZeneca (-2.2%) after PT cuts. European sectors are almost entirely in the green; Consumer Products and Services is propped up by a Tod’s (+16.9%) bid, which has lifted Luxury. Healthcare is hampered by AstraZeneca, as mentioned. US equity futures (ES U/C, NQ +0.1%, RTY +0.3%) are trading around flat with the ES continuing to hold above the 5k mark. Slight outperformance in the RTY, extending on Friday’s strength.

Top European News

- ECB’s Centeno said he prefers interest rates to decline gradually and in a steady way instead of dropping more rapidly, while he added that the indicators they have shown that inflation has been falling, according to Bloomberg.

- ECB’s de Cos said March staff projections will be key to assessing whether they can be sufficiently confident that the 2% medium-term target, according to Bloomberg.

- ECB Panetta said the time for a reversal of the ECB’s monetary policy stance is fast approaching and that they must weigh the pros and cons of cutting rates “quickly and gradually” vs “later and more aggressively” which could stoke market volatility, while he added any speculation on the exact timing of monetary policy easing would be a sterile exercise and disrespectful to the Governing Council.

- European Union reached a tentative agreement on fiscal reform that will aim to reduce debt and protect investment in key areas such as defence and the green transition, according to Bloomberg.

- Gertjan Vlieghe (ex-MPC), and Clare Lombardelli (an ex-Treasury official now at the OECD in Paris), are the leading contenders to replace BoE Deputy Governor Ben Broadbent, according to The Times.

- Finland’s former PM Stubb is to become the country’s next President after winning 52% of votes in the second round of the presidential election held on Sunday.

- Fitch affirmed Finland at AA+; Outlook Stable, while S&P affirmed Denmark at AAA; Outlook Stable.

- ECB’s Lane’s speech on “Euro area international financial flows: analytical insights and measurement challenges” Speech was analytical in nature and did not contain commentary in relation to monetary policy / wages

FX

- DXY saw a dip to 103.89 (10DMA) in early European trade, taking out Friday’s low of 103.95 before recovering to current levels just above 104.00; Friday’s high at 104.26 is still in place, 104.18 the current peak.

- EUR is trivially softer vs. the USD after a brief foray above the 1.08 mark in quiet newsflow. A more sustained breach of 1.08 could bring the 200DMA into view at 1.0830 with the 21DMA just above at 1.0836.

- JPY experiences relatively steady trade with the pair maintaining 149.00 status, Japanese participants away from the market overnight. For now, broadly contained in Friday’s 149.00-57 range.

- NZD the laggard across the majors vs. the USD despite hawkish-leaning RBNZ comments. NZD/USD still within Friday’s range of 0.6093-0.6158 and stuck in consolidation mode after the mid-Jan sell-off.

Fixed Income

- USTs are little changed on the day, with no cash trade overnight due to Tokyo being on holiday for Foundation Day. Session ahead thin from a data perspective aside from the NY Fed SCE so focus will be on Fed speak from voters Bowman & Barkin before non-voter Kashkari.

- Bunds are contained, with slight pressure seen as oil lifted from lows but within earlier ranges. ECB’s Lane added little so attention turns to de Cos who will be joined with Lane once again; 133.36-133.66 bounds are within Friday’s range. Initial modest bid attributed to weekend remarks from Panetta.

- Gilt price action is in-fitting with the above and ultimately will take impetus from a busy particularly UK schedule this week. Before that, BoE Governor Bailey is set to speak; 10yr yield remains around the 4.0975 YTD high from Friday.

Commodities

- Crude price action is choppy and ultimately remains subdued despite the heightened geopolitical landscape and some verbal intervention from Saudi, with the Saudi Energy Minister stating OPEC+ is ready to tweak supply up or down as required by the market; Brent Apr touched a low of USD 81.26/bbl.

- Mixed trade across precious metals with spot gold flat intraday amidst a relatively contained Dollar ahead of tomorrow’s US CPI metrics; XAU resides within recent ranges around USD 2,025/oz with the 50 DMA (USD 2,032.86/oz) to the upside.

- Subdued but contained trade across base metals with the complex also influenced by the Chinese New Year break which sees Chinese participants return in a week.

- Saudi Energy Minister said there is a huge cushion when asked if 1.5-2mln BPD is sufficient spare capacity; adds oil demand is consistently bigger than some projections; Ready to tweak supply up or down as required by the market. “Prince Abdulaziz said there was a lot of misinterpretation around the decision to stick to the 12 million bpd MSC… he noted that increased gas production will be able to free up more of Aramco’s oil”, according to Energy Intel. When asked if Saudi is comfortable with OPEC demand projections for 2024 and 2025, says OPEC’s job is not to be comfortable, “our job is to be attentive”. OPEC ready to tweak policy at any time.

- Saudi Aramco CEO says not in agreement there will be peak demand; expects 104mln BPD demand in 2024 and 105mln BPD in 2025 A rebound in the crude complex was seen in tandem with these comments.

- BHP (BHP AT) was notified by iron ore train drivers that they will conduct a 24-hour stoppage this Friday. BHP responded that it is reviewing a revised set of claims provided by union representatives and believes an agreement can be reached without the need for protected action, while it has contingency plans if the action goes ahead.

Geopolitics: Middle East

- Israeli military conducted a series of strikes on southern Gaza and said two hostages were freed by special forces in Rafah, while it was reported that dozens were killed and injured in the strike on Rafah, according to Reuters.

- Israeli PM Netanyahu pushed back against international concerns regarding Israel’s preparation to enter the southern Gaza city of Rafah and stated that those who say not to enter Rafah are basically saying lose the war, according to Politico. It was separately reported that Israeli PM Netanyahu said enough of the 132 remaining hostages are still alive to warrant the kind of efforts they are making.

- US President Biden and Israeli PM Netanyahu held a phone call in which Biden emphasised the need to capitalise on progress made in the negotiations to secure the release of all hostages as soon as possible, while Biden called for urgent and specific steps to increase the throughput of humanitarian aid to Palestinian civilians. Furthermore, Biden reaffirmed his view that a military operation in Rafah should not proceed without a plan to ensure the safety of 1mln people sheltering there and they both agreed to remain in close contact, according to Reuters.

- US senior official said real progress was made over the last few weeks on a framework deal for the release of hostages and ‘it’s pretty much there’ although there are still significant gaps that need to be closed, while the official said they do not support a military operation in Rafah under current circumstances and that Israelis made it clear they see the safety of civilians as a clear precondition for operations in Rafah, according to Reuters.

- Hamas said any Israeli ground offensive in Rafah would blow up exchange talks, while it was later stated that Israel’s attack on Gaza’s Rafah is a continuation of the genocidal war and forced displacement attempts it wages against Palestinians.

- Iran’s Foreign Minister said any step by Israel towards a widespread attack on Lebanon would be Israeli PM Netanyahu’s final day and only a political solution can resolve the Gaza conflict, according to Reuters.

- US Central Command said its forces conducted self-defence strikes against two unmanned surface vessels and three anti-ship cruise missiles north of Yemen’s Hodeidah on Saturday.

- US-led coalition’s air defence systems blocked six drone attacks at Conoco oil field in eastern Syria.

- Iraq and the US are in talks to set a timetable for a gradual phase-out of US-led coalition forces mission in Iraq.

- Yemeni Houthis said they targeted Star Iris in the Red Sea, according to Reuters citing the group’s military spokesmen.

- Israel PM Netanyahu says Israel will not pass up on any chance to free hostages. Adds, that military pressure should be sustained until “Gaza victory”

Geopolitics: Other

- Ukraine’s military intelligence released an intercept it said confirms the use of Starlink by Russian forces on the battlefield. However, it was separately reported that Elon Musk denied a number of false news reports that claim SpaceX is selling Starlink terminals to Russia and said to his knowledge, no Starlinks have been sold directly or indirectly to Russia, according to Reuters.

- Ukrainian President Zelensky appointed former Deputy Defence Minister Pavliuk as the new ground forces chief, according to Reuters.

- Former US President Trump said he would “encourage” Russia to attack any NATO member country that didn’t meet its financial obligations to the defence alliance, while a White House spokesperson said encouraging invasions of allies is appalling and unhinged.

- NATO said any suggestions that allies will not defend each other undermines all of their security including the US’ and puts American and European soldiers at increased risk, while it added that any attack on NATO will be met with a united and forceful response.

- North Korea said it has developed a rocket launcher controller, according to KCNA.

US event calendar

- 11:00: Jan. NY Fed 1-Yr Inflation Expectations, prior 3.01%

- 14:00: Jan. Monthly Budget Statement, est. -$21b, prior -$129.4b

Central Bank Speakers

- 09:20: Fed’s Bowman Speaks at Community Bank Conference

- 12:00: Fed’s Barkin Speaks at Atlanta Economics Club Event

- 13:00: Fed’s Kashkari Moderates Economic Club of Minnesota Discussion

DB’s Jim Reid concludes the overnight wrap

After the US election campaign threw up renewed conversations about NATO over the weekend, note that we have a call next week (Thursday 22nd at 14:30 GMT) on “Themes and Trade Ideas for US Election Scenarios”. Register here to take part.

On another topical theme, Karthik Nagalingam in my Credit team has just put out a note this morning on how $IG banks can continue to outperform despite CRE risks. Much of the $IG bank universe has a fairly low concentration in CRE exposure. See the piece here for more details.

Welcome to Valentines’ week and a reminder that you have two days to prepare the right gift. My wife instigated the “we’re not bothering getting each other anything this year are we?” conversation last night. While I said “no that’s fine” I’m now wondering whether that was a double bluff. The stress!

Has the sharp inflation falls of the last few quarters been a double bluff? We’ll find out a bit more this week with US CPI tomorrow the obvious focal point. Elsewhere in the US the main highlights will be the NY Fed 1yr inflation expectations (today), Retail Sales/Industrial Production/Factory Orders (Thursday), housing data through the week, and the University of Michigan consumer survey (Friday). There is also plenty of Fed speak that you can see, alongside the other global highlights, in the week ahead calendar at the end as usual. Today sees three Fed speakers; Bowman (hawk), Barker (neutral) and Kashkari (hawk).

In Europe, UK inflation on Wednesday will be a highlight and will be preceded by UK employment numbers tomorrow and followed by Retail Sales on Friday. On the continent, the German ZEW survey is out tomorrow, with Eurozone Q4 GDP on Wednesday. In Asia we have Chinese New Year which will keep things quiet but Japanese Q1 GDP (Wednesday) might be of note with the end of NIRP potentially on the horizon. This is the same day as the election in Indonesia.

With regards to US CPI tomorrow our economists’ preview here suggest that with seasonally adjusted gas prices down almost -2.5% from December, they expect headline CPI (+0.15% forecast vs. +0.23% previously, consensus +0.2%) to undershoot core (+0.27% vs. +0.28%, consensus +0.3%). This would equate to core YoY CPI inflation falling two-tenths to 3.7%, while that for headline would fall by four-tenths to 2.9% (both in line with consensus). The three-month annualised rate would rise two-tenths to 3.5% while the six-month annualised rate would tick up a tenth to 3.3% largely due to base effects. PPI on Friday is also important as some of the subcomponents inform forecasts for the core PCE and an hour or so later the inflation expectations in the UoM consumer survey will round up the big week for US inflation.

It really is quiet this morning with most markets either shut for Chinese New Year or National Day in Japan. Half-term season also kicks off in Europe today so this might not be the most active week unless CPI shatters the silence. US stock futures are pretty flat.

Recapping last week now and we saw a further breakdown of the positive bond-equity correlation that had been in place between the QRA in August and early this year. This came after fresh evidence of a robust US economy helped push equities up but saw fixed income sell off. In fact, in equities it was another week for record breaking, as the S&P 500 hit another all-time high, finishing Friday above the 5000 level for the first time. This was thanks to a +1.37% gain over the week (and +0.57% on Friday), the fifth consecutive week of gains for the index and the 14th out of last 15 weeks.

But the rally was still relatively concentrated. The equal-weighted S&P 500 increased a more modest +0.47% (+0.15% on Friday) and it was the IT sector (+1.50% in the S&P), including the Magnificent Seven (+2.98%), that drove last week’s rally again. Semiconductors were the most prominent outperformer, as the Philadelphia Semiconductor Index jumped +5.32% (and +1.99% on Friday) following strong results from chipmaker ARM and an announcement by Nvidia that it was in talks with top AI firm OpenAI on designing specialised chips. US regional banks recovered on Friday, with the regional banking KBW index up +1.85% (but still -1.31% lower on the week) as New York Community Bank rose by +16.9% on news that its management had bought additional shares. That said, NYCB was -18.9% lower on the week, drawing further attention to turmoil in the CRE market. The STOXX 600 rose a more modest +0.19% last week (and -0.09% on Friday).

With data pointing to a more robust US economy, investors reduced expectations of rate cuts in 2024, driving the expected rate for the December meeting up +12.1bps last week (and +3.5bps on Friday), to 4.20%. It was a similar story in Europe, as investors dialled back expectations of ECB cuts by -13.0bps (-4.1bps on Friday) as comments from central bank speakers pointed to caution on the timing and pace of rate cuts. Adding to the lingering inflation concerns, Brent crude oil prices surged +6.28% to $82.19/bbl (and +0.69% on Friday) after Israel rejected a ceasefire offer from Hamas, with news that the US may be looking to strengthen enforcement of sanctions against Iranian oil adding to the upside.

Against this backdrop, 10yr yields rose +15.4bps last week, and 2yr yields by +11.6bps. There was a brief relief rally in yields on Friday following the tame US CPI revisions, but this then reversed with the 10yr finishing the day up +2.1bps to 4.18%, its joint highest close since the December FOMC meeting. 10yr bund yields rose +14.0bps (and +2.7bps on Friday).

Let’s see what CPI brings this week.

Tyler Durden

Mon, 02/12/2024 – 08:07

via ZeroHedge News https://ift.tt/0Drh2aN Tyler Durden