Key Events This Week: CPI, PPI, Retail Sales And Lots Of Fed Speakers

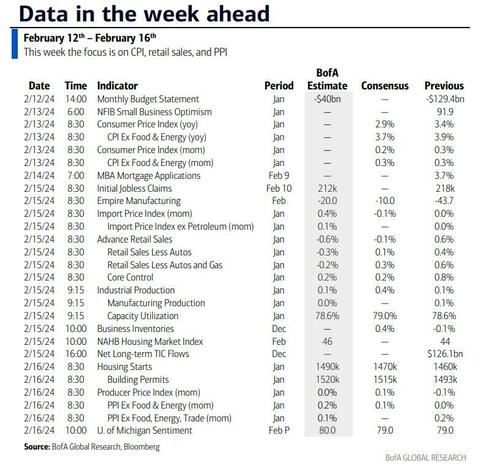

As DB’s Jim Reid sets the scene in his weekly preview, “welcome to Valentines’ week” and a reminder that you have two days to prepare the right gift. Turning to markets, the big question is whether the sharp inflation falls of the last few quarters have been a double bluff? We’ll find out a bit more this week with US CPI tomorrow the obvious focal point. Elsewhere in the US the main highlights will be the NY Fed 1yr inflation expectations (today), Retail Sales/Industrial Production/Factory Orders (Thursday), housing data through the week, and the University of Michigan consumer survey (Friday). There is also plenty of Fed speak that you can see, alongside the other global highlights, in the week ahead calendar at the end as usual. Today sees three Fed speakers; Bowman (hawk), Barker (neutral) and Kashkari (hawk).

In Europe, UK inflation on Wednesday will be a highlight and will be preceded by UK employment numbers tomorrow and followed by Retail Sales on Friday. On the continent, the German ZEW survey is out tomorrow, with Eurozone Q4 GDP on Wednesday. In Asia we have Chinese New Year which will keep things quiet but Japanese Q1 GDP (Wednesday) might be of note with the end of NIRP potentially on the horizon. This is the same day as the election in Indonesia.

Asia will remain quiet as most markets are shut for Chinese New Year. Half-term season also kicks off in Europe today so this might not be the most active week unless CPI shatters the silence.

With regards to US CPI tomorrow DB economists’ expect seasonally adjusted gas prices to be down almost -2.5% from December, and expect headline CPI (+0.15% forecast vs. +0.23% previously, consensus +0.2%) to undershoot core (+0.27% vs. +0.28%, consensus +0.3%). This would equate to core YoY CPI inflation falling two-tenths to 3.7%, while that for headline would fall by four-tenths to 2.9% (both in line with consensus). The three-month annualised rate would rise two-tenths to 3.5% while the six-month annualised rate would tick up a tenth to 3.3% largely due to base effects. PPI on Friday is also important as some of the subcomponents inform forecasts for the core PCE and an hour or so later the inflation expectations in the UoM consumer survey will round up the big week for US inflation.

Here is a day-by-day calendar of events courtesy of Deutsche Bank

Monday February 12

- Data: US January NY Fed 1-yr inflation expectations, monthly budget statement, Japan January PPI

- Central banks: Fed’s Barkin and Kashkari speak, ECB’s Lane, De Cos and Cipollone speak, BoE’s Bailey speaks

- Earnings: Arista Networks, Cadence Design Systems, Waste Management

Tuesday February 13

- Data: US January CPI, NFIB small business optimism, UK January jobless claims, December average weekly earnings, Japan January machine tool orders, Germany and Eurozone February Zew survey, Germany December current account balance, France Q4 ilo unemployment rate

- Earnings: Coca-Cola, Shopify, Airbnb, Zoetis, Marriott, Biogen, Restaurant Brands

Wednesday February 14

- Data: UK January CPI, RPI, PPI, December house price, Japan Q4 GDP, Eurozone Q4 GDP, employment, December industrial production, Canada January existing home sales

- Central banks: Fed’s Goolsbee and Barr speak, ECB’s Vujcic, Nagel and Guindos speak

- Earnings: Cisco, Sony, EssilorLuxottica, Heineken, Occidental Petroleum, Kraft Heinz, Capgemini, Barrick Gold, Albemarle, Twilio

Thursday February 15

- Data: US January retail sales, industrial production, export and import price index, capacity utilization, February Philadelphia Fed business outlook, NAHB housing market index, Empire manufacturing index, December net TIC flows, business inventories, initial jobless claims, UK Q4 GDP, Japan December capacity utilization, Italy December trade balance, general government debt, Eurozone December trade balance, Canada January housing starts, December manufacturing sales

- Central banks : ECB’s Lane and Nagel speak, BoE’s Greene and Mann speak

- Earnings: Applied Materials, Airbus, Schneider Electric, Deere, Safran, Stellantis, DoorDash, Pernod Ricard, Orange, DraftKings, Roku, Renault

Friday February 16

- Data: US January PPI, housing starts, building permits, February University of Michigan survey, New York Fed services business activity, UK January retail sales, Japan December Tertiary industry index, Canada December international securities transactions

- Central banks: Fed’s Daly and Bostic speak, ECB’s Schnabel speaks

- Earnings: Eni

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Tuesday, the retail sales report on Thursday, and the PPI report on Friday. There are several speaking engagements by Fed officials this week, including Vice Chair for Supervision Barr, Fed Governors Barkin and Waller, and Presidents Barkin, Kashkari, Goolsbee, Bostic, and Daly.

Monday, February 12

- There are no major economic data releases scheduled.

- 09:20 AM Fed Governor Bowman speaks; Fed Governor Michelle Bowman will give remarks on defining a bank at the American Bankers Association Conference for Community Bankers in San Antonio, Texas. Speech text, Q&A, and livestream are expected. On February 2, Bowman said “it will eventually become appropriate to gradually lower our policy rate to prevent monetary policy from becoming overly restrictive. In my view, we are not yet at that point.” She went on to say “I will remain cautious in my approach to considering future changes in the stance of policy.”

- 12:00 PM Richmond Fed President Barkin speaks: Richmond Fed President Tom Barkin will speak to the Atlanta Economics Club. A Q&A is expected. On February 7, Barkin said “I make the case for not being in any particular hurry. Let’s see what we learn and set policy appropriately.”

- 01:00 PM Minneapolis Fed President Kashkari speaks: Minneapolis Fed President Neel Kashkari will moderate a discussion with former IBM CEO Ginni Rometty at the Economic Club of Minnesota. Q&A and livestream are expected. On February 5, Kashkari said “the fact that core inflation is making rapid progress returning to our target—as demonstrated by six-month core inflation coming in lower than 12-month, three-month coming in lower than six-month, and both now at or below target—suggests that we are making significant progress in our inflation fight.”

Tuesday, February 13

- 06:00 AM NFIB Small business optimism, January (consensus 92.1, last 91.9)

- 08:30 AM CPI (mom), January (GS +0.20%, consensus +0.2%, last +0.2%); Core CPI (mom), January (GS +0.38%, consensus +0.3%, last +0.3%); CPI (yoy), January (GS +3.03%, consensus +2.9%, last +3.4%); Core CPI (yoy), January (GS +3.90%, consensus +3.7%, last +3.9%): We estimate a 0.38% increase in January core CPI (mom sa), which would leave the year-on-year rate unchanged at 3.9%. Our forecast reflects a temporary boost from above-normal start-of-year price increases, including for prescription drugs, car insurance, tobacco, and medical services. We also assume a 0.7% rebound in apparel prices that reverses holiday promotions—as indicated by Adobe online price data. On the negative side, we assume a 2% pullback in airfares (mom sa) and a negative swing in used car prices (of -1.3%, compared to +1.0% on average in November and December), the latter based on declines in auction prices. We expect a roughly stable pace of shelter inflation following the December stepdown (we estimate +0.40% for both rent and OER), reflecting the slowdown in rent growth. We estimate a 0.20% rise in headline CPI, reflecting lower energy (-2.0%) but higher food (+0.3%) prices.

Wednesday, February 14

- 08:30 AM PPI Annual Revisions

- 09:30 AM Chicago Fed President Goolsbee speaks: Chicago Fed President Austan Goolsbee will participate in a Q&A event at the Council on Foreign Relations in New York. Q&A and livestream are expected. On February 5, Goolsbee said “if we just keep getting more data like we’ve gotten … we should be well on the path to normalization.”

- 04:00 PM Fed Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will give remarks on monetary policy and bank regulation at the National Association for Business Economics conference in Washington. Speech text, Q&A, and livestream are expected.

Thursday, February 15

- 08:30 AM Empire State manufacturing survey, February (consensus -11.8, last -43.7)

- 08:30 AM Retail sales, January (GS -0.7%, consensus -0.1%, last +0.6%); Retail sales ex-auto, January (GS -0.3%, consensus +0.2%, last +0.4%); Retail sales ex-auto & gas, January (GS -0.1%, consensus +0.3%, last +0.6%); Core retail sales, January (GS flat, consensus +0.2%, last +0.8%): We estimate core retail sales were unchanged in January (ex-autos, gasoline, and building materials; mom sa). Our forecast reflects a pause in spending growth following strength during the holiday season as well as a modest drag from severe winter weather in the middle of the month. For the higher-level aggregates, we assume a pullback in restaurant spending driven by the poor weather and as indicated by credit card data. We estimate a 0.7% decline in headline retail sales, reflecting lower auto sales and gasoline prices.

- 08:30 AM Philadelphia Fed manufacturing index, February (GS -5.0, consensus -8.6, last -10.6): We estimate that the Philadelphia Fed manufacturing index rebounded 5.6pt to -5.0 in February, reflecting a rebound in manufacturing and freight activity.

- 08:30 AM Import price index, January (consensus -0.1%, last flat)

- 08:30 AM Initial jobless claims, week ended February 10 (GS 220k, consensus 220k, last 218k); Continuing jobless claims, week ended February 3 (GS 1,880k, consensus 1,880k, last 1,871k)

- 09:15 AM Industrial production, January (GS +0.2%, consensus +0.3%, last +0.1%); Manufacturing production, January (GS flat, consensus flat, last +0.1%); Capacity utilization, January (GS 78.6%, consensus 78.8%, last 78.6%): We estimate industrial production increased 0.2%, as strong natural gas and electricity production balance weak mining production. We estimate capacity utilization was unchanged at 78.6%.

- 10:00 AM Business inventories, December (consensus +0.4%, last -0.1%)

- 10:00 AM NAHB housing market index, February (consensus 46, last 44)

- 01:15 PM Fed Governor Waller speaks: Federal Reserve Governor Christopher Waller will give remarks on the dollar’s international role at the Global Interdependence Center and University of the Bahamas Conference in Nassau, Bahamas. Speech text, Q&A and livestream are expected. On January 16, Waller said “the data we have received the last few months is allowing the Committee to consider cutting the policy rate in 2024. However, concerns about the sustainability of these data trends requires changes in the path of policy to be carefully calibrated and not rushed. In the end, I am feeling more confident that the economy can continue along its current trajectory.”

- 07:00 PM Atlanta Fed President Bostic speaks: Atlanta Fed President Raphael Bostic will give a speech on economic outlook and monetary policy to the Money Marketeers of New York University. Speech text and Q&A are expected. On January 18, Bostic said “premature rate cuts could unleash a surge in demand that could initiate upward pressure on prices… [but] if we continue to see a further accumulation of downside surprises in the data, it’s possible for me to get comfortable enough to advocate for normalization sooner than the third quarter.”

Friday, February 16

- 08:30 AM Housing starts, January (GS -2.0%, consensus flat, last -4.3%); Building permits, January (consensus +1.5%, last +1.8%)

- 08:30 AM PPI final demand, January (GS +0.1%, consensus +0.1%, last -0.1%); PPI ex-food and energy, January (GS +0.1%, consensus +0.1%, last flat); PPI ex-food, energy, and trade, January (GS +0.2%, consensus +0.1%, last +0.2%)

- 09:10 AM Fed Vice Chair for Supervision Barr speaks: Federal Reserve Vice Chair for Supervision Michael Barr will give comments on bank supervision at a Columbia Law School Banking Conference in New York. Speech text, Q&A, and livestream are expected.

- 10:00 AM University of Michigan consumer sentiment, February preliminary (GS 80.4, consensus 80.0, last 79.0); University of Michigan 5-10-year inflation expectations, February Preliminary (GS 2.8%, consensus 2.9%, last 2.9%): We expect the University of Michigan consumer sentiment index increased to 80.4 in the preliminary February reading. We estimate the report’s measure of long-term inflation expectations declined 0.1pp to 2.8%, reflecting lower gasoline prices and favorable inflation news.

- 12:10 PM San Francisco Fed President Daly speaks: San Francisco Fed President Mary Daly will deliver the keynote address at the National Association for Business Economics conference in Washington. Speech text is expected. On January 19, Daly said “there is a lot of work left to do on bringing inflation back down… and it’s premature to think interest-rate cuts are around the corner.”

Source: DB, Goldman, BofA

Tyler Durden

Mon, 02/12/2024 – 10:07

via ZeroHedge News https://ift.tt/ZS5xjf7 Tyler Durden